Trump rally buy climax breakout above final bull flag

Update 6:51 a.m.

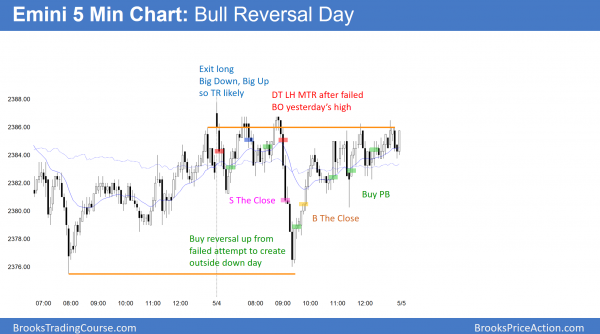

The Emini gapped above yesterday’s high, but immediately reversed down and closed the gap. The bears therefore would like a bear trend day. In addition, they would like the selloff to fall below yesterday’s low and create an outside down day.

While the initial selloff made the market Always In Short, the bulls want an opening reversal up from the moving average and then a bull trend day. Since the first bars were small and had prominent tails, there is a lack of energy again today. Hence, the odds are that today will be another trading range day. Furthermore, this lack of momentum on the open increases the odds of another breakout mode open.

Since the selloff has gone on for the 1st 4 bars, the odds are that today will not be a bull trend day. Therefore, the odds favor either a bear trend day or a trading range day. Because the bars so far are not big, the odds favor another trading range day. Hence, the selloff will probably end above yesterday’s low. Then, the Emini would likely either reverse up into a bull swing for 2 – 3 hours, or enter a trading range.

Pre-Open market analysis

The Emini has been in a tight trading range for 7 days. Since it followed a strong rally, it is a bull flag. Yet, it is just below the all-time high and a measured move target on the monthly chart. Furthermore, the weekly chart has an unusually extreme buy climax. Consequently, if the bulls get their trend resumption, it will probably be brief. The odds favor a reversal down from here or a new high within the next few weeks.

Since the Emini has been sideways for 7 days on the daily chart, today will probably add another bar to the tight trading range. Additionally, the odds favor another trading range day. Yet, there will probably be a breakout soon. Hence, traders should always be ready for a trend day.

Finally, if there is a trend day, it might be a small pullback trend. This is because all swings lately look like and were legs in the 7 day range. This increases the chances that the trend will also look like a leg in a trading range. Yet, if that leg begins to form gaps and negative gaps, traders should swing at least part of their position. This is because those gaps are a sign that the weak trend might actually be a small pullback trend. Hence, it could be a strong trend, and go a long way.

Overnight Emini Globex trading

The Emini is up 6 points in the Globex session. Since yesterday was a High 2 bull flag on the daily chart, a gap up open would trigger a buy signal. Therefore, there is an increased chance of a bull trend day today. Since the all-time high is only about 7 points above the current price, the bulls have a reasonable chance of a new all-time high today.

Because a reversal down is likely within a few weeks, it can come at any time. Therefore, the bears might make today’s gap up fail and reverse down. While the gap above a bull flag increases the chances of a bull trend day, it also increases the chances of a bear trend day. Consequently, today has the best chance to be a trend day in the past 7 days of the tight trading range.

I have been saying for 2 weeks that the bulls will probably have one more final rally before the correction. The combination of a bull flag and a gap up increase the odds that the final leg up will start today.

If so, there is a potential top of a wedge bull channel just below 2,410. That channel line is from the April 5 to April 26 highs. Hence, it is a magnet. If the Emini reaches that line and then reverses, the bears would have a wedge higher high major trend reversal. Since that is a strong sell signal, traders will be prepared to sell a reversal down from there.

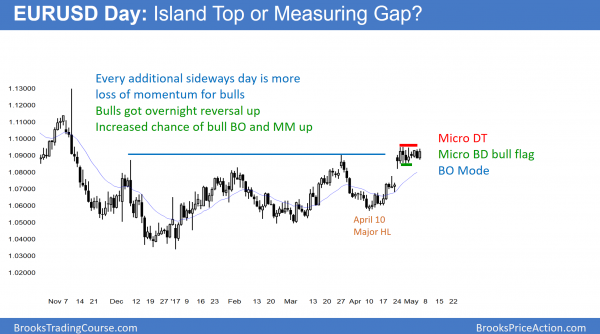

EURUSD Forex market trading strategies

The bulls overnight reversed yesterday’s selloff in the 9 day tight trading range on the daily chart. They there increased the chance of a bull breakout and measured move up.

The EURUSD Forex market rallied strongly in April. Yet, the breakout above the 6 month trading range was small. Additionally, the market has been sideways in a tight trading range for 9 days. This is therefore a disappointing breakout for the bulls. But, since the chart is in a 6 month trading range within a larger 2 year trading range, traders are hesitant to buy too high or sell too low. The result it that every strong rally or selloff reverses before going too far. Consequently, that is likely to happen again.

Since the momentum was strong in mid-April and there is no reversal down yet, the probability is that the rally will continue at least a little higher before reversing. A reasonable target is a measured move up based on the 100 pip height of the 2 week tight trading range.

Overnight EURUSD Forex trading

The EURUSD Forex market traded down yesterday, but reversed up overnight. Since the 9 day tight trading range is more likely a bull flag than a top, the overnight reversal increases the chances of a bull breakout over the next few days. However, until there is a successful breakout, there is no breakout. Hence, the probability is only slightly better for the bulls.

The overnight rally stalled at the top of the 9 day range. The bulls correctly expect that the 3 hour pullback will likely lead to another attempt today or tomorrow to break above the 9 day range. Consequently, bulls will probably buy this pullback. At a minimum, they expect a test of the overnight high.

Day traders still mostly scalping their Forex trades

Since most breakout attempts fail, traders tend to scalp most or all of every trade. Because the context favors a bull breakout, traders will be more willing to swing part of any buys today. Yet, a day trader who prefers high probability trades will not swing trade until there is a strong breakout above the 9 day range.

If there is a strong downside breakout, traders will swing trade for 2 legs down. This is because the odds favor the bulls. If there is downside breakout, it is a lower probability event. As a result, bulls will be trapped into losing trades. In addition, bears will be trapped out of a winning trade. Both will use any small bounce to sell. This will therefore usually create at least a 2nd leg down.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off sharply from above yesterday’s high, but reversed up strongly from just above yesterday’s low.

Yesterday was a High 2 bull flag buy signal bar. The buy triggered on the open. The bears tried to turn the day into an outside down day, but the bulls bought just above yesterday’s low. Consequently, today was a reversal day at the bottom on an 8 day bull flag. The odds therefore favor higher prices over the next few days.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al-

I only discovered 4-5 weeks ago that you posted a 5 m chart after the close.

This is very helpful as a study aid. I compare my real-time reads to this every day now.

If it is not too much trouble, I’d like to see the TL you are using when calling MTR’s.

Thanks.