Posted 7:40 a.m.

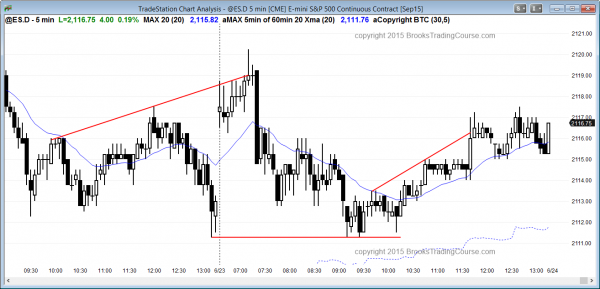

The Emini began with a limit order open, which increases the chances of more trading range price action throughout the day. When the Emini begins with a tight trading range, traders wait for a breakout with follow-through in either direction. However, a strong trend day becomes less likely.

At the moment, the bears had a strong 1 bar breakout, but the follow-through has been bad. Although it is enough to make the market Always In Short, it is barely more than 50% likely to be followed by a measured move down. The bulls are hoping it is only a 50% pullback from the gap up, and a higher low major trend reversal. They do not yet have a strong signal bar or reversal up. Until they do, the bears have a slight advantage and will try to get the measured move down to below yesterday’s low.

My thoughts before the open: Price action trading strategies for a bull flag

The Emini is up 4 points in the Globex session at the moment. Traders learning how to trade the markets can see that the rally of the past week was strong and that the Emini is about 10 points below the all-time high. The odds are that there will be a breakout to a new all-time high within the next week or so, especially since the Emini is seasonally strong from June 26 to July 5.

Because there is no breakout yet, the bears might be able to keep the Emini within its 6 month trading range for several more day. Since most breakout attempts fail, they might even be able to create a lower high that leads to the top of the next several months. However, the Emini is so close the the high and the rally was so strong last week that the odds favor the bull breakout unless the bears are able to reverse the Emini back down strongly. The bears see the rally as a wedge lower high major trend reversal where the first leg up was the June 11 neckline of the double bottom. They need a strong reversal down before traders will conclude that they are stronger than the bulls who bought that double bottom.

Yesterday was a trading range on the 5 minute and the bulls see it as a wedge bull flag or a high 2 buy setup. The bears see it as a trading range at the top of a 6 month trading range. They will try to create a major trend reversal today. Online daytraders will watch for a strong breakout with follow-through up or down to see which side will control today’s price action. At the moment, the bulls have the edge, but the bears only need a few consecutive big trend bars to convince daytraders that they have taken control.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off from an expanding triangle and then rallied back to the open of the day to form a doji day. The legs were weak and the price action was mostly for limit order trading with a trading range day.

Nothing has changed. The bears were unable to turn the Emini down and it is just below the all-time high and the Emini is entering a seasonally strong period through July 5. The odds favor a new all-time high at some point in the next 2 weeks. However, whenever the odds favor one direction, traders learning how to trade have to realize that this sets up a possible pain trade, where the market suddenly and relentless does the opposite without warning.

Best Forex trading strategies

Traders learning how to trade the markets can see that the dollar was strong and the Euro was weak overnight, but the trends were climactic, making a lot of trading range price action likely today. The daily chart of the EURUSD is breaking below a head and shoulders top bear flag. The 5 minute chart was in a spike and channel bear trend overnight and therefore will probably go sideways to up for at least a couple of hours today, but swing traders will still look to sell rallies. Scalpers will both buy and sell, but most traders will focus on shorts until there is more buying pressure. The EURJPY and EURGBP have the same candlestick pattern.

The USDJPY was strong on the 5 minute chart, but the rally is still below yesterday’s high and within the trading range of the last week. It is therefore still a bull leg in a trading range, and those trading Forex for a living will take trades in both directions. Last night’s rally was climactic enough to make a trading range likely for at least a couple of hours today.

The USDCAD reversed up strongly yesterday and is testing the top of the week long trading range. The USDCHF had the strongest rally last night, but it is still within the trading range of the past 2 weeks, although it is now at the top. The rally is strong, but climactic. However, even though the climax makes a pullback likely, the rally was so strong on the 60 minute chart that swing traders will look to buy a pullback to 0.9250 to 0.9300 over the next day or two for a swing trade. This should offer good Forex trading for beginners who want to learn how to trade Forex markets.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.