Trump rally continuing into tax cut vote this week

Updated 6:49 a.m.

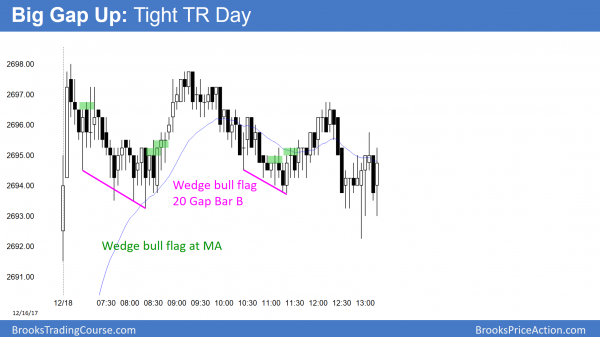

The Emini opened with a big gap up and then had 2 good, but not great, bull bars. Yet, it is far above the average price. While there is a 20% chance of a continued strong rally for the 1st hour, there is an 80% chance of a pullback within the next few bars.

The bears want to break strongly below the low of the day. However, without a parabolic wedge top or a trading range and then a major trend reversal, that is unlikely. Most likely, the Emini will begin to enter a trading range.

If it pulls back to the low of the 1st bar, the bulls would try to get a double bottom around the moving average. A deep pullback would reduce the odds of a big bull day.

With the early bull bars, the odds are against a bear trend day. The bears need 3 or more big bear bars if this is going to be an early high in a bear trend day. Since the 1st bull bar had a tail on top, the 2nd was not especially big, and the follow-through was bad, the odds favor an early trading range for the 1st hour or so. In addition, the odds favor a weak bull trend day at the moment.

Bulls are not yet willing to buy this far above the average price. Therefore, the Emini looks like it will have to go sideways to down to around the average price to find buyers.

Pre-Open market analysis

The Emini rallied strongly to a new high on Friday. The bears want a small wedge top today, but the overnight rally makes that unlikely. Friday’s breakout was strong enough so that there will probably be some follow-through buying this week.

Congress will probably vote on the tax bill. The strong rally over the past couple of months is in part due to the belief that the bill will pass. If it fails, the Emini will probably sell off. Even if it passes, the market still might sell off. This is because traders might have wanted a more bullish bill. Also, some traders will want to take some profits before year end.

There is no sign of a top. The odds continue to favor higher prices, despite the buy climaxes on the daily, weekly, and monthly charts.

Overnight Emini Globex trading

The Emini is up 10 points in the Globex session. It will therefore likely gap up. It is now close enough to the 2700 Big Round Number to likely get there this week.

When there is a big gap up, the 5 minute chart is far above its 20 bar exponential moving average. Many traders do not like to buy too far above the average price. Therefore, the Emini usually cannot rally more than an hour or so after a big gap up without stalling. To get closer to the average price, it then usually either enters a tight trading range for several hours, or it reverses down to get near the average. Once near the average, the odds favor another leg up.

The first several bars are important. If there are several big bull bars, the odds are against a bear trend day. However, traders always have to watch for a parabolic wedge top, which can lead to a trend reversal.

If there are several big bear bars on the open, the odds will be against a bull trend day. The bears would then have a 40% chance of a bear trend day. If they get 4 or 5 unusually big bear bars, there would be better than a 50% chance of a reversal down into a bear trend day.

Friday’s setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

The EURUSD daily Forex chart bounced last week from a double bottom with the November 21 low. Since the December selloff was likely just a 50% pullback from the November rally, last week’s rally was a breakout above a double bottom bull flag. After a 2 day pullback, the bulls are trying to resume up to test lower highs above.

The EURUSD daily chart rallies strongly in November, but pulled back in December. A pullback is a pause in a trend. When I use the term “pullback,” I saying that the odds are that the selloff in December will likely lead to a resumption of the November rally instead of a bear trend. While the selloff lasted several weeks and formed a head and shoulders top, it only had a 40% chance of a continuation down to the November 7 low before a test back up to the November 27 high.

Last week formed a double bottom with the November 21 low. In addition, the bulls were strong enough to keep last week’s low above the November 21 low. Last week the had a big bull bar. That was likely the start of a swing up to test last week’s high and possibly the November 27 high. While Thursday and Friday were bear days, they held above the big bull day on Wednesday. They therefore were probably only a pullback from Wednesday’s rally. The overnight rally is a resumption of Wednesday’s rally.

If the bulls get 2 or 3 consecutive bull trend days this week, they will test last week’s lower high. The need a couple of closes above that high to make traders believe that the rally will continue up to the November high.

Don’t ignore the bears

The daily chart is in a 2 month trading range. It is nested within a 5 month trading range, which is in a 2 year trading range. Strong legs up and down are common. Yet, successful breakouts are rate. Consequently, no matter how strong a leg up or down is, the odds are that it will soon reverse.

Trading ranges constantly disappoint bulls and bears. While the bulls know that the probability favors them over the next week or two, the probability is not as high as they want. As a result, traders should never ignore the bear case.

The bears want the overnight rally to stall at or below last week’s high. This would then create a double top. That double top would be a right shoulder in their 2 month head and shoulders top. They need a strong breakout below the November 21 and December 12 double bottom. The odds of that are currently only 40%. If they get it, they would then try to test down to the November 7 bottom of the 5 month trading range.

Overnight EURUSD Forex trading

The context is good for the bulls this week since the daily chart is reversing up from a major higher low on the daily chart. In addition, the 5 minute chart has rallied 70 pips overnight in a tight bull channel. However, the rally lacked consecutive big bull trend bars. It therefore looks more like a bull leg in a trading range that the start of a bull trend.

Since there were several gaps below pullbacks and above breakout points overnight, this weak rally might in fact be a small pullback bear trend. If so, it can go a long way. The bulls need a strong upside breakout today or tomorrow. If they get it, the odds will favor another 100 pips or so up, and then a test of the November high, which is 250 pips above. Without it, the rally will probably stall around last week’s high, which is 70 pips above the current price.

While the daily chart looks good for the bulls, the 5 and 60 minute charts are less bullish. The bulls need a strong rally above 1.1860 this week. Without it, the 2 week trading range will likely continue. That means that the bears will then get a test back down to last week’s low.

The overnight bull channel is tight. That means that the 1st reversal down will be minor today. Therefore, bears will only scalp. Bulls will buy a pullback. While they can swing trade, most will begin to take profits unless there is a strong bull breakout today. This means that today will probably start to go sideways.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Today gapped up on the daily and weekly charts, but traded in a small range.

Today’s gap up on the weekly chart will probably be an exhaustion gap. That means that it will probably close within a few weeks and maybe this week. A big gap up on the daily chart usually leads to several sideways days. Therefore, tomorrow will probably be another small, trading range day. Since there are buy climaxes on the higher time frames, there is an increased risk of a big reversal down. However, sideways is more likely this week.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.