Trading Update: Friday August 5, 2022

Emini pre-open market analysis

Emini daily chart

- The market is beginning to stall just under the June 2nd high and may have to pullback before test of the high.

- While the rally up to the June 2nd high has been strong, it is beginning to form a parabolic wedge, increasing the odds of a couple of legs sideways to down.

- The bulls want a strong breakout above the June high, however, they will probably be disappointed with the breakout, and the market will form a large trading range with the June 2nd high and June 16 low.

- Bulls are hopeful that the market will breakout far above the June 2nd high, which would increase the odds of the bulls getting a successful breakout above the June 2nd high (neckline of a double bottom) and the market getting a measured move up from the June 16th low to the June 2nd high.

- The bears hope that any breakout above the June 2nd major lower high will fail and lead to a double top. Next, the bears want the market to test the neckline of the double top (June 16th low) and go for a measured move down of around 500 points.

- The June 2nd price level formed a tight trading range, and now the market is beginning to go sideways at that same price level.

- The market will probably get above the June 2nd major lower high in the next couple of days to see if there are more buyers or sellers above. The odds favor sellers and continued sideways trading.

- Today is Friday, so weekly support and resistance are important.

- The bulls want today the week to close on its high and have it close above last week’s high.

- The bulls are hopeful today can get above the June 2nd high and close above it, which would be another sign of strength.

- Bears want to create as big of a tail as possible in the current week. They hope to get back to the open of the week (4,105). The next target for the bears would be a close below the midpoint of the current week.

Emini 5-minute chart and what to expect today

- Emini is down 45 points in the overnight Globex session.

- The bears so far have a strong breakout after the 5:30 AM PT report was released.

- The bears want the market to gap down on the opening session and form a trend from the open bear trend.

- More likely, today will have a trading range open and a limit order market.

- As always, most traders should wait for the first 6-12 bars before placing a trade since the odds favor a sideways open.

- Traders can always wait for the market to form a credible double top/bottom, wedge top/bottom, or a strong breakout with follow-through.

- If the market forms a trend from the open, there will be plenty of time to enter the trend’s direction.

- Since today is Friday, there is an increased risk of a surprise breakout late in the day as the market decides on the close of the weekly chart.

- As always, traders must trade the chart In front of them and not be in denial about what the market is doing.

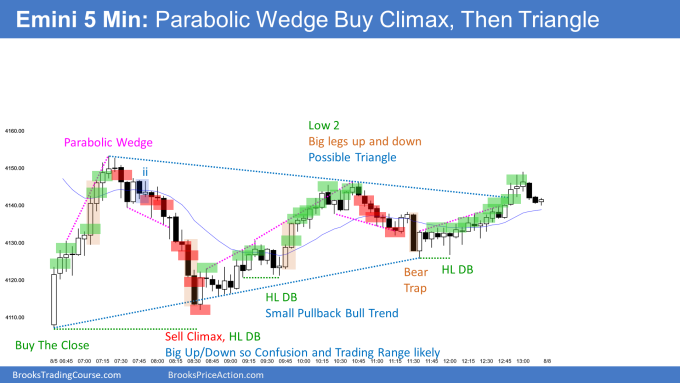

Yesterday’s Emini setups

Al created the SP500 Emini charts.

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The EURUSD has been going sideways for over 12 bars in a tight trading range.

- The market is neutral and very close to a 50% probability for the breakout up or down.

- While the odds may slightly favor the bulls due to the bull bars closing near their highs, most traders will see the market as completely neutral.

- The market is deciding on testing the 1.0000 big round number or going up to the 2017 low, and the bottom of the May to June trading range.

- Most traders would rather see the market test down to the 1.0000 big round number and form a double bottom with the July 14 low. That would create a major trend reversal and give the bulls a better chance to break above the August 2nd high (neckline of double bottom), and get a measured move up to the June 27th high, which would also be the middle of the May-June trading range.

- Most traders should wait for the breakout and not trade this tight trading range.

- Today is Friday, so weekly support and resistance is important.

- The week’s open (1.0215) is a magnet, and the market will probably not get far away from it as the market decides on a bull or bear close this week.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Al created the SP500 Emini charts.

End of day video review

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com on trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

Hi!

During live trading, I categorized the market as BTC and then a deep pullback occurred. I even bought with a limit order in 50% correction with 1/4 of my position, because I expected, in moment that i bought, a possible spike and channel. Was I wrong for thinking like that?

Att,

After 7:20 PT, the odds favored a second leg up, but the bulls had one problem. The market formed a parabolic wedge top. Parabolic wedges are climactic behavior and increase the odds of a pullback. Most bulls took profits since the risk was big, and the market may have gone up too far too fast.

The bears knew this, so they tried hard to make the reversal strong enough to keep the bulls from being eager to establish longs again. At 7:35 PT, the market formed two strong bear breakout bars that increased the odds of a second leg down and sideways. The bulls had several chances like 7:55 and 8:15, and they failed, which led to a bear breakout below a wedge bottom and two legs down.

This was a lower probability event, but it can happen. One can also see it as an endless pullback. If the rally on the open were less climactic, the odds would have been less for this kind of reversal down.

I agree with you. Bulls try make a H2 on bar 17 and H3 on bar 20 but with bad signal bar in those bars.

I thought about taking an endless pullback, but with so much strength on the open and with strong rally I thought a breakout below the day’s low and a continuation to a bear trend would be a low probability event, although when market formed wedge top at EMA I get out with my long below 35 assume that can be a down to test 24 or 1.

Honestly, I still haven’t been able to list for myself how good my management was, but I’m more likely to assume that it was a reasonable management and that it wasn’t a skunk stop.

When I entered buyer I assumed – from the context – 60% chance of my target being hit before my stop, but after such a deep correction, with a possible wedge flag at EMA I think the odds have decreased to less than 60% and staying in the 1×1 position no longer made sense.

Thanks, Brad!

Brad, thanks for another great video. Question re MM vs Measuring gap. Bar 1 low to bar 3 high was a MM with bar 10 high. Bar 7 was the measuring gap bar (I think) above bar 5 vs the low of bar 8. At which stage you shift your trade management from MM target to MG target?

If I understand your question right, you are asking at what point you expect the measured move from bar 1 low to bar 5 high to fail and test the measuring gap (bar 7 was a measuring gap body of bar 5 high and bar 8 low.

The first measured move from the bar 1 low to the bar 3 high was likely to get a measured move up.

So it depends on a few factors. One is the strength/uniformity of the breakout. The rally up to bar 12 was very climactic and formed a parabolic wedge top which increased the odds of a possible reversal. In other words, the market went too far, too fast, and hesitated along the way up. All the bars up to bar 10 (except for bars 1 and 7) had lots of overlapping, which is a sign of weakness. The above reasons increased the odds of a trading range and possible reversal.

Compare Friday’s opening rally to the slight pullback bull trend on August 3. This day formed lots of measuring gaps, and the market kept going higher and higher. The reason for this is that the market “drifted” up calmly. Since the market was not racing like last Friday, traders wanted to buy a pullback. Since traders bought almost every pullback on the rally up to August 3rd, the market remained in a small pullback bull trend.

Go back and watch the small pullback trend video (14E) and compare it to the parabolic wedges video (24D).

Hope that helps

Thanks Brad!

Excellent video Brad! Exiting longs below the inside bar 11 was a good call. The high of bar 10 was exactly the close of yesterday, so limit order bears were suspiciously expected