Market Overview: DAX 40 Futures

DAX 40 bear surprise bar and always in short on the weekly chart. The bears want a follow-through bar breaking below the range for a move down. The bulls have successfully reversed up twice here and will look to scale in here and lower. We look like we will go to the harmonic move below, but it has not been easy for stop-entry traders.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures on the weekly chart was a bear surprise bar closing on its low so we might gap down on Monday.

- We are always in short and reversed down again at the 20-week moving average (MA). We said last week that traders would do this until it was no longer profitable.

- The bulls see a double bottom with April and a wedge bottom with March and April. They see a sell climax and test of the breakout point at 13000 big round number.

- The bulls want another pause like April and then consecutive bull bars closing above their midpoints, to break above the channel, and get a measured-move up.

- The bears see a broad bear channel and failed higher low major trend reversal. They want another strong bear bar closing below March and April for a measured move down.

- We are at the bottom of a 5-month trading range so the math favors buying above a reasonable buy signal, but there is nothing to buy yet.

- Limit bulls will scale in at the channel trend line below and below April looking for a failed breakout and reversal.

- Better to be flat or short, stop above August 14th. Bears want the harmonic move down and they might get it after another 2 legs.

- You can sell with a wide stop and look to scale in, betting on a close below the range and add-on the break. You can also add position higher on a small pullback as it’s a low-probability buy after 2 big bear bars.

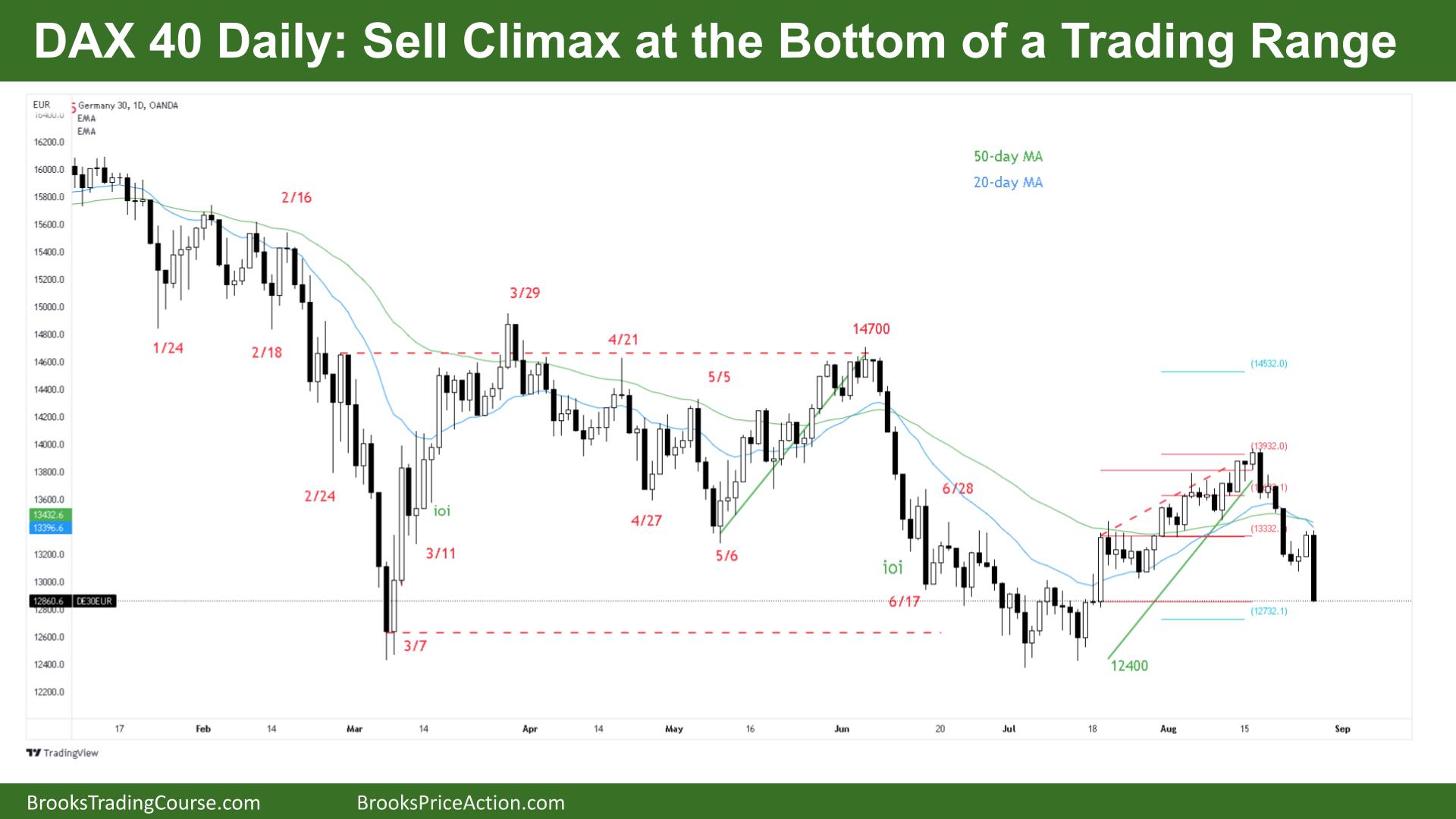

The Daily DAX chart

- The DAX 40 futures was a sell climax on Friday closing on its low so we might gap down on Monday.

- The bulls see a sell climax, higher low major trend reversal and are looking to buy in the lows of a trading range.

- The bears see we are always in short and an 8-bar bear channel with only one pullback. They look left and can see the biggest bars are all bear bars and the bulls failed to get big consecutive bull bars last month.

- The bears want to break strongly below March for a measured move down but can expect limit order bulls to scale in here and lower.

- The bulls want a strong reversal bar closing on its high for a possible High 2 buy. They see we might form a wedge bottom with one more leg near the lows, and reversal above that would have a higher probability.

- But it’s a bad buy signal, a big bear bar so most traders should be flat or short.

- We reversed down strongly from two measured move targets so the longer-term bear trend looks to be intact.

- In general, with 4 months of sideways trading, traders should look to buy low, sell high and scalp (BLSHS.)

- With such a large bear bar it might be too much risk for bears to sell with a stop, so we might trade up early next week to attract further sellers.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.