Market Overview: DAX 40 Futures

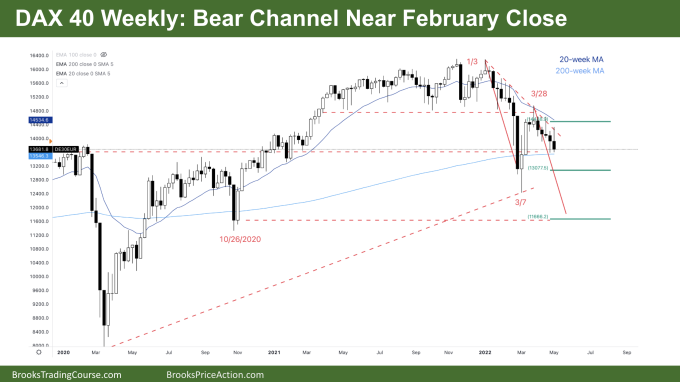

DAX futures moved lower last week with a DAX 40 bear channel near the February close and near the 200-week moving average (MA). The bears want a breakout below the February low down to a measured move target near October 2020. The bulls want a higher low major trend reversal, possible double bottom buy, to keep the long-term bull channel up to March’s highs. With tails on the bars expect some sideways to down trading next week.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures weekly had 5 consecutive bear bars testing the 200-week moving average (MA). After a 2-year bull trend traders expected 2 legs sideways to down and are deciding whether this is nearing the end of the second leg.

- We are always in short in a bear channel, so we will likely trade lower next week. But the last time there were 5 consecutive bear bars was the COVID crash. I could not find a consecutive set of 6 bear bars before.

- So it is climactic and therefore a reasonable place for profit-taking.

- But with 5 bear bars, traders expect the first reversal to be minor so we might get to either the February close or low. Maybe both.

- The bulls see we are pausing at the 200-week MA which is the pre-COVID support area. They see a sell climax and a possible higher low major trend reversal.

- But they need bull bars. An outside up or a good close to convince traders to swing long. They want a double-bottom trend resumption but the math isn’t that good for a swing yet.

- The bulls see last week was a possible micro DB with an equal low to last week. But neither bar closed on their lows, so it’s not as bearish as it could be.

- The bears see a bear trend from January, with the most recent 5-week consecutive bear bars as the second leg. They want the leg to continue down to the February lows and a breakout with a possible measured move.

- Al recommends using the lower high as the first measured move target distance.

- So from the March 28th high to the February low, the target would be around 11600, the October 26th 2020 low. That is also a harmonic with the distance from January’s first bear leg.

- Bears are unwilling to hold short into the weekend so they are scalping. That means bulls will start to swing, buying here and lower, betting on a wedge bottom reversal or a double bottom with February.

- We have been going sideways in a narrowing trading range since February. Why? 14000 is a big round number and that could become the middle of a trading range that might last for the remainder of the year.

The Daily DAX chart

- The DAX 40 futures moved lower last week ending Friday with a pair of consecutive bear bars closing near their lows. It is reasonable to expect that we move lower next week.

- We reversed down from both the 50-day MA and the 20-day MA, back to the April 27th low but not lower. Even though is it a bear channel, the tails on the bar suggest that even though we might be always in short, it is not as bearish as it could be.

- The bulls are looking for a higher low major trend reversal. They see a wedge bottom with March 11th and April 27th. They see we are at the bottom of a tight trading range and a reasonable place to start swings.

- But where is a good buy signal? The previous 4 bull bars which closed on their highs all sold off, so it is likely next week with any strong reversal the bulls will continue to scalp.

- The bears see a broad bear channel and continual resistance along the bear trend lines. They see we are rejecting the 20-day and 50-day moving averages so it reasonable to keep swinging until a reasonable buy signal appears.

- The bears want a close below 13600 for a measured move down to near the February low.

- But why are we pausing here? We are in the middle of a trading range with February’s low and the March 29th high. No one wants to buy high or sell low.

- When the probability is now 50% there are equal buys and sells, so we might continue to go sideways to down next week.

- If the bulls can get a reasonable reversal here they might get a double bottom reversal up with a measured move from the bottom of the wedge up to the March 29th high.

- If you’re buying, looking to trade small and scale in.

- If you’re short, get out above a bull bar closing above its mid-point or a High1 buy setup next week. Look to sell again at the trend line of the bear channel.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.