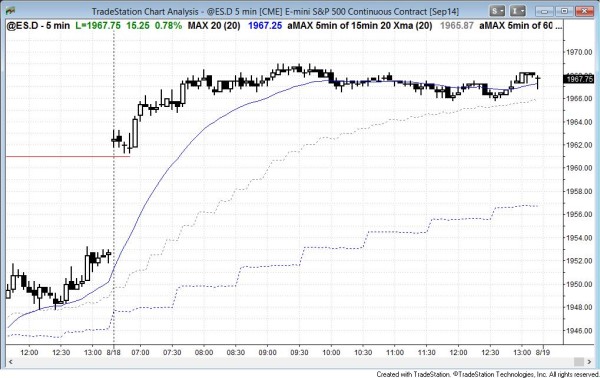

I posted this chart after the close. The Emini gapped above last week’s high, had a brief rally, and then entered a tight trading range.

End of day comments

The S&P500 Emini gapped above last week’s high, which was also Friday’s high. This created a potential measuring gap on both the daily and weekly charts. The bears hope that it become an exhaustion gap.

Despite the strength represented by the gap up, 11 of the first 13 bars were small bars or dojis, and this was a sign that there was not much urgency for the bulls or bears. This trading range open type of price action increased the chances of mostly a trading range for day traders today.

The Emini became a small pullback bull trend, but the price action evolved into a tight trading range. This limited the upside potential and was consistent with the very quiet open. It had a higher high major trend reversal at measured move targets at 9:30 a.m., but remained in the tight trading range until the end of the day. After 4 small consecutive bull candles at 12:10 a.m. and then a double bottom, the bulls had a minor trend resumption up into the close. The Emini will probably test the all-time high soon. Traders will decide whether there will be a breakout or a double top and a reversal.

S&P500 Emini intraday market update

Time of update 7:46 a.m. PST.

Although the Emini is currently in a bull trend, the day will more likely end up as mostly sideways. The trend up can continue all day, but the bulls will need to stop the bears from creating so many dojis. The day can reverse down because this is the third push up on the 60 minute chart, but the bears will need a strong bear breakout. Until there is a strong breakout up or down, day traders will mostly scalp, buying low and selling high.

S&P500 Emini daily and weekly candle charts

The S&P500 Emini reversed up from the weekly moving average last week, but the candle was not big enough to fully reverse the bear bar of two weeks ago, and the signal bar was only a doji and therefore not strong. This increases the chances that the reversal will end up as part of a trading range rather than a resumption of the bull trend. Unless this week creates a strong bull trend bar, the Emini will probably continue to go sideways for at least several more weeks.

The next target for the bulls is the all-time high, which is the July high. The bears want a double top and the bulls want a breakout above the July high and then a measured move up.

See the weekly update for a discussion of the weekly chart.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.