Market Overview: Nifty 50 Futures

Nifty 50 futures breakout gap on the weekly chart confirmed by forming consecutive bull bars near the top of the developing trading range, which is more likely to get converted to an exhaustion gap. On the daily chart, the market formed a triangle late in the trend, and also there is seen an increase in trading range price action which could be the sign of a possible final flag. But bears are not able to get strong bear legs, so best bears can get for now is a trading range and not a reversal.

Nifty 50 futures

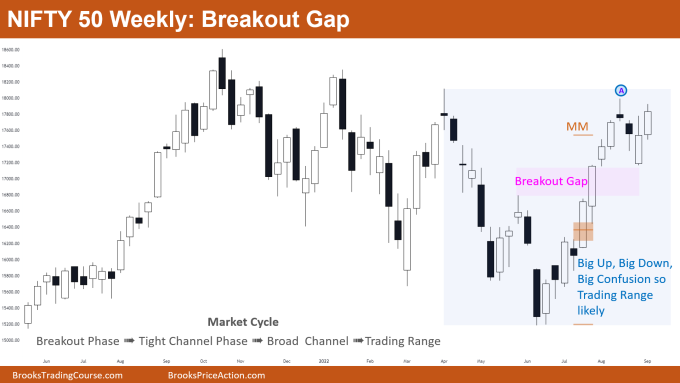

The Weekly Nifty 50 chart

- General Discussion

- Nifty 50 is near its trading range top, and also the market is forming a breakout gap so traders expect a measured move up.

- When the market is in trading range traders should follow a buy low sell high strategy, but bears are not able to form strong bear bars to reverse the market.

- Some bulls would be buying on the current bar’s high, which is reasonable.

- Bears should not sell until there is at least one strong bear bar closing near its low.

- Deeper into the price action

- When the market reaches a measured move (brown colored text) you can see that not enough bulls booked profits.

- Bar A was a reversal bar, but it did not get any follow-through, instead, many bulls bought below Bar A.

- This means only bulls can make money, and bears are losing money. When that is the case, you should not sell, only focus on buying.

- Patterns

- Big move up, big move down on Nifty 50 charts, so this means the market is in a big trading range.

- The market formed a breakout gap, which means there could be a possible measured move up.

- Bears tried to fill the breakout gap but failed to do so. So, you can expect a measured move up.

- Pro Tip

- The market is always present in any of these phases

- Bull Breakout Phase: Only bulls can make money, in this phase the low of the prior bar is never broken. This means only stop order bulls make money.

- Tight Bull Channel Phase: Pullbacks are present but these are not too big. In this phase, limit order bulls and stop order bulls make money, also limit order bears can make money selling above bars. No stop order bears make money.

- Broad Bull Channel Phase: Both bulls and bears can make money by limit and stop orders, with a buy low sell high strategy.

- Trading Range Phase: Similar to the broad channel both bulls and bears can make money by limit and stop orders, with a buy low sell high strategy.

- The market is always present in any of these phases

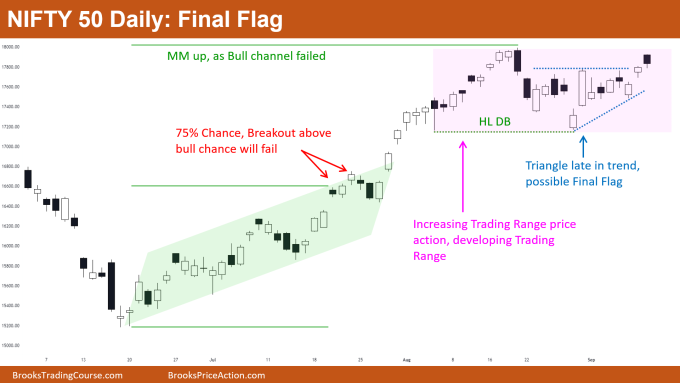

The Daily Nifty 50 chart

- General Discussion

- After reaching the measured move level (overshoot of the channel) market has shown increasing in trading range price action.

- No strong reversal pattern formed till now to get a major trend reversal; the best bears can expect is a trading range and not a reversal.

- The market also formed a triangle late in the trend, so bulls and bears would be skeptical about possible final flag and reversal down.

- Deeper into price action

- The market has not got good follow-through after the triangle breakout, also some bears sell, as it is the trading range top.

- For bull trend resumption bulls need to show consecutive bull bars closing near their highs to convince more bulls to buy higher.

- If the market forms another bear bar, then more bears would be shorting for failed triangle breakout and trading range top.

- Patterns

- The market is trading near the measured move level and gave the deepest pullback since the bull trend started.

- If the next bar in the daily chart would be the bull bar closing near high, then traders would expect a measured move up based on the triangle and higher low double bottom.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.