Posted 7:20 a.m.

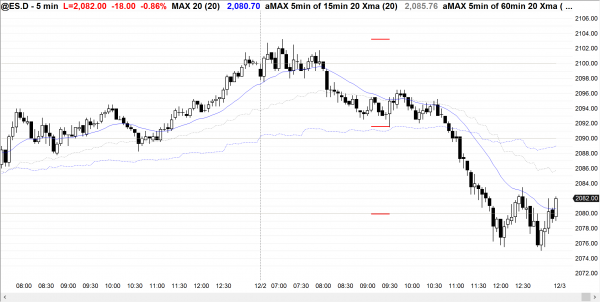

The Emini began with a rally, but it was mostly trading range price action with multiple reversals. This made it more likely a bull leg in what would become a trading range than the start of a strong bull trend. The bulls want at least 1 – 2 hours of follow-through buying from yesterday’s rally. The bears want at least a couple of hours of sideways to down trading after yesterday’s buy climax.

The bears got a small double top above yesterday’s high, a good sell signal bar, and a good entry bar. This increased the chances that there would be sideways to down trading for the next couple of hours. However, the lack of a strong bear bar after the initial strong entry bar increased the chances that the Emini will be more sideways that down. Unless the bears get strong follow-through selling, most trades will continue to scalp. The bulls want the early selling to fail and lead to an early low of the day. This has happened often over the past couple of weeks. However, a trading range is more likely.

Until there is a breakout with strong follow-through up or down, the odds of more trading range price action will remain high, and day traders will be quick to take profits. Even though the Emini is Always In Short, this is a trading range open, and probably the start of 2 hours of sideways to down trading.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade a divergence between the Emini and the cash index

There is a discrepancy between the cash index and the Emini, giving day traders a chance to learn how to trade a divergence between the Emini and the S&P500 cash index. Yesterday’s close in the Emini was about 17 points below the all-time high. Yesterday’s close in the S&P500 was about 30 points below its all-time high. The Emini could go to a new high this week with the cash index still below its high. Institutions traditionally pay more attention to the cash index. The Emini has become extremely reliable. If the Emini reaches a new all-time high, the odds are that it will go at least 13 points above its July high because the cash index will also probably follow and reach a new high.

The Emini broke above its 6 day tight trading range yesterday. The bulls want follow-through buying today. Since the Emini has been in a trading range for 6 weeks, the bulls probably will be disappointed. This means that today is not likely to be a big bull trend bar on the daily chart. Although there are the nearby bull magnets of the November high at 2110.25 and the all-time high of 2117.00, there is the opposite force of inertia that comes from being in a trading range. Traders learning how to trade the markets should know that most trading range breakouts fail, no matter how strong the legs up and down are. This means that when then Emini races to the top, as it is now doing, bulls tend to take quick profits and bears tend to sell any strong rally. The result is that most breakout attempts fail, even though they look like they have a high probability of succeeding.

Look at the weekly or daily chart for the 1st 7 months of this year to find many examples. Eventually one succeeds. There is room to the targets above, this is a seasonally bullish time of the year, the daily chart is in a bull trend, and the momentum is strong. The odds are that the Emini goes at least a little higher. Since it is at the top of the range, those who trade the markets for a living know that there is still only about a 50% chance that it will get above the July high.

Yesterday had a small pullback bull trend for the final 30 bars. This is unsustainable price action. There is about a 50% chance of follow-through buying for the first hour or two. There is a 75% chance of at least a 2 hour, 2 legged sideways to down move beginning in the 1st two hours. The channel up yesterday was tight. The first reversal down will probably be bought for at least a test up. Will the market rally for 2 hours and then enter a trading range or reverse? Will it enter a trading range on the open? It is impossible to know, but those are two good possibilities. The Emini has been in a tight trading range in the Globex session, and is around yesterday’s close. This increases the chances for an early trading range.

Forex: Best trading strategies

The EURUSD has been in a tight bear channel for about a month. This is a sell climax, but there is no bottom yet and it is only 60 pips above its April low and about 100 pips above the March low, which is the low of the past 15 years. Both are important support. Support is a magnet that draws the market to it. If the EURUSD reverses up from its current level without reaching those lower prices, most traders will see the selloff as a successful test of support, and they will see it as the 2nd leg down in a double bottom. Even if the EURUSD reverses up from below its March low, it will still be a double bottom.

Because the daily chart is in a sell climax, the odds are that it will soon bounce for about a month. The bulls will see the reversal up as a double bottom and the start of a bull trend. When the test down is in a tight channel, as it has been, the first reversal up is usually sold. This means that even if the bulls are able to rally 250 pips to the bottom of the May-July trading range, the rally will probably be followed by a test back down.

Bulls have been making money over the past month by buying every new low on the 60 minute and 240 minute charts. They scale in lower and the scalp out on a reversal back above the prior low. When the bulls are able to repeatedly make money buying in a strong bear trend, that bear trend is not as strong as it appears. It usually is a bear leg in what will become a trading range. This means that the odds are that the 2 month selloff will have a 200 pip rally soon and that the bear trend will then evolve into a trading range. Until there is a strong bull reversal, bulls will continue to only buy new lows and scalp. If they get their strong reversal up, they will conclude that the next selloff will not reach the prior low. They will then chance their style of trading to trading range trading. They will start to buy strong selloffs before there is a new low. The result will be a trading range. Bears will continue to sell every rally, but will soon begin to scalp more. This will also result in trading range price action.

At the moment, bulls buy new lows and scalp. Bears sell rallies for scalps or swing trades. This will probably soon be replaced by trading range price action that will last for at least a month where both will scalp.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Posted 7:20 a.m.

The Emini sold off on the open from above yesterday’s high and accelerated down midday. It formed an 19 bar bear micro channel, which happens only about once a year, and then went sideways into the close

The Emini reversed strongly down after yesterday’s bull breakout of the 7 day tight trading range. Today was a reminder that, as strong as the bulls have been, they are still not strong enough to break above the resistance at the all-time high. The bears keep overpowering them. Nothing has changed. The bulls still have momentum on the daily chart, and the bears have resistance at the all-time high. The Emini is balanced and there is still only a 50% chance of a new high before a test of the October low. Today’s sell climax will probably be followed by 2 hours of sideways to up trading, which began in the final hour today.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al, any thoughts on Crude today please? It seems that today’s breakout and strong bear bar on the daily chart after the EIA report seems highly likely to lead to some kind of measured move down, and a break of the August low…

You previously said you thought a wedge bottom was more likely than a double bottom, could it be that your prediction is coming true and we get a wedge bottom with this current third push down extending into the high thirties before the bulls come back in?

Surely the bigger picture (the number of oil fields worldwide that can’t produce profitably at these lows prices for one) will result in the institutions seeing value not too far below this current trading range? I mean a MM based on the height of the trading range August – now takes us down to 27.39, surely the probability of that happening is very low, meaning that traders will fade this bear breakout, no matter how strong it is?

As you know, I said that I thought a new low was likely and that it would result in a wedge bottom. I never think about the logic because the price has nothing to do with logic over the short term (several months). It simply needs to find out how low is too low, and it has not accomplished that yet. I would not be surprised to see a 20 handle, although I believe the odds are that it will not drop below the low 30s, if it falls that far. If you think about it, as price falls, many producers need more money and they need to produce far more to get any small profit. Also, they do not want to lose mkt share, and will produce at a loss for a long time before giving up. The charts do not show a sell panic yet. They might not at any time, but if we see a quick $5 – 10 drop, that will probably be the low.

Thanks Al! Some prediction on the EURUSD as well!!

is it correct to conclude that today’s choppy open is the channel following yesterday’s spike from ~10:45 AM PST? I.e., I’m looking to improve my ability to read a likely choppy opening range. is a spike yesterday a valid indicator?

thanks, Al

When I look at the chart, I think that the gap up and 1st 6 bars up on yesterday’s open was the spike, and the rally from 7:25 was the channel. There was another breakout at 12:30 that was followed by a smaller channel. Today’s open was that 2 hours of sideways to down that I said had a 75% chance of forming after yesterday’s buy climax.

When you say the odds are high that emini will go 13 points above it’s all time high if it breaks above July high, do you expect it to happen within same trading day? Or is this a broad statement that it will at some point in the near future after breaking high? I know it’s a probability statement, but as a day trader this would be important information. Thanks for all your help!

I do not have an opinion and would need to see the strength of the breakout and the context at the time of the breakout. The breakout could easily immediately continue up 13 points if the breakout was strong and there was time left in the day. If the breakout occurred in the final 5 minutes of the day, or if it was in a weak rally, it might take 1 – 3 days for the cash index to get up to its all-time high.