Likely 5% correction to down 20,000 and December 2016 close

Updated 6:53 a.m.

Yesterday tested yesterday’s low and reversed up. The Emini is Always In Long. In addition, after a 7 day bear micro channel on the daily chart it is oversold. Hence, the odds are that it will go above the prior day’s high today or tomorrow.

Because the bears have succeeded in reversing every rally, they might succeed again today. Yet, because the Emini will probably get neutral before the FOMC report next week, the downside is probably limited. Hence, this early rally is probably a bull leg in a trading range day, or the start of a bull trend. The target for the bulls is the open of the week and then yesterday’s high.

Pre-Open market analysis

Yesterday was the 6th day in a bear micro channel after last week’s dramatic reversal down. Furthermore, the top was in a cluster of measured move targets based on a 2 year final bull flag on the monthly chart. In addition, it was at the 2400 Big Round Number.

While a big bear trend probably will not begin until after the FOMC meeting next week, this behavior is consistent with the start of a bear trend. The bears therefore need a big bear breakout with follow-through to convince traders that the move down to the December close and Dow 20,000 has begun.

Since the weekly chart is so far above its moving average, the odds of much higher prices are small. This is because traders do not want to buy this far above the average price.

Overnight Emini Globex trading

The Emini is down 1 point in the Globex session. Therefore the endless pullback is growing. If it continues much longer, traders will conclude that the selloff is no longer a pullback in a bull trend. Hence, they will assume that the Emini has evolved into either a trading range or a bear trend.

While the Emini has been in a broad bear channel for 5 days, the channel is relatively flat. Therefore every day has had times when the 5 minute chart is Always In Long. Hence, traders are both buying and selling. Since there have been multiple reversals every day, day traders are mostly scalping for 1 – 4 points.

Since the FOMC meeting next week is unusually important, all financial markets are trying to get neutral before the announcement. Hence, the ranges and swings will probably continue to be small. Furthermore, the days will probably continue to be small days with a lot of trading range price action.

EURUSD Forex market trading strategies

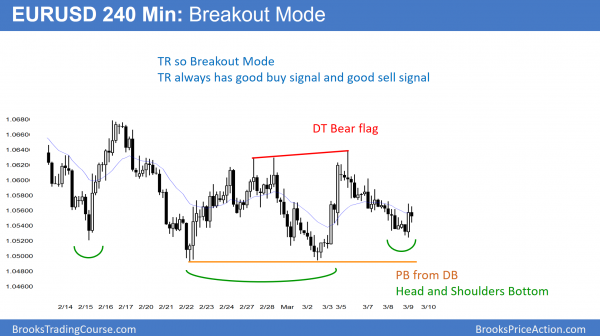

The EURUSD 240 minute Forex chart is in a trading range. It therefore always has a reasonable buy setup and a reasonable sell setup.

The EURUSD is still in its 4 week tight trading range. It therefore has a buy setup, which is a double top. Furthermore, it has a sell signal, which is a head and shoulders bottom. This means it is in breakout mode, and the probability of a successful breakout up or down is equal. Because the likely Fed interest rate hike is so important to all financial markets, the breakout will likely happen next week. Yet, the market has factored in all variables as best as it could. As a result, even though everyone knows that there is a 90% chance of a rate hike, no one knows if the breakout will be up or down.

In addition, this trading range is within a larger 5 month trading range. The larger trading range is therefore also in breakout mode. It therefore as a good sell signal, which is a double top bear flag. Furthermore, it, too, has a head and shoulders bottom.

Since the range in each session has been small, day traders can either only wait or scalp, often with limit orders.

Overnight EURUSD Forex trading

The EURUSD Forex market traded in a 30 pip range overnight. As a result, the only option for day traders is scalping until there is a breakout. Traders should never scalp for less than 10 pips. This is because the transaction costs become too big relative to the stop required and the size of the profit. Therefore, traders have to win 70% or more of their trades to be profitable. Since that is unrealistic, no one should be entering a trade with a goal of a smaller profit.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off to below last week’s low and the bottom of the 6 day channel. Yet it reversed up strongly into the close.

Today was the 7th day of a bear micro channel in a strong bull trend. That is extreme and unusual. Today also reversed up from a breakout below the tight bear channel on the daily chart. The odds are that the Emini will trade sideways and maybe a little up tomorrow.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.