Market Overview: Bitcoin Futures

Bitcoin breakout test of the 20-week EMA after a bull breakout. During the past week, the price decreased -7.28% of its value.

Bitcoin futures

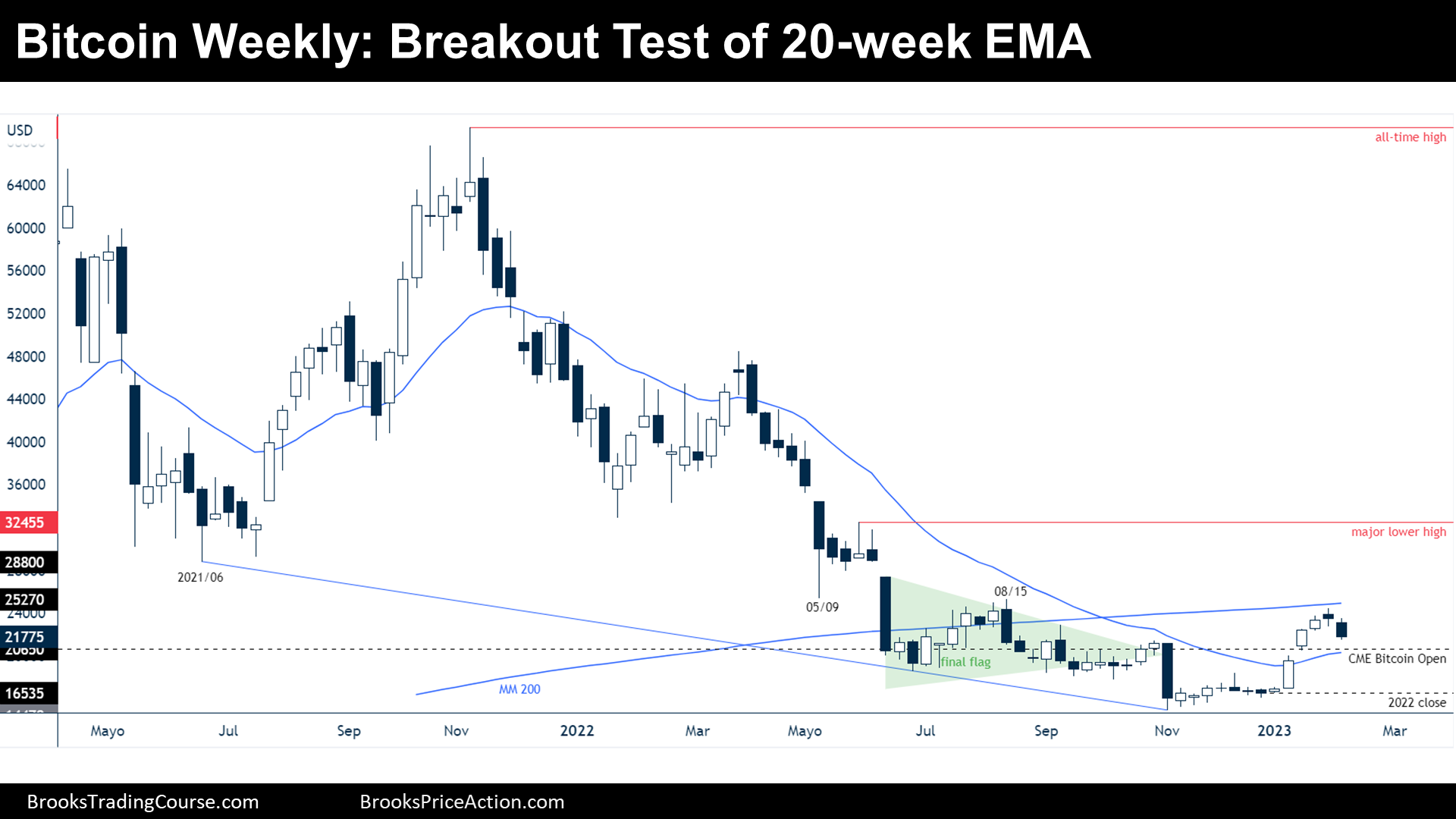

The Weekly chart of Bitcoin futures

Analysis

- This weekly candlestick is a bear breakout bar closing around its low. It is the first retracement of a bull micro channel.

- During past reports, I have said that a pullback was likely within the following weeks, and this is what happened.

- Furthermore, I have said that before there is a bull breakout attempt of resistances like the 200-week MA (moving average), the price might test the apex of the final flag, or the CME Bitcoin Opening. That area of prices also confluences with the 20-week EMA (exponential moving average).

- The overall context is likely a trading range around the major lower high and 2022 lows. Bulls are not likely to start a bull trend here since the bear trend was strong enough and the chances of a bear leg starting around the $30000 are high.

- As stated since 2022 June, bulls probably bought around the June 2021 low. Those bulls still currently trapped, and they will likely add selling pressure during a reversal up. Strong bear channels like that one fail the first reversal up most of the time: currently, the price is experiencing the first reversal up.

- The price is either:

- Bull case: A bull leg up to $30000 area is underway. Now, the price is testing the 20-week EMA before there is a breakout of the 200-week MA. Bulls want to end bearish tentatively by trading above the prior major lower high. They know that the most likely scenario is a trading range and therefore, they would like to buy low, not at resistances: that is the reason the price might test first supports because there were not enough buyers around resistances after a climatic bull leg.

- Bear case: They see a possible double top lower high with 08/15 high. They want to close the open gaps that the price left during the bull micro channel because that will indicate that bulls are not as strong as they look right know.

- Since the bull micro channel was strong, traders should not expect good follow through for the bears next week.

Trading

- Bulls: Bulls might buy the first bear bar after a strong bull spike. They think that this is an early pullback of a bull leg. Furthermore, the probability risk-reward equation looks attractive to them again.

- Bears: Since the bull reversal was strong, bears will have better chances to sell with limit orders above the current bar than if they sell with a stop order below. Most traders would prefer to sell with a stop order after a micro double top or an ii, an oo, or an ioi pattern.

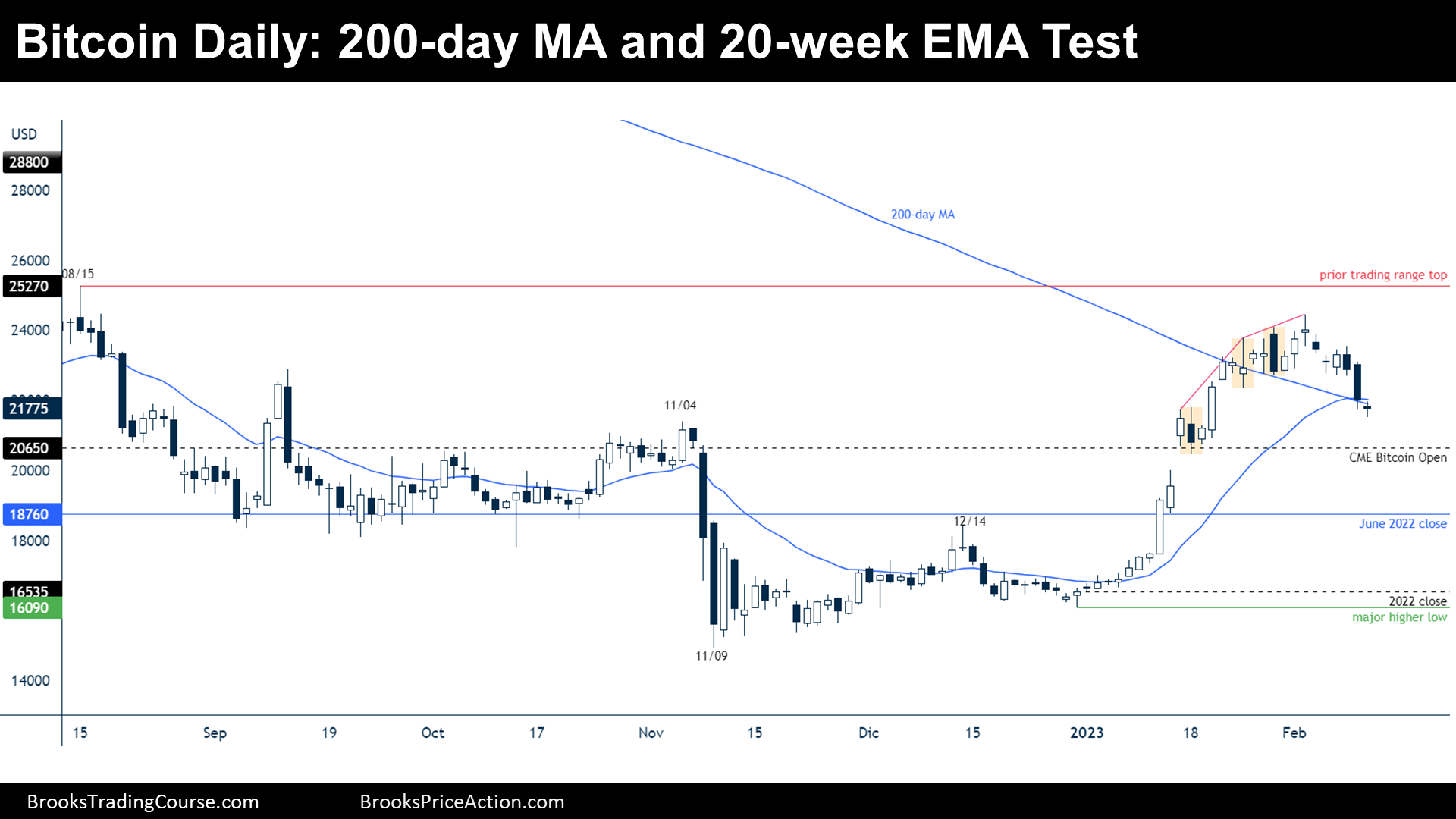

The Daily chart of Bitcoin futures

Analysis

- This week, the price reversed down from consecutive wedge tops. The price closed below the 200-day MA and the 20-day EMA on Friday.

- During the prior weekly report, I have said that there were signs of exhaustion that suggested sideways trading during February. Furthermore, I have said that the price was far from the 20-day EMA and that I was expecting a pullback down there and the 11/04 high, which is what is happening right now.

- The bear leg after the wedges is tight; hence, traders should expect a fail of the first reversal up.

- Nowadays, the price is either:

- Bull case: the price is forming a spike and channel bull trend. They ended the bear trend, and now they want to trade above the next resistance, which is the prior trading range top, and then keep trending up to $30000.

- Bear case: after the strong bull leg, the best that bears would get is probably a trading range; therefore, they will want to sell high, this means, around $24000.

- Because the bull breakout was strong and that now the price is testing supports, traders should expect another leg sideways to up, starting soon.

Trading

- Bulls: Some traders are already buying around the 20-EMA and the 200-MA with limit orders. Others will wait after a bull bar emerges from there. Ideally, they want a serious rebound from here, to dissuade future bear temptations to short, and then buy a double bottom or a higher low at the current support area.

- Bears: Because the best that they can get is likely a trading range, they prefer to sell top formations like a double top or a wedge top instead of selling low.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.