Market Overview: DAX 40 Futures

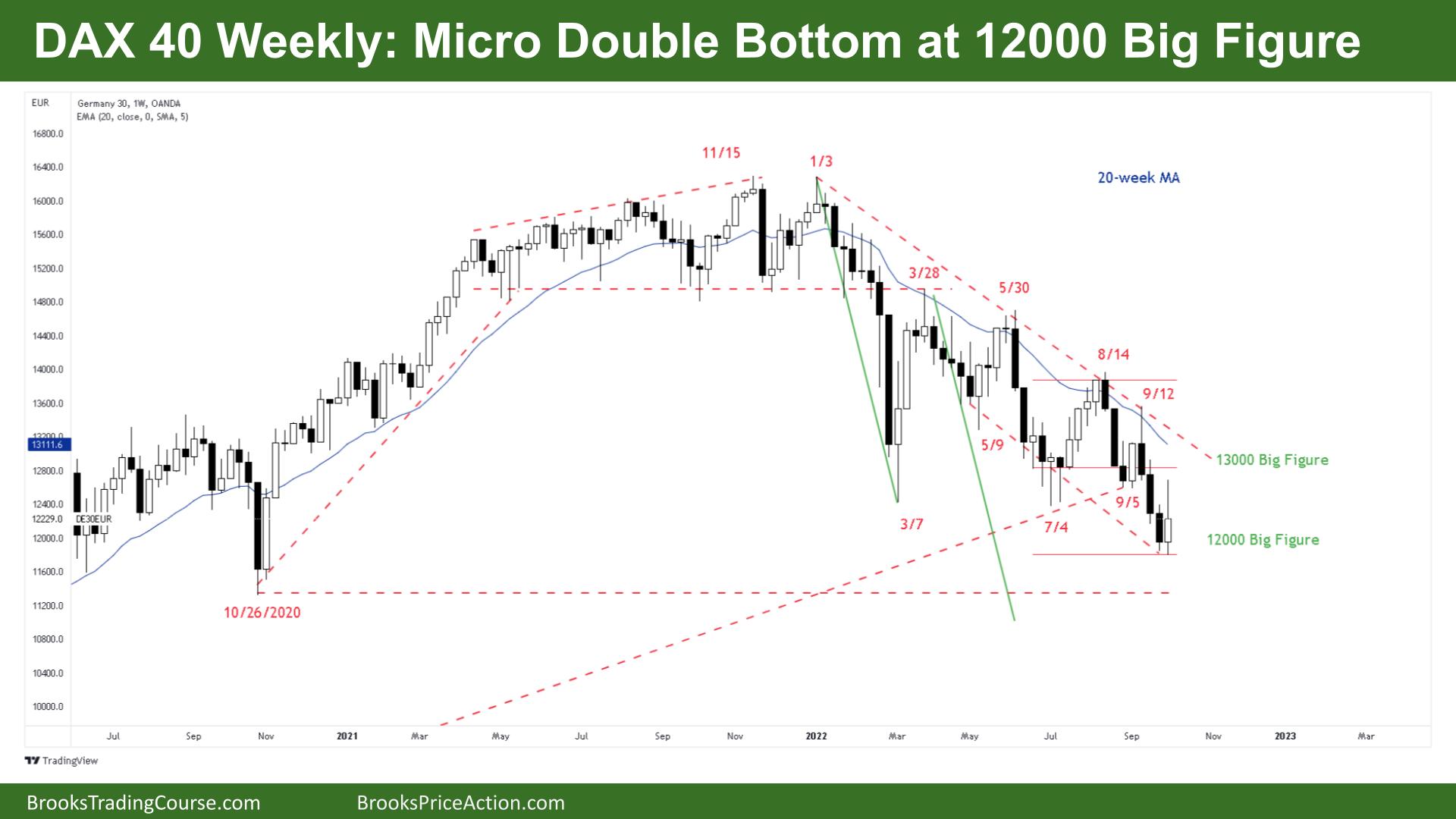

DAX 40 Micro Double Bottom on the weekly chart as bulls started to scale in buys at the lows of the previous trading range. It is possibly still always in short after 3 consecutive bear bars, but the math favors bulls if they can get a better buy signal. So far bulls are scalping. The bears need a break below the lows to convince traders there is a reasonable swing target below. Currently it is forming a wedge bottom with March and a possible double bottom with October 2020

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a bull outside bar with a large tail above.

- It was a Micro Double Bottom (Micro DB) and pause at the 12000 big figure.

- The bulls see possible wedge bottom with May and July but it’s not a great buy signal yet, so they might wait until there are consecutive bull bars, or a bull bar closing on its high.

- The bulls also see a breakout pullback and test of the trading range from pre-COVID, they expect there is not much further to fall here, as longer-term buyers look to scale in.

- They might see 4 consecutive bull bars in July/August as the middle/high range of a smaller trading range and will expect most reversals to fail by the bears. That’s why they bought below 3 bear bars last week.

- It’s a bear channel so a bear overshoot bar below the channel next week might also attract buyers.

- The bears see a bear trend and after 3 consecutive bear bars it was not a great buy setup, so limit bears sat above the high of the prior bar and limit bulls would have traded small and scaled in lower, as they have been buying new lows for many months.

- The bears expect another leg after such a strong move, it was the lowest close since March, but the risk is big and the potential move is smaller now in this range, so we might see short covering into the next few weeks. The Micro Double Bottom will reduce the number of bears looking to sell below.

- You can see the overlapping bars make it look like a bear leg in a trading range, so traders will be more selective with stop entries down here. Although we could see a sell vacuum test, sell climax to complete the harmonic retracement.

- If the bulls get another bull bar next week it would be a reasonable swing long for a scale-in buy but most traders should wait for a clear signal or consecutive reasonable bull bars before entering.

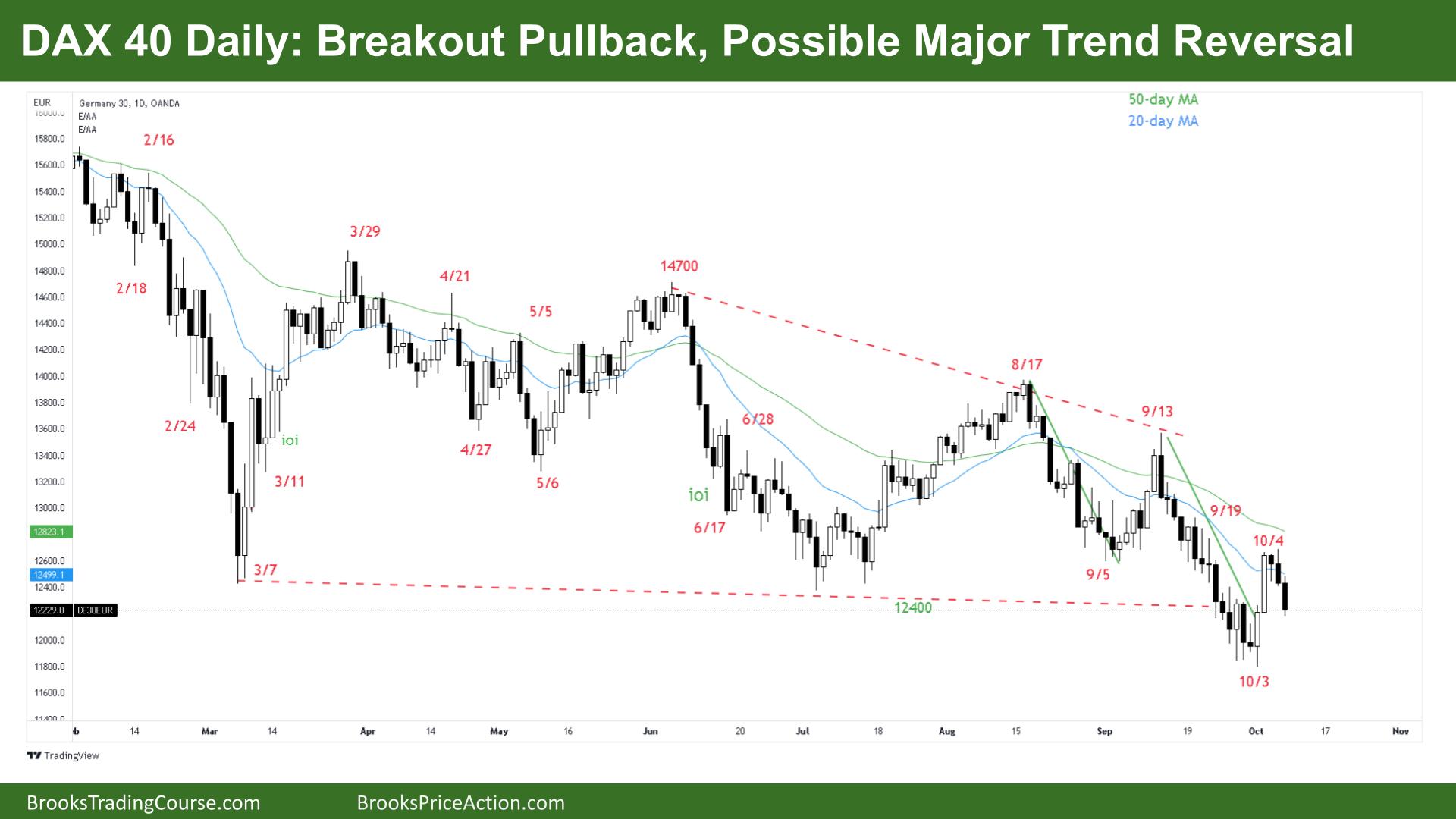

The Daily DAX chart

- The DAX 40 futures was a bear bar closing near its low on Friday so we might gap down on Monday.

- It is 3 consecutive bear bars to close the week, but after 2 large bull surprise bars it’s confusing.

- The bulls see a breakout pullback. It is a lower low and a possible wedge bottom and a major trend reversal. It’s a low-probability buy setup, especially after 3 bear bars so most bulls will wait.

- The bears see a strong reversal at support, a tight bear channel and a break of a trend line so they sold the 2 bull bars for a chance to get out breakeven on their first sell and a profit on their second sell.

- The bulls want a High 2 after the failed High 1 on Thursday – it might be a wedge, High 3 that works. They see the low of the Micro Double Bottom as the smaller trading range here.

- The bears see the 3 consecutive bear bars and will look to sell above after the outside down bar, they saw the breakout bars as a second leg trap and were looking to sell at the moving average after 15 days below the average price.

- Last week there were mostly overlapping bars, so it could be a final flag and a magnet – so low probability to swing below and a better buy area so they will likely scalp short. Bulls will look to scale in long below and if there is a better buy signal, above it.

- Is it a trading range, or is it a bear trend? All the consecutive big bars are all bearish so it’s difficult to find good stop entries for the bulls. Some might wait for consecutive bull bars above the moving average before looking to scale in. If you look left a lot of bull swing setups were disappointing and they scalped out.

- Better to be short of flat. Bulls can look to buy above a strong buy signal, but at the start of next week, we might move back down to the lows to see what’s down there first.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Hi Mr.Fairweather,

What is the minimum scalp size of the DAX? Thank you.