Stock market breakout mode before March 15 FOMC rate hike

Updated 6:45 a.m.

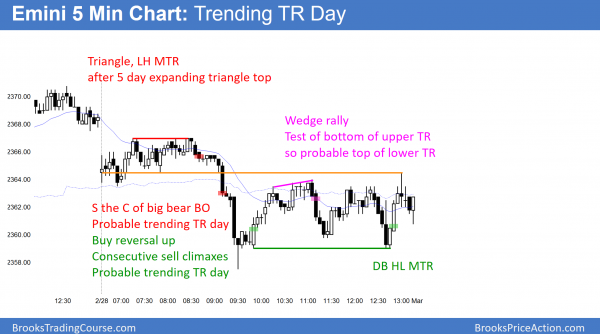

The Emini formed an expanding triangle top over the past several days. Hence, that is a higher high major trend reversal. While today gapped down and triggered the sell, the 1st bar was a doji. Therefore, there is not much urgency. In addition, the open is just above the 60 minute moving average support. Furthermore, it is near yesterday’s early higher lows.

If the bears are going to create a strong bear trend day, they need consecutive big bear bars closing far below support. This is unlikely at the moment.

The bulls need a strong reversal up from this support area, and a strong break above the moving average. While the Emini is currently trying to create an Opening Reversal up from the 60 minute moving average, the reversal is weak. Hence, this is another trading range open. It therefore increases the chances that today will be like most recent days and have a lot of tight trading range price action.

While the days have had swings, they have been small and within trading range days. This early price action makes today likely to be another trading range day.

Pre-Open Market Analysis

Today is the last day of the month and therefore monthly support and resistance can be important. Yet, today they will probably be minor. The month so far is a big bull trend bar, and even if there is a selloff today, the odds are that the month will remain a big bull trend bar. While the monthly chart is in a cluster of measured move targets, there are a few above. Furthermore, the highest one is around 2425, which is probably too far for today to reach.

The daily chart had an ii pattern late in buy climax 2 weeks ago. At the time, I said that the Emini would therefore mostly go sideways for a week or more. In addition, a logical bottom of the trading range is the bottom of the ii. Because that is 30 points below, the odds are against the Emini getting there today.

A buy climax far above the moving average limits the upside. Yet, the February rally was strong and there is no clear top. Hence the downside is small as well. Therefore the 2 week trading range will probably continue until the March 15 FOMC meeting.

Overnight Emini Globex trading

The Emini is down 2 points in the Globex market. Because it is far above the weekly moving average, the upside over the next week or two is probably small. Yet, the bull trend on the weekly and daily charts is strong. Therefore, the downside is probably small as well. The bears need more bear bars to create enough selling pressure to convince traders that they can take control. As a result, small days with a lot of trading range price action will be common.

Trump speaks tonight and that talk is therefore a potential catalyst. Hence, the Emini has an increased chance of being in a narrow range today. Yet, as always, if there is a strong breakout up or down, traders will swing trade.

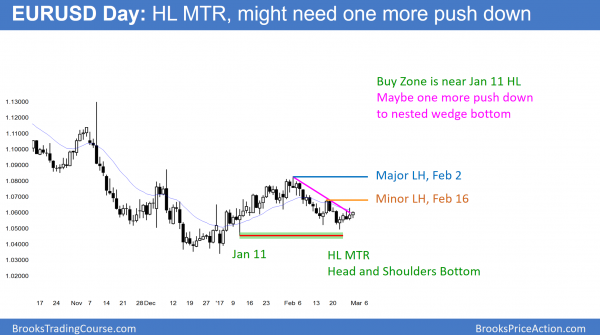

EURUSD Forex Market Trading Strategies

While the EURUSD daily Forex chart has a head and shoulders bottom, the selloff did not quite reach support. Hence, there might be one more small leg down before a reversal attempt up.

The 4 week selloff on the daily EURUSD Forex chart was weaker than the 6 week rally. In addition, the pullback is around a 50% pullback. Yet, it is so close to the January 11 major high low that it probably has to get there before bulls will aggressively buy.

While it currently is rallying from a head and shoulders bottom, the rally is weak. This therefore increases the odds that it will test down to the January 11 low before rallying up to the February 2 major high. That high is the neck line of the head and shoulders pattern. Furthermore, it is the top of the 4 month trading range.

Most reversal attempts have a 40% chance of leading to a reversal. Therefore, even if there is a strong rally to the top of the 4 month range, the odds are that the year long trading range will continue.

Overnight EURUSD Forex trading

The EURUSD Forex market traded in a 30 pip range overnight. In addition, it is in the middle of its small 3 week trading range. It is deciding if the bottom on the daily chart is complete, or if traders want one more push down. Hence, it is in breakout mode.

Trump speaks tonight and there is an FOMC meeting in 2 weeks. Because both are catalysts, the EURUSD market might remain in a narrow range until March 15. Hence, most of the days will probably be scalping days.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini broke to below yesterday’s low and formed a trending trading range day after a 5 day exapnding triangle top.

While today traded below yesterday’s low, yesterday had a bull body and therefore was a weak sell signal bar. Yet, the Emini will likely test the bottom of the ii on the daily chart before the FOMC meeting in 2 weeks. Today might be the beginning of that pullback.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

If I sold the wedge rally (highlighted in purple) would the proper stop be above the morning’s TR? Thanks.

Dave

I would put stop right above bar 55 (last bar touching the purple line), it was a reasonable stop entry signal for two legs down. For stop entries, the stop typically goes above your signal bar (55).

Allow me to post here Al’s analysis for bar 55 from the other site:

Wedge 45, 50, 55

failed BO above bottom of upper TR and 60MA,

probably 2 legs sideways to down in lower TR

Thanks. I’ve always traded using the SB as my stop, but in the course Al has stressed putting the stop in the “correct” place. I saw this as a PB from the recent bear leg, so my impression is that the stop should go above the last major swing high.