Trump impeachment risk is catalyst for 5% correction

Updated 6:48 a.m.

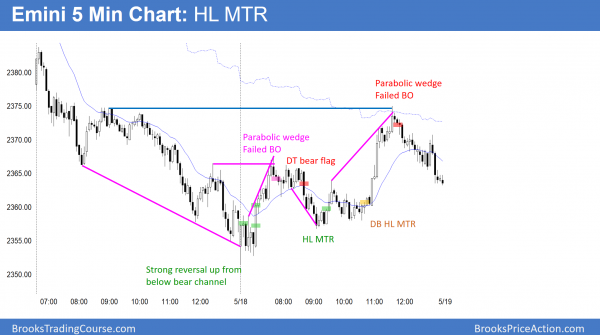

The Emini reversed up from below yesterday’s low on the open. In addition, the 1st selloff failed and created a small double bottom. The bears want this reversal to fail, like yesterday. Yet, it is a reversal up from below a bear channel as well as yesterday’s low. The entry bar had a bull body. There is therefore a 30% chance that it will remain the low of the day. In addition, there probably will be buyers below the low of the day.

Unless the bears get a strong breakout below the low, the odds are that today will probably be a trading range day. While a bull trend day is possible, a strong bull trend day is not likely.

Pre-Open market analysis

The Emini gapped down yesterday. It therefore created both a 2 day and a 1 month island top. Furthermore, the weekly chart is extremely overbought. Consequently, there is a 60% chance that yesterday was the start of a selloff to below the weekly moving average.

When there is a big gap, the Emini often goes sideways for a few days. The bears need follow-through selling. The bulls need a strong reversal up to reduce the odds of the selloff. The next few days will therefore be important.

Overnight Emini Globex trading

The Emini is down 8 points in the Globex market. While yesterday is probably the start of a move below the weekly moving average, the daily chart is still in a trading range. Consequently, the bears will probably be disappointed by the lack of strong, immediate follow-through selling.

Hence, the correction will probably take more than a month. Furthermore, it will more likely be a Spike and Channel bear trend than a sudden collapse. Therefore, there will probably be at least 2 more legs down after the 1st pullback.

As a result of a bear channel on the daily chart, day traders will have swings up as well as down. This is true even though the daily chart is probably in a bear trend for a couple of months.

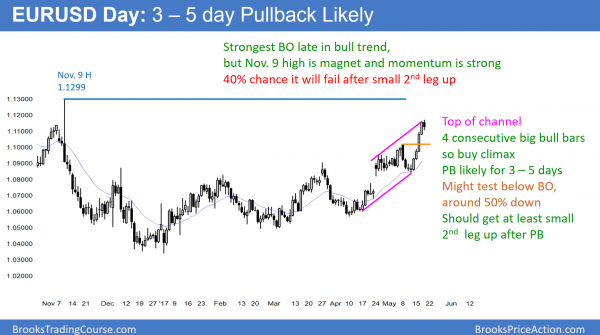

EURUSD Forex market trading strategies

After 4 strong bull trend days, the daily chart will probably pull back for 3 – 5 days. It might test below the top of last week’s high, which is the breakout point.

As I wrote yesterday, the 4 day buy climax was likely to pull back for a few days. The small selloff might fall back below last week’s high, and it might retrace 50% of the 300 pip rally. Because the momentum up is strong, the odds favor a test of the November 9 high within a few weeks.

Since this is the strongest bull breakout in more than 20 bars in the current rally from the April 10 low, there is an increased chance that it is an exhaustive end of that bull trend. Yet, when the momentum is as strong as it has been for these 4 days, the bears usually will need at least a micro double top before they can reverse the bull trend. This momentum up is very strong. Additionally, there is an important magnet at the November high. Finally, the current price is close enough to that magnet so that the rally probably will be unable to escape the magnetic pull of that resistance. Consequently, there is a 60% chance of a test of that high within a few weeks. Hence, there is only a 40% chance that the EURUSD chart will reverse down to the bottom of the 4 day rally before going up for that same distance.

Overnight EURUSD Forex trading

The EURUSD Forex market has pulled back 70 pips over the past 8 hours. Since the buy climax was extreme, this pullback is probably the start of a 3 – 5 day bull flag. Furthermore, that bull flag will probably have at least 2 legs down on the 240 minute chart.

Because the chart is still bullish, traders will be more inclined to buy than sell. The will buy reversals up from new lows on the 5 minute chart. In addition, some will buy below a prior low and scale in. Since a trading range is likely, most traders will scalp for 10 – 20 pips for the next few days.

Because a pullback on the daily chart will create swings up and down on the 5 minute chart, day traders will also look for sell scalps. The will sell rallies that reverse down from around prior highs. Some will also sell at and above prior highs and scale in, as long as the momentum up is not too strong. Their concern is that the rally on the daily chart can resume at any time.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini rallied strongly up from below yesterday’s low. After a deep pullback, it resumed up from a higher low major trend reversal. Yet, it reversed down from the 60 minute moving average and the top of yesterday’s bear channel.

The bulls got a strong reversal up today, reversing much of yesterday’s selloff. Since the weekly chart is so overbought, the odds still favor a swing down on the daily chart to below the weekly moving average.

Yet, the Emini could rally to the daily moving average before resuming down. That would also be about a 50% pullback. Less likely, tomorrow could gap up and create a 2 day island bottom. The bulls would therefore expect a new all-time high. Since the weekly sell climax is so dominant, the odds favor a lower high and a move down to around 2300.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hey Al — I’ve only been buying intraday dips after climatic sell-offs, and using wide stops. I’ve been doing it profitably for over 6 months now, but I want to add another setup.

Yesterday I knew not to buy, and by mid-day I wanted to sell.. but struggled with pushing the sell button. Today I knew I wouldn’t get the sell off I needed to buy, and 2 hours before close knew I should just press the buy button.

Besides trading small — any tips for broadening my trading setups and starting to act on more trades that I’m seeing. I’m scared to act because these “other trades” are not what has got me to where I am so far.

As always — thanks for everything.

I always tell profitable traders to not worry about adding anything once they are consistently profitable. However, everyone does, and that is fine, as long as what they do makes sense. As you know, I talk about lots of setups in the course. Most days have trading range trading, and therefore it’s good to know how to enter on 2nd reversals at the top and bottom. In strong bull trends, High 2 bull flags at the EMA are good (and L2 in bear trends). I think that you are smart to trade small and be patient. Other than that, an important key is to not try to do too much because it is easy to make mistakes.