Market Overview: DAX 40 Futures

DAX futures moved higher with a follow-through bull bar, so consecutive bull bars above 18000. We had an overshoot on the measured move and now have 3 legs in a tight channel, so we might start to go sideways here soon. Bulls will likely buy the first reversal attempt and with so much room to the moving average, the best the bears can get is a trading range.

DAX 40 Futures

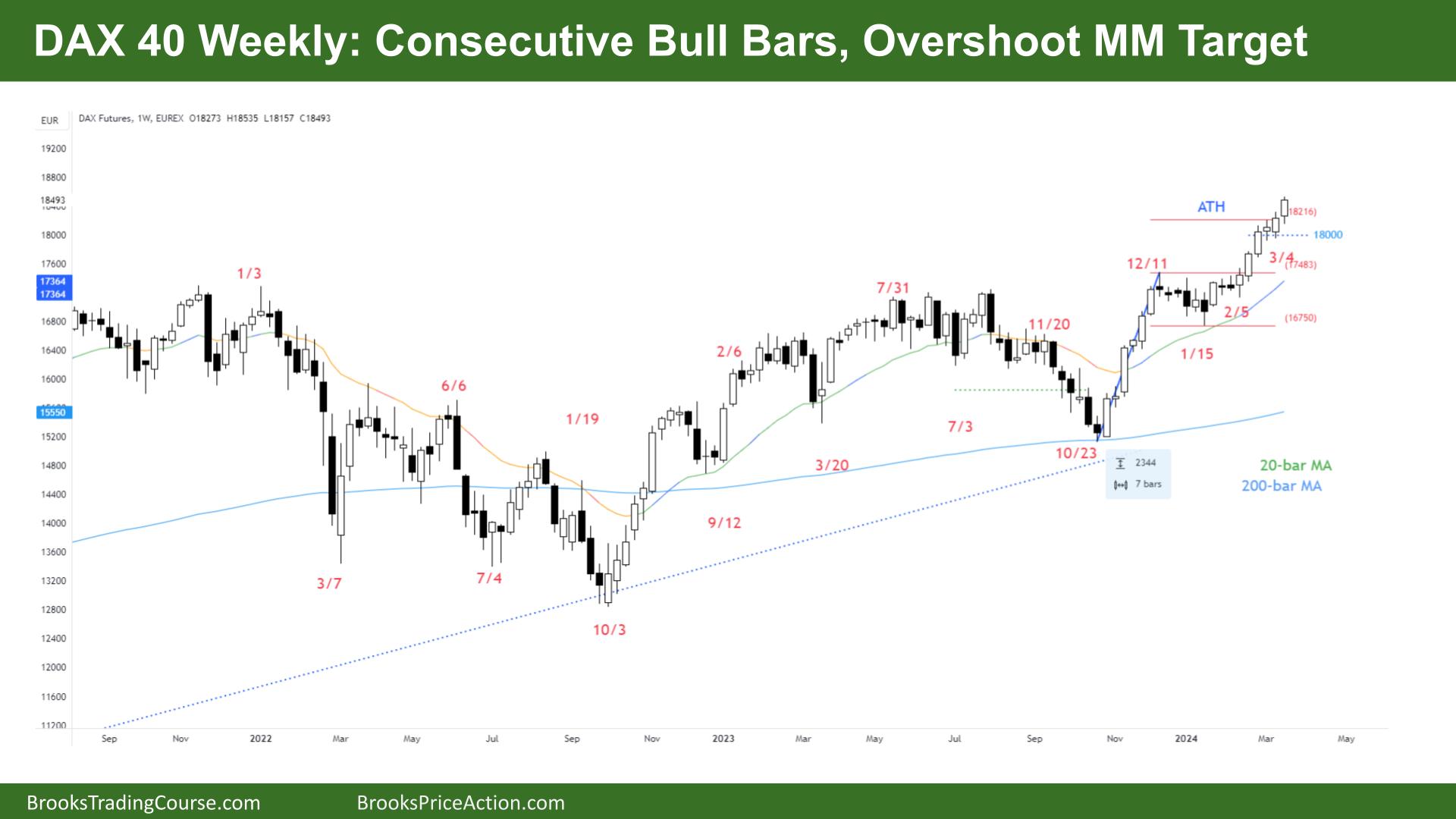

The Weekly DAX chart

- The DAX 40 futures rose last week with consecutive bull bars past 18000.

- Last week was a strong bull bar closing near its high, so it is buy the close.

- It is also the sixth bull bar in a tight bull microchannel. Microchannels have a higher rate of pulling back past 6 bars, so we might start to go sideways next week.

- It was a measured move overshoot, so some bears will scale in to get back there. But this is probably not the chart to do it on!

- The moving average is sloped up, and we are shooting away from it. That means acceleration.

- The bears tried to reverse at 18000 but it was too strong. Open gaps so going higher.

- Acceleration late in a trend is a sign that profit-taking should happen soon, so perhaps sideways to one more bar up.

- You can see the lack of bear bars in the trading range below where we are. Nothing to sell for the bears, so better to be long or flat.

- We are always in long.

- The bulls don’t need to get out, either. The first bar to go below the low of a prior bar after consecutive bull bars in a microchannel is likely to be bought, so bulls will buy and scale in lower.

- It is starting to get climactic. Look back to December. When the bulls got 6 bars, we went sideways, so we might do that again.

- Bears can argue a parabolic wedge top, with three pushes: January, February, and now March. So traders expect two legs sideways to down and then, in a few months, another leg up? That would then be three larger legs.

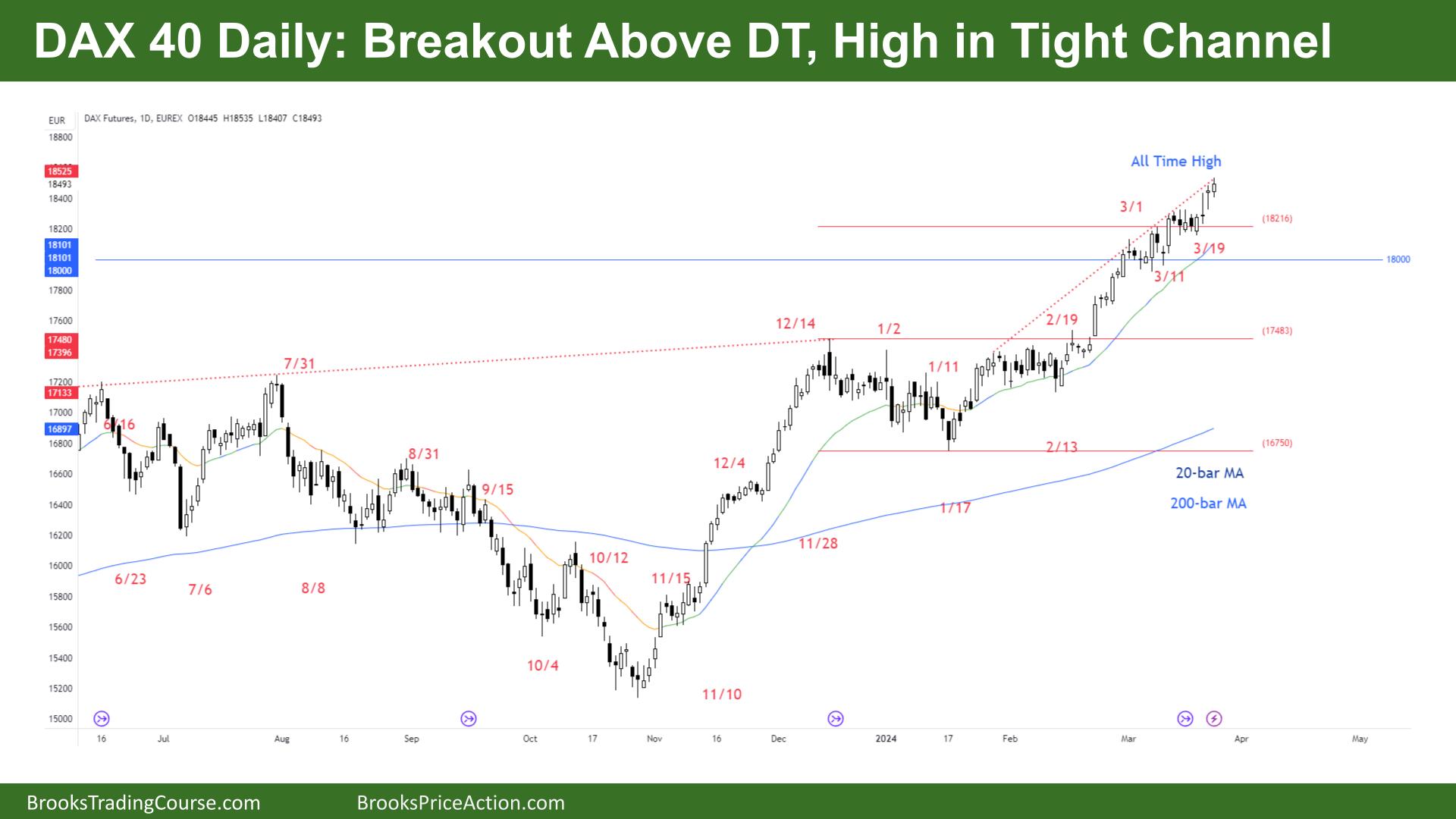

The Daily DAX chart

- The DAX 40 futures went higher with a bull doji, high in a tight bull channel.

- Three dojis in a row, so we will probably convert into a trading range in the next 10 bars.

- The market went right past the trading range measured move target, so there might be another larger target which is more important. Perhaps on the monthly chart.

- I think we will come back to 18000. We have a wedge top in a tight channel, so perhaps we will form a trading range, and 18000 will be the bottom.

- But nothing to sell for the bears.

- The bulls see open gaps above 18000, so as long as measuring gaps are there, limit order bears are losing money.

- Bears might argue a wedge top, but where was the good daily sell signal? We are hugging the top of the channel, so some bulls might take profits. Others will look for the channel to jump another range.

- Most traders should be long or flat. Always in long so next week should be sideways to up.

- But its a late leg so might be better to wait for a couple of legs sideways to down before buying again.

- Above both moving averages and a large airpocket above the 20 MA. So the first reversal down is likely to be minor.

- Friday didn’t close above Thursday so signs of the trading range are starting to appear. If bulls are not buying above yesterday’s high, then they are looking to buy below it.

- So bears will be more aggressive above bars, or sell a distance above it.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.