Market Overview: DAX 40 Futures

The DAX futures moved lower last month with follow-through selling below a bear breakout. It’s always in short on the daily chart but bears failed to get consecutive bear bars last week so it looks like we might go sideways. The bulls have support after a long-term trend and we are about 3000 points off the high where we reversed up previously. We can expect bulls to scale in here and lower.

DAX 40 Futures

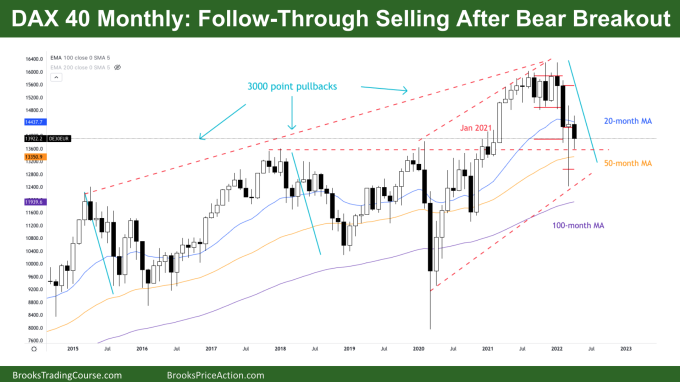

The Monthly DAX chart

- The DAX 40 was a bearish inside bar with reasonable tails above and below. There was a bear surprise in February and follow-through in April so it’s likely we are always in short. Traders will expect to trade lower next month as well.

- For the bears, it’s a tight bear channel, and a bear breakout below a tight trading range and measured move which was completed this month.

- They saw the moving average gap bar was bought, but it couldn’t close above the moving average (MA) so they expect lower prices as well.

- For the bulls, it’s a pullback in a broad bull channel. They see we are sitting above the prior breakout in January 2021 which might support a double bottom longer-term trend resumption higher.

- The bears might see this as a failed breakout above the range and returning back to the range lower.

- If you’re selling, the bars are big so the stops are wide and the risk is greater. Tails on the bottom of bars will keep bears scalping, avoiding selling at the bottom of a potential trading range.

- With two bear scalp measured moves completed, the sell below April has a tail which will keep most bears from selling until we move higher.

- With magnets above (prior tight trading range) and magnets below (previous resistance) it is likely we go sideways to down here while traders decide.

- The bulls want a High 1 above April, which they might get now that the measured move has been completed. Either an inside bar in May or a follow-through High 1 in June/July. But it’s likely there are sellers above betting the trend is not over so buyers might be near the March lows.

- The bears want more bear bars. If they can close lower, consecutive bear bars on the monthly, that would get them to the 50-month MA. They saw the first test of support as failing and will likely look for a second leg with any sustained buying.

- If the bears get another bear bar, we might get a sell climax down to the measured move from February. That is around the 50-month MA, prior support and near the March lows. Once the bears take profit there, the bulls waiting for a double bottom buy setup and a possible higher low major trend reversal back up.

The Daily DAX chart

- The DAX 40 had a bear bar closing on its low on Friday so we might gap down on Monday. We rejected the 20-day MA for the 2nd time.

- We traded lower last week but the bears have failed to get more than 2 consecutive bear bars. Al says when there is something wrong with the trend, it’s likely a leg in a trading range.

- We triggered a Low 1 sell below April 21st and a head and shoulders sell below April 22nd which both remain alive. But it’s been mostly limit order trading since then which means we are probably in a trading range or going to be soon.

- The bulls see a two-legged pullback from a tight channel, three pushes up to March 29th. This week probably finished the 2nd leg so bulls will buy below bars. They see Tuesday’s large bear bar as a possible sell climax and failed head and shoulders sell.

- The bulls see a possible double bottom with March 9th and will look to scale in lower.

- The bears see a broad bear channel with rejection at the 20-day MA again and with a Low 1 and Low 2 still live we are always in short.

- The bears want follow-through bear bars Monday/Tuesday to close below last week’s low to get a 3rd push down to the March lows.

- It’s possible both will get disappointed and we go sideways. The bears might get a bear bar but it closes inside last week so the bulls buy it.

- Then the micro double bottom (Micro DB) will look strong but likely more sellers above the MA betting on the channel continuing down into the range.

- If the bulls can keep the bears from hitting their targets, we can expect both buying back of shorts and bulls buying creating a stronger reversal up.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.