S&P500 60 minute chart wedge top reversal: I updated 7:02 a.m.

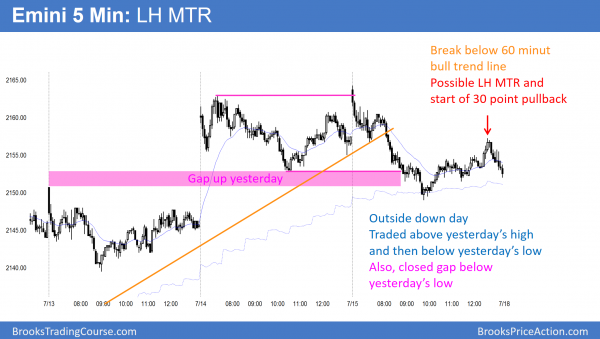

Like every day this week, the Emini sold off early. Because yesterday was a small range day, today could trade below its low and become an outside down day. As a result of the early selling in an overbought market, the odds favor sideways to down trading today.

Whenever something is obvious, traders have to be aware of a possible Pain Trade day. Here, given the obvious difficulty that the bulls face, the pain trade would be a relentless rally to well above the top of the 60 minute wedge bull channel.

At the moment, the Emini is Always In Short. However, there have been several small sideways bars with prominent tails. This is trading range price action and it increases the chances that today will have a lot of trading range price action today, like all of the other days this week.

Most outside down days are not big bear trend days. As a result, even if today trades below yesterday’s low, the odds are that today would be a weak bear trend day or a trading range day.

While today might form a successful opening reversal and an early low, the odds of a strong bull trend day (a Pain Trade day) are probably 25%. Today will most likely be a weak bear trend day or another trading range day.

S&P 500 Emini 60 minute wedge top and tight bull channel: Pre-Open Market Analysis

The Emini is in a strong bull breakout, but the stop for the bulls is now far below. Institutions need to reduce their risk. Consequently, most will begin to reduce their position size over the next few days. This profit taking will create a pullback. While the pullback might be as brief as one day, it probably will be 2 – 4 days.

Bulls have been so eager to buy that they have been buying the breakout without waiting for a pullback. However, more will begin to wait to buy lower so that the stop will not be as far. Bears know this and they will wait for the 1st signs of hesitation on the daily and 60 minute charts and begin to sell above bars for scalps. This is usually the beginning of the transition to a trading range. Since I am referring to the 60 minute chart, I am talking about a trading range on that chart. If it lasts 20 bars or so, that would be a 3 day bull flag on the daily chart.

Friday, so weekly chart is important

Today is Friday, but there is no obvious nearby weekly support or resistance. However, the close of the week will affect the tail on the top of the bar on the weekly chart. The bulls want a 3rd consecutive week that closes on its high. This increases the chances that next week will continue up. The bears want a big tail on the top of this week’s bar. This would make traders less willing to buy high next week, and more interested in waiting to buy a pullback. There is often a strong Buy The Close or Sell The Close trend just before a bar closes, which means in the final hour of the week tomorrow.

Overnight Globex market

The Emini has been in a tight trading range since yesterday’s buy climax. It is up about 3 points in the Globex session. Yesterday’s tight trading range on the 5 minute chart in a strong bull trend is a bull flag on the 60 minute chart. The odds favor a bull breakout. Yet, the rally has gone on for 7 days. The odds favor a pullback today or early next week. Yesterday’s trading range would then be the Final Bull Flag. With the 60 minute bull channel as tight as it is, the odds are that the reversal down will be minor. Therefore, it would probably be a 2 – 5 day bull flag and lead to at least a small 2nd leg up.

Forex: Best trading strategies

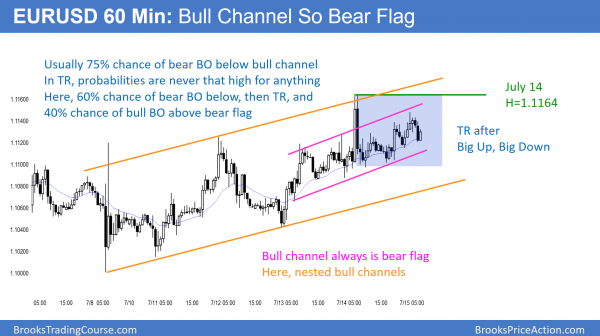

The 60 minute EURUSD Forex chart is in nested bull channels. The odds favor a bear breakout, and then a trading range.

The bears hope that yesterday’s reversal down from the daily moving average will be the top of a double top bear flag with the July 5 high. They then want a breakout below the July 8 neck line an a measure move down to below the June 24 sell climax low.

Whether or not the bears succeed, the downside is probably limited because the EURUSD daily chart is near the bottom of a 6 month trading range.

The bulls want a higher low major trend reversal from last week’s low, and then a test of the June 24 sell climax high. At the moment, the trading range is in control, and there is no sign of a breakout up or down. Traders will continue to expect strong rallies and selloffs to reverse instead of creating breakouts. The result will probably be more small trading range days, which Forex day traders will mostly scalp.

Bull channel so bear flag

A bull channel functions the same as a bear flag. There is a 75% chance of a bear breakout that leads to a trading range. Hence, there is only a 25% chance of a successful bull breakout. When there is a successful bull breakout, the market cycle begins again. The breakout leads to a bull channel and then another trading range.

Since this bull channel is within nested trading ranges, the probabilities are less. As a result of the confusion that always exists in a trading range, probabilities for everything gravitate to around 50%. The probability of a bear breakout below the trading range is probably about 60%. The probability of a successful bull breakout above the channel is about 40%. Even if the bulls succeed, they then have to break above the resistance at the top of the 4 month trading range, which is only another 25 pips or so higher.

European session

The overnight rally was weak, and the EURUSD has drifted down for the past 4 hours. The bears see the rally as a lower high major trend reversal. The bears need a strong breakout below a major higher low before traders will believe that the bull channel has evolved into a trading range or a bear trend.

The bulls see it as a bull leg in a broad bull channel. The bulls need a strong breakout above the month-long trading range before traders will believe that the rally will reach the 1.1400 or 1.1600 tops of the nested trading ranges.

Most breakout attempts fail. Therefore the trading range will probably continue again today. Hence, day traders will continue to mostly scalp.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini reversed down from above yesterday’s high and fell below its low to become an outside down day. The bulls bought the 60 minute 20 gap bar buy setup. However, this might be the start of a 2 – 5 day pullback.

The Emini reversed down on the open and formed an outside down day. This ended its 8 day bull micro channel. It reversed up from a 60 minute 20 gap bar buy signal and closed around the middle of the day.

While it is too early to know if today is the start of a 30+ point pullback, this is a reasonable candidate for the start. The best the bears probably will get next week is a 2 – 5 day bull flag. Because the Emini is so overbought, it is more likely that there will be at least a 2 day pullback next week than a continued tight channel bull trend. However, the bulls will probably buy the pullback.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.