Outside down week and bull trend line break

Updated 6:55 a.m.

While the Emini sold off on the 1st 3 bars, the bodies were shrinking. The bears therefore became less willing to sell lower. The bulls want a higher low major trend reversal. Yet, the 3 bear bars represent enough selling pressure so that the bulls will probably need at least a micro double bottom.

The reversal up did not have a strong bull signal bar. The bulls therefore will probably need a test back down for a double bottom. Yet, if they can create several strong bull trend bars, this could be the low of the day.

Because neither the bulls nor bears have done enough to convince traders that they are in control, the Emini will probably go sideways for 1 – 2 hours. While today could be a strong bear trend day, the Emini is again finding support at the daily trend line. The odds are that the trading range price action of the 2nd half of yesterday will continue for at least a couple of hours today.

Pre-Open Market Analysis

The Emini yesterday broke below the bull trend line of the month-long bear flag. Furthermore, it poked below the bull trend from the February low. Hence, today is a very important day. The bears have a breakout that could be the start of a move to below the July 2015 high. They therefore need follow-through selling today or tomorrow. As a result of their failure to get it, yesterday will end up as just another big bear day in the month-long trading range.

Tight Trading Range Double Top

I have mentioned the August 15 and 23 double top at the all-time high many times. This is because it was a double top in a tight trading range at a possible top. This particular pattern often leads to 2 legs down. Furthermore, the 2nd leg is often surprisingly big, but brief. Traders should be ready for a possible strong Sell The Close selloff in the final 30 minutes. This is because that often happens when a trading range market converts into a bear trend.

Yesterday might be the start of that 2nd leg down. Yet, the 2nd leg down typically is fast. Therefore, if today is a bull day or a weak follow-through day, the odds of a strong 2nd leg down will be less. The bulls will then try to reverse yesterday over the next few days. Therefore, yesterday would be just another big day in the trading range.

Sell climax

Because yesterday was a sell climax, there is only a 25% chance that today will be a strong bear trend day. Yet, there is a 50% chance of follow-through selling in the 1st 2 hours. Furthermore, there is a 75% chance of at least a couple of hours of sideways to up trading that begins by the end of the 2nd hour.

Overnight Globex session

While there was follow-through buying for several hours after yesterday’s close, the Emini has sold off since. It is now down 4 points. The bulls will try to create a major trend reversal today. While a higher low is more likely because yesterday’s rally was so big, a lower low reversal is just as reliable.

The bears want yesterday’s rally to be just a bull leg in a broad bear channel. Because the rally was strong and it began at a trend line on the daily charts, the odds favor a 2nd leg sideways to up today.

Forex: Best trading strategies

The daily chart broke below the September trading range low. Today is so far a good follow-through bar. The bulls see the selloff as just the 2nd leg down in a pullback from the late July rally, or just 2 legs down in a 4 month trading range.

Yesterday was a strong bear breakout below the September trading range on the daily chart. Yet, the EURUSD is still above the bottom of the June and July reversals. Because yesterday was a strong breakout, today is important. Bears want to see follow-through selling today. If they get it, the odds of a test of the July low goes up. Furthermore, so do the odds of a 200 pip measured move down based on the height of the September range.

Yet, if today is a bull reversal bar, then yesterday’s selloff will more likely be just a bear leg in the trading range that began in June.

Sell climax

The tight bear channel on the 240 minute chart was almost a Micro Channel. Furthermore, it lasted about 10 bars. This is strong selling, but climactic. Therefore, the odds are that there will be a bounce today. Yet, the bears will try to keep any rally from going much above the 1.1104 bottom of the trading range. If the bears are successful, then they will sell the rally because they will see it as a bear flag.

While a sell climax usually results in a lack of selling for about 10 bars, it does not usually immediately result in a bull trend. Ten bars on the 240 minute chart is about 2 day.

The 1st reversal up is usually minor and leads to a trading range. After 10 – 20 bars, the bulls try to create a major trend reversal. Therefore, the best the bulls will probably get over the next couple of days is a trading range.

Overnight EURUSD Forex sessions

While the EURUSD Forex market continued its selloff last night, the 60 minute chart had a big bar 4 hours ago. It therefore was a sell climax late in a bear trend. Hence, the odds are that the selling will stop on the 60 minute chart for 10 or more bars. Therefore, the trading range of the last 4 hours will probably continue all day today. Furthermore, the odds of a strong bear day today are only 25% after the sell climax.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

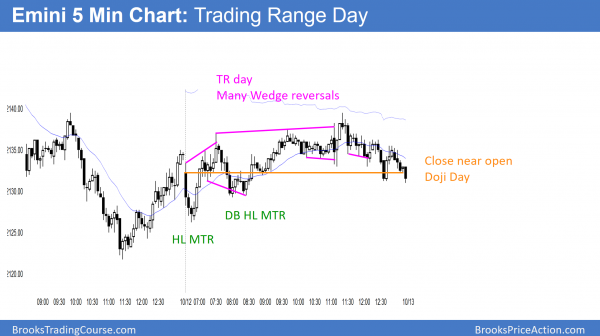

The Emini was in a weak bull channel all day, but stalled at the 60 minute moving average. By closing at the open, it was also a trading range day. Furthermore, it was a doji day on the daily chart.There were many Wedge patterns all day.

The Emini was in a weak bull channel after yesterday’s strong bear trend. This is bad follow-through for the bears and increases the chances that yesterday’s bear breakout will fail. While the daily chart can trend up, it is more likely to continue sideways.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Thanks all. Your perspective is much appreciated. Also, if that lunatic gets elected President, do you think the market will foreshadow the event?

People buy or sell stock not based on the present. They do it as an expression of their belief about the future. It does not make sense to not take an action that you know you need to take. As a result, the market is always immediately incorporating the latest information into the price of every stock.

Al,

Basic question: Do you consider the first bar that trades above the prior bar’s high an H1 or does the bar actually have to close above the prior bar’s high?

Bar counting is subjective and the basic principle is to get an idea of when the market is about to do something. I just look for the bar to go above the H1 buy signal bar, whether or not it closes there. It often reverses and then later forms a H2 or H3, or sometimes an opposite trend.