Trump rally ending with FOMC Fed rate hike

Updated 6:40 a.m.

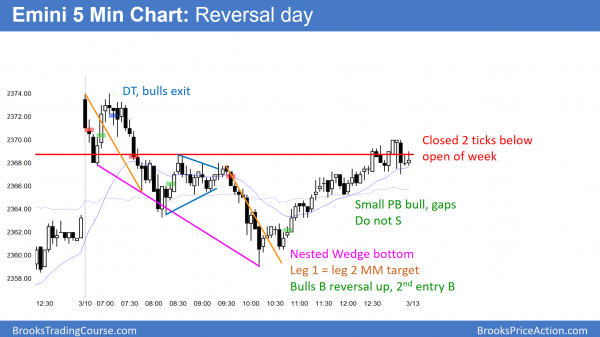

While today reversed down on the 1st bar after a big gap up, yesterday was a strong reversal up from a failed breakout below a 7 day bear channel. Therefore, the bulls will probably get 2 legs up. Hence, the odds are against a strong bear trend day.

Furthermore, a bear channel usually evolves into a trading range, not a bull trend. This is especially true when the bears were strong enough to control the Emini for 7 days. In addition, the Emini will probably try to be neutral going into Wednesday’s FOMC meeting. Since 7 days down is extreme, more down is unlikely. The odds therefore favor a trading range day today.

The key price is the open of the week, and it might be a magnet all day. If so, today will probably have a hard time getting far above or below. Hence, a trading range day is likely.

Pre-Open market analysis

The bears have a 7 day bear micro channel on the daily chart. Since that is unusual in a bull trend, it is climactic and therefore unsustainable. In addition, it is at the daily moving average, and there is a 20 Gap Bar buy signal. The odds therefore are that today will probably not be another bear trend day. Furthermore, either today or Monday should trade above the prior day’s high.

Furthermore, next week’s FOMC meeting creates uncertainty. That is a hallmark of a trading range. Hence, this down leg will probably end soon and be followed by at least a bounce.

Bear channel is a bull flag

This bear micro channel is still a bull flag. Yet, if it grows to 20 or more bars, traders will be less certain that the bull trend will resume. The Emini would therefore be in breakout mode. As a result, the bears would have the same probability of a breakout as the bulls. For the bulls, they want trend resumption up. The bears want a bear breakout below the bull flag and a measured move down. In addition, if the bears get their breakout, the selloff will probably reach the 2016 close and Dow 20,000.

While it’s possible for the bull trend to continue up without more of a pullback, that is unlikely because the Emini was extremely far above the weekly moving average last week. That is climactic, and usually leads to a test of the moving average.

Friday, therefore weekly support and resistance are important

Today is a Friday and therefore weekly support and resistance are important. The most important price is the week’s open of 2368.75. This is because the weekly chart has had 9 consecutive bull trend bars. That happens only about once every 5 years. Therefore, a 10th consecutive bull bar is even more rare. Hence, the odds are that this week will be a bear bar. Therefore, today will probably close below the open of the week.

Furthermore, it might close below last week’s 2354.50 low. But because last week was a bull bar and the 9th consecutive bull bar, it is a weak sell signal. However, there is still a 60% chance of a drop below the December close within 2 months.

Overnight Emini Globex trading

The unemployment report just came out and the Emini is up 10 points. This is therefore follow-through buying after yesterday’s bull trend reversal. Furthermore, it will probably create a gap up open.

Since a bear channel usually evolves into a trading range, the Emini will probably begin to test the lower highs in the bear channel over the next few days. The bulls will try to retrace about 50% of the 7 day pullback before Wednesday’s FOMC announcement.

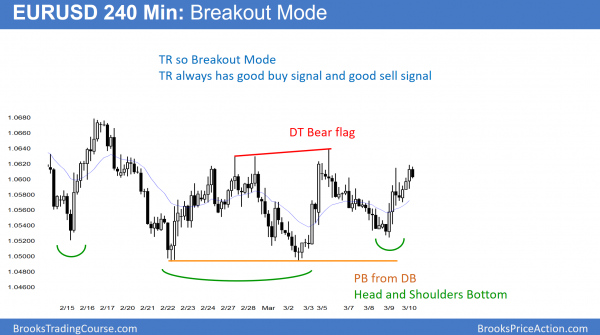

EURUSD Forex market trading strategies

The EURUSD 240 minute Forex chart has been in a tight trading range for 5 weeks. It therefore has both reasonable buy and sell setups. As a result, the probability of the breakout is the same for the bulls and bears.

The 5 week tight trading range means that the bulls and bears are balanced. There is an equal chance of a breakout up or down. Today’s unemployment report will probably create a breakout attempt. Yet, Wednesday’s FOMC report is the most important catalyst near term.

In addition, this 5 week trading range is in the middle of a 4 month trading range. There is therefore a larger breakout mode pattern.

Furthermore, this 5 week range is at the bottom of a 2 year trading range. A breakout above the 5 week range would probably test the top of the 2 year range. A breakout below the 5 week range would break below the 2 year range. It therefore would likely test par. A breakout above the 2 year range would probably rally over the next couple of year back into the 10 year trading range from 2014 to 2014.

Overnight EURUSD Forex trading

I am writing just before the unemployment report. While the EURUSD market has been in a 20 pip range over the past 5 hours, it will probably break strongly up or down on the report. Yet, unless it breaks above or below its beyond the 4 week range, today’s trend would only be a leg within the 4 week range. If the breakout is big and has follow-through, traders will swing trade for today. Since 50% of breakouts fail and reverse, traders should be prepared to swing trade in the opposite direction if there is a strong reversal.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini gapped up above its 7 day bull micro channel, but then sold off in a leg 1 = leg 2 measured move. It then rallied up from consecutive sell climaxes and a nested wedge back to the open of the week.

While the Emini sold off for the 1st half of the day, it rallied back above the open of the week during the 2nd half. However, it closed below the open of the week. This week was therefore the 1st bear bar on the weekly chart in 10 weeks.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al, question re 6E behavior around 8:30 AM Eastern time:

I watch the ETH 5 m chart. It seems many mornings there is a spike, often up and down, at the 8:30-8:35 bar.

is this the EU market closing, US opening? not sure how to account for or include this in price action assessment.

ideas? Thanks as always.

Years ago, traders traded Euro futures, which opened at 5:30 am PST. Bonds opened at 5:20. I think of the US Forex session opening around then, and many traders do as well. That is when US traders in NY begin to get active.

8:30AM EST is a time when very important fundamental reports are released. For instance today, it was the Non-Farm Employment Change. These are very dangerous times to be in the market. You should always review scheduled reports on https://www.forexfactory.com/calendar.php?day=today and stay away from the market during those times. For most traders, checking upcoming reports is a part of a daily routine and an absolute must have item on their checklists.