Market Overview: DAX 40 Futures

DAX futures increased last week with a strong buy signal, a High 2 buy setup, closing above the last strong bull bar in the prior spike. The bears tried to get a strong reversal, but you can see the tail below as traders tried to scale into another move. Some traders see the consecutive bear bars as disappointing for bulls. But nothing clear to sell, so more likely up next week.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures went higher last week with a strong bull bar closing on its high, a High 2 buy setup so that we might gap up on Monday.

- The bulls see a parabolic wedge top, a bull microchannel and a high probability of a second leg up.

- Bulls are in control, and it could be the start of a strong channel-up. bears would need to do much more to convince traders it is the top of something.

- Some traders expected 2 legs sideways to down. It may have been enough for the several dojis.

- The bears triggered several sell signals, but they were not strong. And certainly not strong enough for a swing.

- It would have made some bulls get out. But those always in traders will probably buy again above this bar.

- The bears see a strong bear spike and sellers above. An expanding triangle and now a second entry short might set up for them.

- But with so much market control from the bulls, most traders should be long or flat.

- Some bulls were waiting to get back to the MA before buying and now they might have to chase the market up.

- There were buyers below the last bull bar in the spike and at the gap between the two bars.

- There is a gap above the high of the prior bear spike from September and the reversal. The bulls want to keep this gap open for as long as possible. If the bears can close it soon, it will more likely convert into a TR again.

- Expect sideways to up next week.

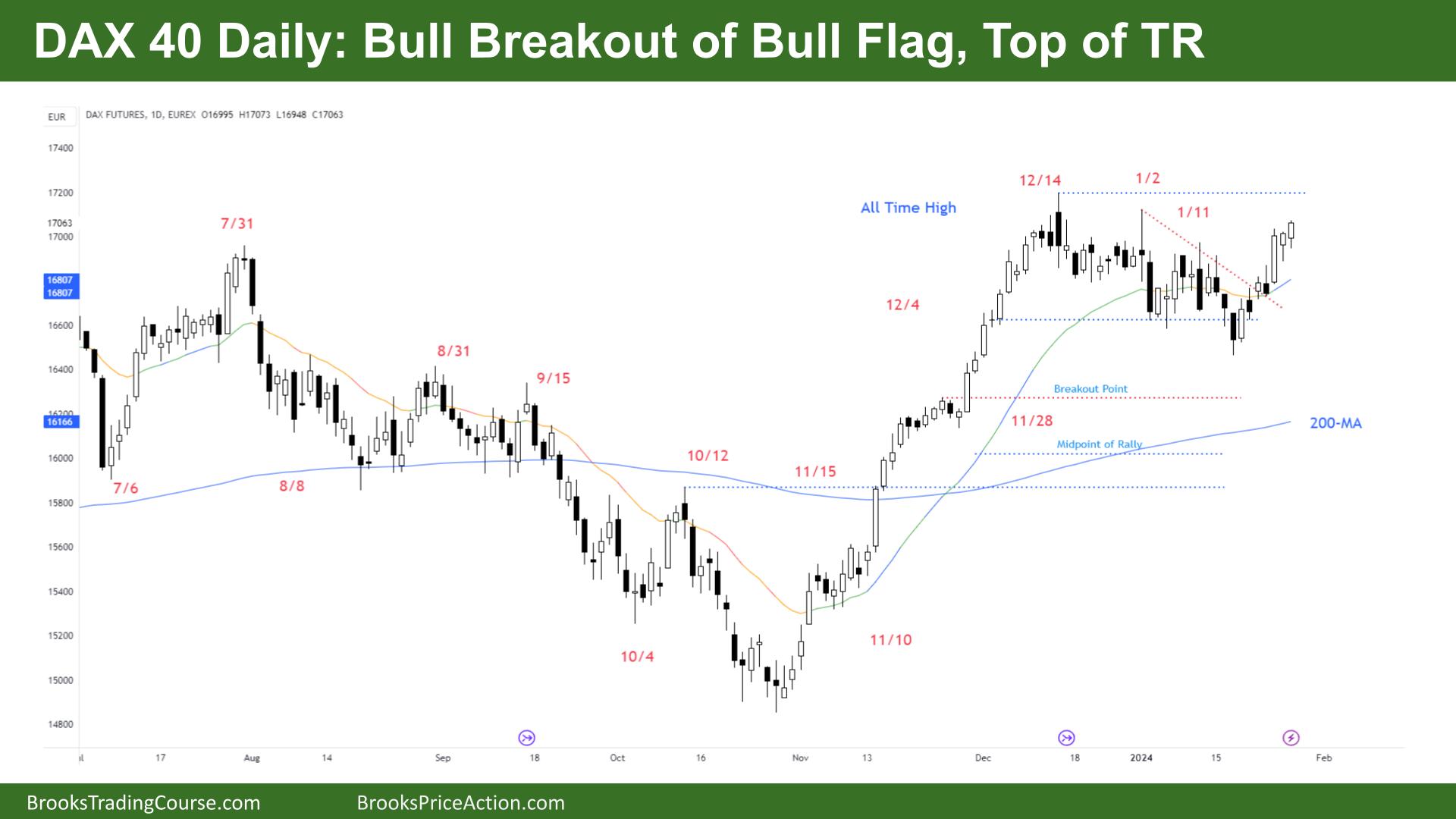

The Daily DAX chart

- The DAX 40 futures on Friday was a small bull bar closing on its high.

- It is the third consecutive bull bar in an 8-bar bull microchannel. The first bar to go below the low of a prior bar will probably attract buyers.

- Bulls are in control, and we are always in long. Traders should be long or flat.

- The next magnet is the prior ATH. Bulls will look for a measured move of this range above it.

- A High 2 buy setup on the HTF, so expect sideways to up.

- Bears will need a double top here to convince traders to begin shorting strongly.

- Most traders will see a breakout of a bull flag and trend continuation.

- It is reasonable follow-through for the bulls after a strong bar on Wednesday.

- The bulls see a bull breakout of a bull flag at the top of a trading range.

- The bears see a reasonable pullback after a bull spike. They think the pullback went for enough bars to disappoint the bulls into giving up when it goes above the high.

- The bears got stuck on Tuesday with a bad sell signal, and Wednesday immediately trapped them into a losing trade. That could be the pressure needed to get to a new ATH again.

- The bulls want another big bull bar to make the bears give up.

- The bears want a good sell signal to sell under or above.

- There are many open gaps below, but so far, in this range, there has been a lot of overlap.

- Bulls bought the first reasonable bull bar below the MA and have their 2:1 target slightly above.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

I love it!