- Market Overview: Weekend Market Analysis

- 30 year Treasury Bond futures

- Bond futures weekly chart in minor leg down in trading range

- Bond futures daily chart turning down from a double top bear flag

- EURUSD Forex market stalling at the September 2018 high

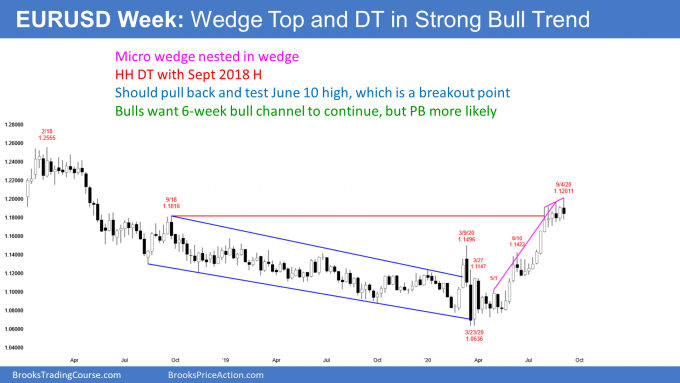

- EURUSD weekly chart has a micro wedge top nested within a 5 month wedge top

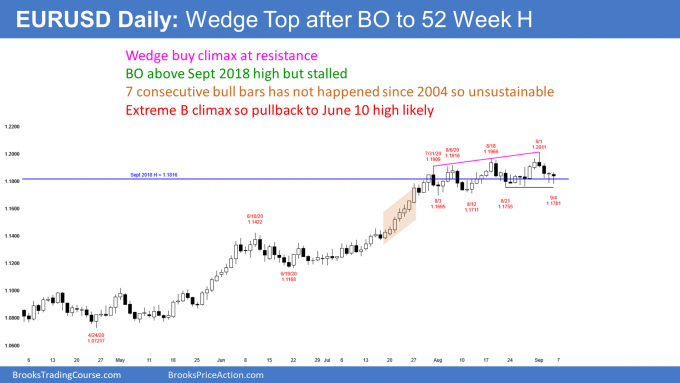

- EURUSD daily chart is in a weak bull channel and a month-long trading range

- SP500 Emini futures

- Weekly SP500 Emini futures chart formed weak outside down bar in a buy climax

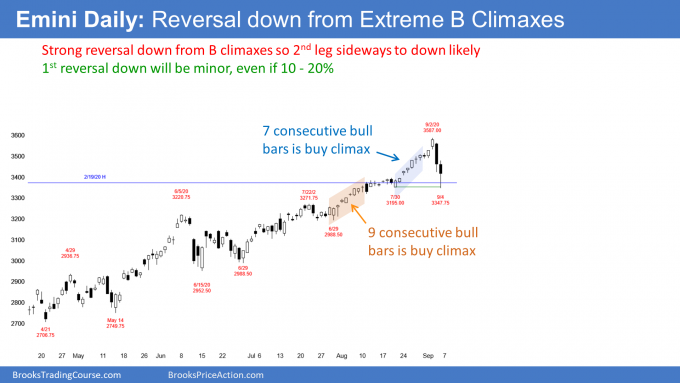

- Daily SP500 Emini futures chart has strong reversal down from a buy climax

Market Overview: Weekend Market Analysis

The SP500 Emini futures sold off sharply for 2 days but bounced on Friday. The bounce might continue to above 3500, but traders expect a 2nd leg down to around 3200.

Bond futures are turning down from a double top bear flag on the daily chart, but the yearlong trading range should continue.

The EURUSD Forex weekly chart has a micro wedge nested in a 5 month wedge at resistance. Traders should expect a pullback to the June 10 high.

30 year Treasury Bond futures

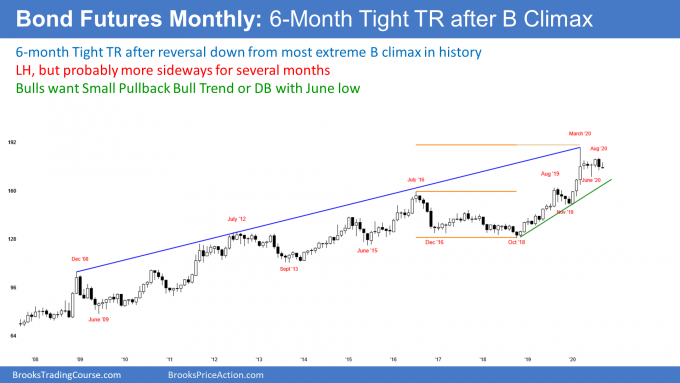

Bond futures monthly chart has been sideways for 6 months

The monthly bond futures chart has been sideways for 7 months and there is no sign that this is about to change. After the March reversal down from the biggest buy climax in history, I have been saying that the most likely outcome would be a trading range for the remainder of the year. That is still what is most likely.

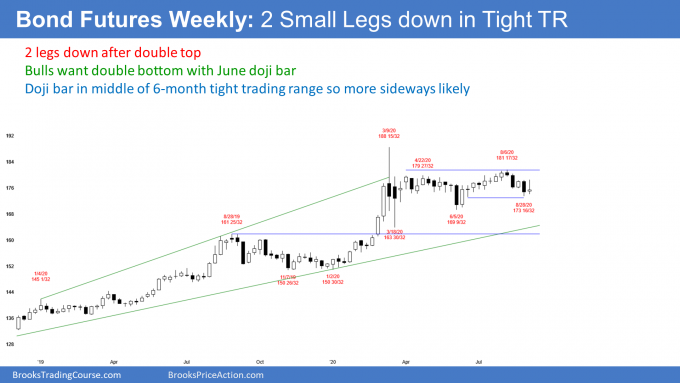

Bond futures weekly chart in minor leg down in trading range

The weekly bond futures sold off for 2 weeks and reversed up from around the June 16 low. I have been saying for 4 weeks that this was likely because that is what typically happens after a Spike and Channel bull trend.

The reversal up usually forms a lower high and then the market goes sideways. Consequently, traders expected the rally to stall around the August 24 high, which it tested Thursday.

This week mostly overlapped last week and it had tails above and below. That makes more sideways trading likely next week.

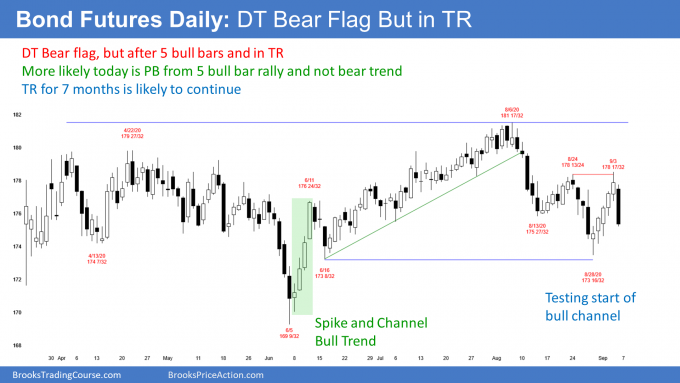

Bond futures daily chart turning down from a double top bear flag

The daily bond futures reversed up last Friday from 2 legs down to around the June 16 low. That low was the start of the 2 month bull channel.

Last weekend, I said that last Friday was a reasonable candidate for a buy signal bar, and that traders should expect a rally up to test the August 24 lower high. That is what happened this week.

The bears got a reversal down from a double top with that high on Friday, but after 5 consecutive bull bars, the reversal should be minor. The bulls see Friday’s reversal down as a pullback from the 5 day reversal up. This confusion should lead to at least a couple sideways weeks.

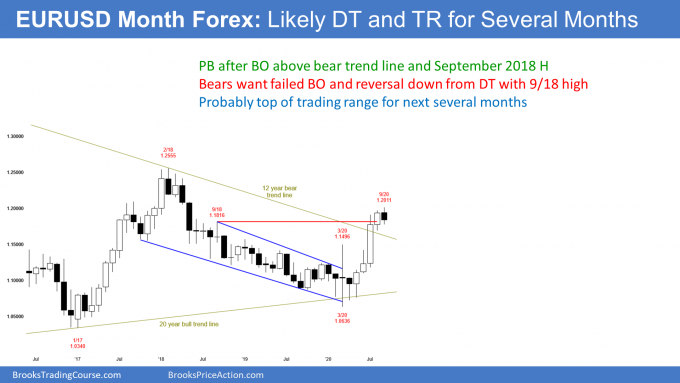

EURUSD Forex market stalling at the September 2018 high

EURUSD monthly chart has a double top with the September 2018 high

The EURUSD Forex monthly chart had a bull breakout in July, and August was a bull follow-through bar. That combination makes it likely September would trade above the August high, which it did this week.

However, for several months I have been saying that the EURUSD Forex market should eventually test the September 2018 high and then enter a trading range. That is still true. Therefore, as strong as the 4 month rally has been, it should stall here for at least a couple of months. At a minimum, traders should expect a pullback to the March high, which was the breakout point for the July breakout.

EURUSD weekly chart has a micro wedge top nested within a 5 month wedge top

The EURUSD weekly chart rallied strongly, but it has stalled for 6 weeks at the September 2018 high. Since the rally from the March low has had 3 legs up in a tight bull channel, it is a parabolic buy climax.

That typically leads to a couple legs sideways to down to support. Obvious support is at the 2 breakout points, the March 9 and the June 10 highs. That means traders should expect a 500 pip pullback over the next couple months.

This week was a bear bar. It is a sell signal bar for a nested wedge buy climax at resistance. However, it had prominent tails above and below and it is in a 6 week tight trading range. It is therefore a weak sell setup.

The past 5 weeks formed a micro wedge top. That wedge is nested within the bigger wedge that began with the March low. Traders should expect lower prices for about 10 bars, which is about a couple months. However, the EURUSD has been sideways for 6 weeks and it might continue sideways longer before it begins to test down.

Can the strong bull trend keep going up to the February 2018 top at around 1.2500? The bulls currently have a 30% chance of that. Sideways to down is more likely.

EURUSD daily chart is in a weak bull channel and a month-long trading range

The EURUSD daily chart has been in a weak bull channel for a month. It is basically a trading range that is tilted up. There were 3 pushes up to the August 18 high, and the pattern was therefore a wedge.

This week broke above the 3rd top and reversed down. Some will call that a failed breakout above a wedge, which is a sell signal. Others will say that it was a wedge with 4 legs up instead of 3. Both are correct.

What matters is that the bulls continue to fail to break far above the resistance of the September 2018 high. As a general rule, if the market keeps trying to do something and fails, it will probably then try to do the opposite.

While the daily chart is still in a 6 week trading range, the odds are slightly better for a bear breakout. However, a couple closes above this week’s high will flip the odds back in favor of the bulls.

The reversal down so far has not been strong. But a reversal down from a wedge top typically has at least 2 small legs. Consequently, if there is a bounce over the next few days, it will probably form a lower high.

But will the bears get a couple closes below the August 3 low at the bottom of the range? We don’t know yet, but if they do, traders will conclude that a swing down has begun. They will look for a test of the June 10 high breakout point and possibly the June 19 start of the June/July buy climax.

SP500 Emini futures

Monthly Emini chart has bear bar at the top of a 10 year bull channel

The monthly SP500 Emini futures chart’s price action is similar to that of 2017. That was the most extreme buy climax in the history of the stock market on the daily, weekly, and monthly charts. At that time, I said it would probably lead to a 10% correction, which it did early in 2018.

I have been saying that traders should expect a 10 – 20% pullback to begin in September. It might have started this week.

September so far is a bear reversal bar on the monthly chart. The bears want the month to have a bear body and for it to close on the low of the month. It might even trade below the August low and form an outside down month. If it has a bear body, it would then be a sell signal bar for next month.

This is still very early in the month. The candlestick could look very different when it closes in 4 weeks. But given how overbought the monthly chart is, and it being at the resistance of the top of the 3 year expanding triangle, traders should expect a pullback for a month or two.

However, after the dramatic reversal up from the March sell climax, the bulls will buy the pullback. This is true even if it lasts a couple months and the Emini falls 20%.

What has been happening for 5 months is that the bulls have been resuming that 2017 trend up . They were so exhausted from such an extreme buy climax in 2017 that it took them 2.5 years to begin to buy aggressively again. If often takes a long time for the fundamentals to catch up to price when the price is overextended. Are the fundamentals that good now? The market thinks so whether or not you or I do.

How high can the Emini go after a pullback?

Will the current trend continue up for a 1,000 point measured move, based on the height of the trading range since early 2018? It might within a couple years, but I don’t think so, and certainly not in a straight line. There probably will be a pullback first before there is a new high. This is because the monthly chart is testing the trend line drawn across the January 2018 and February 2020 highs and because of the extreme buy climaxes on the daily and weekly charts (see below).

Also, I have been saying since 2017 that the Emini will probably be mostly sideways for a decade. But I have also said that the top of the range could be as high as 4,000.

Why sideways? Because that is what it typically does after a decade-long strong bull trend. Just look at what happened in the 1970’s and after the 2000 tech buy climax. Sideways for a decade. There were new highs in both ranges, but there were also 50% selloffs.

It’s hard to think this way after a huge 5 month rally, but that is what is likely. Although the Emini is at a new all-time high, it is also at the top of a 3 year trading range. Traders should expect the trading range to last for many more years, even though traders will probably get at least one more test of the current high after the incipient selloff.

Weekly SP500 Emini futures chart formed weak outside down bar in a buy climax

The weekly SP500 Emini futures chart had a big bull bar last week late in a buy climax. That typically attracts profit-taking, especially when the rally is at resistance. The Emini is failing at the top of the 3 year expanding triangle. This is also the top of the 3 year trading range. It is a logical location for bulls to start to take profits.

The Emini traded above last week’s high and then below its low. This week is therefore an outside down bar on the weekly chart. It is therefore a sell signal bar for next week. But is had a big tail below and that makes it a weaker sell signal.

This week also closed the gap below last week’s low. That gap is therefore now a possible exhaustion gap. However, a small gap is rarely very significant, and many other factors are much more important.

It is important to note that the bull trend has not had a pullback since July 3. Every low has been above the low of the prior bar. This is a 10 bar bull micro channel.

All bull micro channels come from aggressive buying. And the bulls will typically buy the 1st 1 – 2 bar pullback. However, when the buy climax is as extreme as this one has been, it sometimes sells off much longer and deeper than what seems likely.

Parabolic wedge buy climax

The 10 week rally has had 3 surges (small legs up). That makes it a parabolic wedge buy climax, which sometimes leads to a trend reversal and not just a pullback. However, one of 2 things typically happens. The first common pattern is that there is a sharp selloff lasting 1 – 3 bars (weeks) and then a tight trading range for about 10 bars. At that point, traders decide if the sideways trading is a bull flag or a pause in an early bear trend.

The 2nd pattern is an Endless Pullback. That means the market drifts down with smaller bars, constantly looking like it is forming a bull flag, but every attempt to resume the bull trend fails within a couple bars. This is a Small Pullback Bear Trend. After 10 – 20 bars, there is usually either a breakout up or down. The bulls want a resumption of the bull trend, but the bears want a strong break below the bear channel and then a clear bear trend.

There are many other things that the market can do, but these are the 2 most common after an extreme parabolic wedge at resistance.

How big will a reversal down be?

Regardless of what happens, if this week is the start of profit-taking, traders will look for at least 2 small legs down over the course of 5 – 10 bars (weeks). They will expect the selloff to test breakout points in the 5 month rally. These include the February high and probably the June 5 high.

If the Emini falls that far, it might then go sideways for a month or two before traders decide whether the Emini will test this week’s high or continue down toward the middle of the 3 year trading range.

Possible Cup and Handle bottom

The 5 month strong reversal up followed a sell climax. There eventually will be a pullback and then an attempt to resume the bull trend.

The sell climax and reversal up form the cup. The pullback then forms the handle. The pullback is a bull flag. The pullback can be brief, like a few bars, or it can last 20 or more bars. That means possibly months.

However, traders should expect an eventual test of the old high, which could be a small breakout above the old high. Then, they will watch to see if the bull trend continues up or if the rally from the handle forms a double top with the top of the cup.

Daily SP500 Emini futures chart has strong reversal down from a buy climax

The daily SP500 Emini futures chart has been in a Small Pullback Bull Trend for 3 months. I have been saying that a very tight bull channel like this often accelerates up sharply before the profit taking begins. That has been what has been happening for the past couple weeks. Thursday was the start of profit-taking.

There was follow-through selling on Friday. I have been saying that the Emini should trade down below the streak of consecutive bull days that ended this week. It fell a few ticks below on Friday and reversed up for the rest of the day.

Bulls want just 1 – 3 day pullback, but more is likely

The bulls hope that the selling will last only a few days and that the bull trend will resume. There is currently a 40% chance that they will get their wish.

There is a 60% chance that the selloff will be deeper and last longer. As a general rule, I look for a TBTL (Ten Bar, Two Leg) pullback after an extreme buy climax. It can be more or less, but that is a reasonable guide. The bulls want to give the bears 2 chances to create a bear trend reversal. If the bears fail twice, the bulls will look to buy again. That is why I say that traders expect at least a couple legs down.

The acceleration up over the past couple weeks created a third leg up from the June 29 low. Three legs up in a tight bull channel is a parabolic wedge. Traders can also see it on the weekly chart. That often soon attracts profit-taking. It is another reason to expect a couple legs down starting this week.

Why is the selling so violent?

There was a strong rally in March and it has continued for 5 months with only small pullbacks. Why is the current selloff so big and deep? The March buyers were value buyers. They bought because the Emini was down 35% and they saw it as a great value. It was cheap. If it fell more, they would buy more. There were buyers below.

The August buyers did not see the market as cheap. They knew that it was expensive. They bought because the momentum up was strong. They knew the odds were that they could make a quick profit. These are momentum bulls.

A momentum bull will not buy more if the market pulls back. They buy, expecting a high probability of a quick profit. They will only allow a small risk since they are going for a small reward. Once they decide that the momentum has stopped, they quickly exit.

That is what happened on Thursday. The momentum bulls who bought in August panicked out of their longs.

The Emini probably has not fallen enough for value bulls to eagerly buy. So who is left to buy? Probably no one at this price and time. Therefore, the Emini will likely have to fall more to attract buyers.

Streaks of 9 and 7 consecutive bull bars

I talked about the streak of 9 consecutive bull bars that ended on August 11. There was another streak of 7 consecutive bull bars that ended on August 31. I mentioned above that the Emini on Friday reversed up from below the bottom of the 7 day streak. It will probably go lower.

The most recent prior streak of 8 or more bars was in June. Five days later, the Emini fell 8% to below the bottom of the streak.

The last streak of 9 bars ended January 16, 2018. The rally had 2 more legs up over the next 2 weeks, and then the Emini sold off 10% to far below the bottom of the streak.

With streaks of 9 and 7 consecutive bull bars over the past month, traders should expect a reversal down to below the bottom of one or both streaks. The 7 bar streak began around 3,350 and the bottom of the 9 bar streak was 3,195. A pullback to 3,200 would be a 10% selloff from the high.

There is a 50% chance that the selloff will continue down to below the bottom of the tight bull channel, which is around 3,000. That would be about a 20% correction. That is why I have been saying that the eventual reversal down will probably be at least 10% and possibly 20%.

What about next week?

The Emini was very overbought on the daily and weekly charts prior to Thursday’s dramatic reversal down. What happens over the next few days will give traders an idea of what to expect over the next couple weeks.

If the Emini quickly resumes up, then traders will expect a new high. More likely, the Emini will have at least a small 2nd leg down after an extremely big Bear Surprise Bar whether or not it tests above 3500 early next week.

As I have been saying for several weeks, the Emini will probably have to fall between 10 – 20% before the bulls will look to buy again. Furthermore, if it falls that much, it might have to go sideways for many weeks before traders are convinced that the selling has ended.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

For the E-Mini Weekly chart, is it accurate to see three pushes up since the March low and look for possible two legs down?

I think that the size of the 3rd leg up reset the count. While this is the 3rd leg up from the March low, the shape is no longer that of a wedge. The less something looks like a pattern, the fewer traders will trade it like the pattern.

The 2nd leg up from the May low was strong enough to be a Spike up. The tight bull channel from the June low is a parabolic wedge bull channel. I think more computers see the chart as a Spike and Parabolic Wedge Bull Channel. Others see it as a 3 year expanding top or a higher high double top with the February high.

Your point is correct, though. After any buy climax, no matter what traders call the pattern, traders will expect a couple legs sideways to down. And this is a buy climax.

I suspect that there will be rotation from nasdaq to emini, so it is possible that the nasdaq will fall more and the money will have to go somewhere. This maybe the s&p. I bought WMT, and sold calls, thinking that while nasdaq could fall more the money has to go somewhere. I have noticed that SPYD has not fallen (it pays 7%)

There is a typo “has been has been”.

I fixed it.

Thanks!

Al