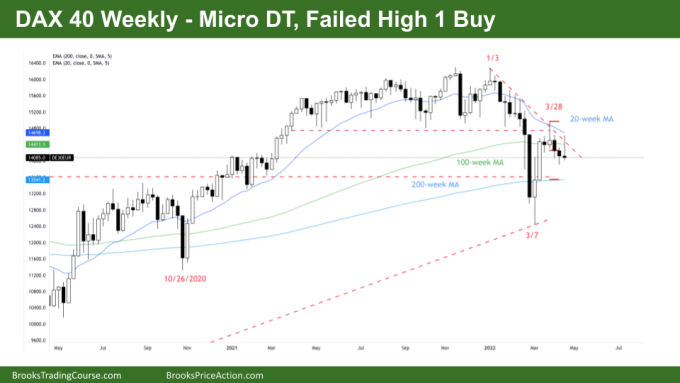

Market Overview: DAX 40 Futures

DAX futures closed lower last week with a Micro Double Top (DT) and failed buy signal but without new lows. The weekly broad bear channel has set up a possible head and shoulders sell on the daily chart. The bulls have managed to reverse consecutive bear bars and with buyers below bars we will likely go sideways to down next week. If the bulls can get a double bottom buy setup it might quickly trap late bears in the channel.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 Weekly chart was a 3rd consecutive bear bar and potential Micro DT. It had a long tail on top, closed below its midpoint and rejected the 100-Week MA.

- For the bulls, it’s a pullback from a March 7th sell climax and support at the 200-Week moving average (MA). They see a 2-year bull trend and the two legs sideways to down before trend resumption.

- The bulls also see we are in the 2nd leg starting from March 28th. There was a failed High 1 buy signal and bulls will look for the High 3, wedge breakout for trend resumption. They might see the whole move as a bear flag.

- For the bears it is a broad bear channel, and we are still in the Low 1 sell signal from 2 weeks ago.

- The bears see the failed High 2 this week as potentially trapping bulls, but we didn’t close lower than last week, so it is not as bearish as it could be.

- The bulls want a double bottom near the bottom of March and the bottom of a trading range for a high probability buy signal. They see the tails on the bottom of the bear bars as evidence the bears are still scalping.

- The bears want a decent bear bar closing on its lows to get a vacuum test of the lows

- But look at the bars: Overlapping bodies, tails, we are going sideways so we are still likely in a trading range. That means we can expect buyers below bars and sellers above bars making us go sideways.

- If the bulls can get a reversal bull bar closing on its high, we can start to setup a breakout and then pullback to force out the bear scalpers. The issue is the distance needed to get the High 1.

The Daily DAX chart

- The Dax 40 had a strong bear reversal on Thursday and large bear bar closing on its low Friday so we might gap down.

- Although we closed lower last week, we did not make new lows, so it is not as bearish as it could be.

- The bulls see a tight trading range since last month after a strong sell climax and potential double bottom with April 12th. They see the lack of consecutive bear bars as a sign they are still scalping and bears are hesitant to sell much lower.

- The bears see a broad bear channel and possible head and shoulders move down and we are ending the week on the neckline. They see this as the possible 2nd leg down after the February bear channel.

- The bulls want the follow-through to be weak. This would set up a High 1 to confirm the double bottom to continue their prior trend.

- They see the strong reversal up in March and the 17-bar bull spike as changing into a channel. They see the first leg from March 29th and know this might now be the start of a second leg.

- The bears need follow-through. But sitting at the bottom of a tight trading range is not a great place to sell, and we can see hesitation previously here looking left at all the tails below bars.

- If there is a strong move down on Monday with a good close, that could set up the head and shoulders with a measured move down to the March lows.

- Note: I have put the measured move from the right shoulder for now as we did not break the neckline.

- If the bulls get a reversal bar, or perhaps consecutive bull bars here, or an outside up bar, that would force bears to sell higher and they might trap the aggressive bears looking for the next leg down.

- If you look left you see the lack of commitment by either side and with buyers below and sellers above, we might trade sideways to down again next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.