Trading Update: Monday March 21, 2022

Emini pre-open market analysis

Emini daily chart

- Emini strong bull breakout with 4 consecutive bull bars following a higher low major trend reversal. These three bars are strong enough that the odds favor a second leg sideways to up.

- The bulls are hopeful that this is the rally that leads to a test of the all-time high.

- Right now, the odds are the market is going to test the February 9 top of the wedge/bear channel.

- The market is always in long, so traders expect the first reversal down to fail. This means bulls will buy betting on sideways worst case.

- The bulls have a breakout of a double top (March 3). The bulls hope they can get a measured move up (4,666.25)

- The bears are hopeful that this rally will lead to a double top and trap the bulls into buying too high in a trading range.

- As strong as this rally is, the market is still probably in a trading range, which means the bulls will likely be disappointed soon after any second leg up.

- Even if the market reaches the all-time high, the bears will try and set up a major trend reversal in the form of a higher high or lower high.

- Since the bulls have four consecutive bull bars, this makes today less likely it will have a bull close. This is because the daily chart does not have many instances of 5 consecutive bull/bear bars.

- Traders should expect a pullback lasting a day or two followed by a second leg up.

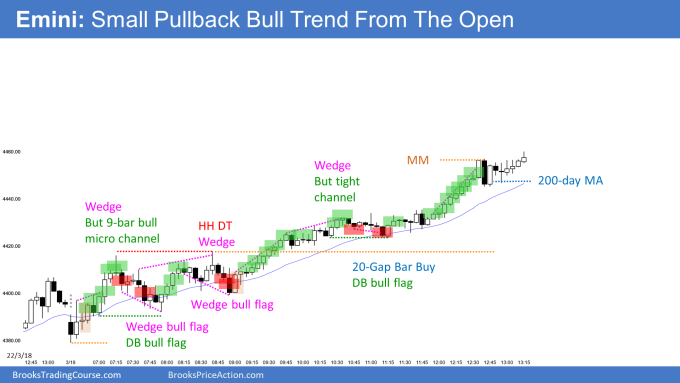

Emini 5-minute chart and what to expect today

- Emini is down 4 points in the overnight Globex session.

- 5-minute chart has been in a strong trend since last Wednesday. The bulls are likely exhausted, which means the market will need to go sideways at least for a day or two to relieve the bulls.

- Just because the bulls are exhausted does not mean the bears will get a bear trend. The past four trading days have been very strong for the bulls, so traders expect the best the bears can get is a 1–2-day sideways pullback.

- Traders should expect a trading range day and a limit order market. Traders should be cautious of swing trading on the open and wait for a strong breakout with follow-through or a credible stop entry.

Friday’s Emini setups

Al created the SP500 Emini charts.

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

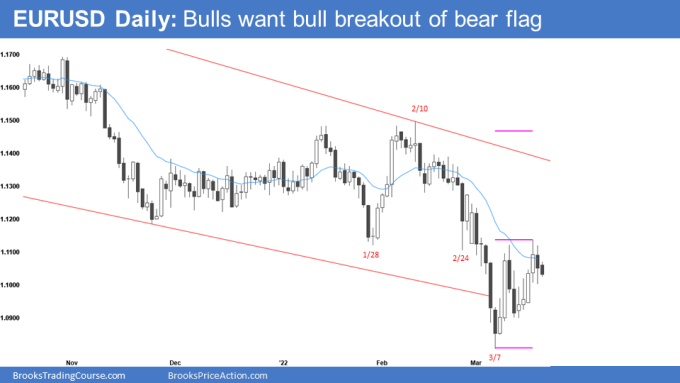

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The bulls have a two-legged pullback testing the bottom of the 3-month trading range.

- The bears are trying hard to trap the bulls and keep the gap open from the low of the 3-month trading range.

- The bears want a double top with March 10 and a bear breakout below the March low, and a selloff testing the 2020 price level.

- The bulls see today and Friday as a two-bar pullback, leading to more up.

- The bulls hope that the market will get a bull breakout of a bear flag and lead to a measured move up to 1.1470 price level, which is close to the February high.

- The market may have to test the March 14 high low and form a double bottom higher low major trend reversal. This would give the bulls a more credible bottom.

- Right now, the market is deciding between breaking out above last week’s high or testing the March 14 higher low. The market will likely go sideways for a couple of days since the market is close to 50%.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Al created the SP500 Emini charts.

End of day summary

- Today was a trading range day.

- Bar 1-2 was a strong bull breakout. However, it was following a strong buy climax last Friday. When you have a strong bull breakout on the open especially following a buy climax, the probability is not as high as it appears for the bulls getting a second leg up. Remember that on the open, there is a 50% probability that there will be a major reversal, such as what happened on bar 3.

- Another thing to point out is bars 1-2 significantly reduce the odds of a bear trend day. This is because traders will not be willing to bet on a strong bear trend below bar 1.

- The point I am making is when you have a strong breakout on the open, it has a higher probability of a reversal than what appears. Second, when you get a breakout on the open that reverses, if the breakout is big (bars 1-2), there is an increased chance of a Trading Range day and not a bear trend day.

- The selloff to 7:30 am PT formed a wedge bottom and reversed up with several strong consecutive bull bars.

- One thing to remember is that trading ranges are notorious for sudden reversal, such as the sudden reversal up from 7:30.

- Also, bar 2 was technically a buy the close bar, which means it is a magnet. So when the market formed a bottom for a couple of hours around 7:30 PT, bulls would try hard to reach the bar 2 close. They tried several times, 8:30 – 9:30 AM PT.

- The bull clearly gave up at 9:40 AM PT, and the market led to a second leg down.

- Around 10 AM PT, the market formed a wedge bottom and reversed up back to the open of the day.

- Overall, trading ranges are complicated because they always make traders buy too high or sell too low. It is constantly making traders second guess if their trade will work. Usually, when you are at the bottom or top of the range, it is best to wait for the breakout to fail and enter on a reversal, such as a wedge or second entry.

- The bull now has five consecutive bull bars on the daily chart, and today was a doji. This means traders should expect tomorrow to have a bear close on the daily chart.

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com on trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

Should expect what tomorrow?…You didn’t finish the sentence.

Thank you for catching that. I made the correction.

Just want to put this out there…what a frustrating day for me. Big ups, big downs, and I just could not get a read on what was happening. Ended with a small loss, but not after having gains and big losses. Thankfully a cooler head and better price action reading turned it around.

I’m finding that I prefer to stay in trades for as short as possible, so perhaps I tend towards scalping.

Trading ranges are challenging because they force traders to have to anticipate a reversal and are constantly forcing traders to sell too low or buy too high.

For example, the 9:35 PST bear breakout was a strong breakout. However, the follow-through bars were terrible. This would force traders to question if the bear breakout would fail.

The key on a day like today is when the market is clearly Always in long, or always, in short, expect the follow-through to not last long and for the market to reverse. This is why traders will often scalp.

The bear surprise at 09:30 was also exactly the speech of Jerome where he said to raise interest rates:

Federal Reserve News

Hi everyone,

Can anybody tell me if it was somehow reasonable to short bars 55 or 57? (Wedge, around 11 o’clock)

Thanks!

Some traders would sell there, but most would be very quick to get out. Notice how 11:25 was a big bull bar closing on its high, and the open of the bar was low. This was an upside bull Breakout of a bear flag, which is common in a trading range.

Also, the bull bar at 11:20 was the 2nd leg down after the wedge top.

Thank you Brad!

2nd to last point on the Emini you stated that, “Since the bulls have four consecutive bull bars, this makes today less likely it will have a bear close. This is because the daily chart does not have many instances of 5 consecutive bull/bear bars.” I am assuming you meant to write – less likely to have a BULL Close, correct? Thanks! J

Hi Jason,

Yes, surely right so have edited on behalf of Brad.

Thanks.