Fed interest rate hike causing stock market profit taking

Updated 6:55 a.m.

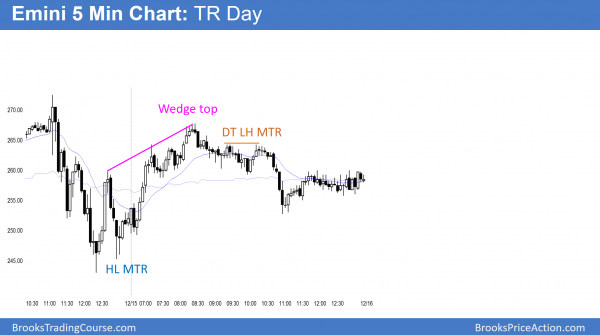

Today’s open continued the evolution into a big triangle. This is a trading range open. Because the triangle is so tall, it might last many more bars. The bulls see a higher low major trend reversal while the bears see a bear channel. This is therefore a breakout mode setup.

Because yesterday had so many abrupt, big reversals, traders will take quick profits until there is a series of trend bars up or down.

The Emini is Always In Long, but the bulls need a strong breakout above the 60 minute moving average and the final lower high from yesterday if today will be a strong bull trend day.

Pre-Open Market Analysis

The Emini yesterday fell below the Wednesday’s low. That was therefore the 1st pullback in a 10 day bull micro channel. Hence, the odds are that the reversal down will be a 1 – 3 day pullback and lead to another test of the all-time high.

The 60 minute chart pulled back to the 60 minute moving average after more than 50 bars. The odds are that 20 gap bar bulls will buy the pullback. Hence, the downside will probably not be big.

Because the Emini is in an extreme buy climax on the daily chart and has 3 pushes up on the weekly chart, this could be an exhaustive end of the bull trend. Yet, traders want to see a strong reversal down lasting several days before they believe yesterday’s reversal is not just a pullback.

Overnight Emini Forex trading

The Emini had consecutive sell climaxes yesterday with big reversals. That indecision continued overnight. The Emini is unchanged. Because yesterday was the 1st break below a 10 day micro channel, the odds are that the selloff will last 1 – 3 days. Then, the Emini will probably test the old high again.

EURUSD Forex Market Trading Strategies

The EURUSD weekly Forex chart is breaking below the 2 year trading range. It is therefore at a new 14 year low. The measured move target is just above par (1.0000).

The EURUSD Forex chart broke to a new 14 year low last night. Yet, the bulls are still hoping for a double bottom with the bottom of the 2 year trading range. The bears need a big bear bar closing on its low on the weekly chart. In addition, they want the close to be far below the 2015 bottom of the 2 year trading range. If they get both, the odds of a move down to par will be at least 50%.

The bulls want this breakout to fail. They want the weekly chart to close above the 2015 low. Furthermore, they want it to close above the midpoint of the week. Finally, they want a bull body, but that is unlikely.

Overnight EURUSD Forex trading

The EURUSD broke below the 2015 low last night. Yet, it has paused for 2 hours. Because of the consecutive sell climaxes on the 240 minute chart, the bears are exhausted. As a result, today will probably be a small trading range day. While it is always possible that the bulls will reverse the bear breakout, there is no evidence yet of a strong reversal. Tomorrow’s close is important. The more bearish the weekly close, the more likely the EURUSD Forex market will fall to par.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini rallied on the open. It sold off from a wedge top, and then from a double top lower high major trend reversal.

Today was the 2nd day of the pullback after the buy climax on the daily chart. A pullback below a bull micro channel on the daily chart usually lasts 1 – 3 days. The odds are against a bear trend without forming at least a micro double top first.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hey AL,

The 5 min emini chart you displayed… is that the new H17 chart. Z16 expires tomorrow. Because my chart, for the S&P emini (both H17 & Z16), does not have a 3 push wedge at the beginning of the day as your chart is displaying. Is Tradestation showing a deferent price pattern than my Multichart software… I wonder?

Thx-Richard

Hi Richard,

Al is using the day session continuous chart in TradeStation. If you are trading the overnight Globex, it has a different look.

Richard