Emini October bear flag breakout

Updated 6:44 a.m.

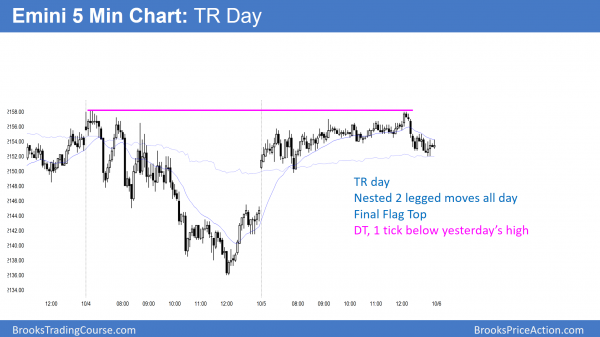

While the Emini gapped above the 60 minute moving average, the initial bull bars were small and had prominent tails. This usually happens when the opening rally will fail after about 5 bars. Therefore, the odds are that there will be a pullback soon, and then a trading range for the 1st hour or two.

This trading range price action reduces the chances for a bull trend day. Yesterday failed 3 times around 2158. The bulls are trying to get above that level on the open. Yet, the momentum so far is too weak and therefore the odds are that the Emini will trade sideways for an hour or two. While it might reverse down into a bear trend, yesterday’s rally and today’s gap up make a trading range more likely than a bear trend day.

Pre-Open Market Analysis

The Emini had big swings and reversals yesterday. Yet, the bears were unable to break below the 9 day trading range. While they broke below the 3 week bear flag, they need follow-through selling today. Otherwise, yesterday will be just another day in the trading range.

Therefore, nothing has changed. The Emini is still is a trading range after last month’s strong bear day. Hence, the Emini is still in breakout mode with a 50% chance of a bull or bear breakout of the bear flag.

Overnight Globex session

The Emini reversed up at the end of the day yesterday. The rally continued overnight, yet it was weak. It will probably open around the 60 minute moving average and the 4 day bear trend line. Because it is still in the 2 week tight trading range on the daily chart, it is still in breakout mode. Strong rallies and selloffs continue to reverse instead of creating breakouts.

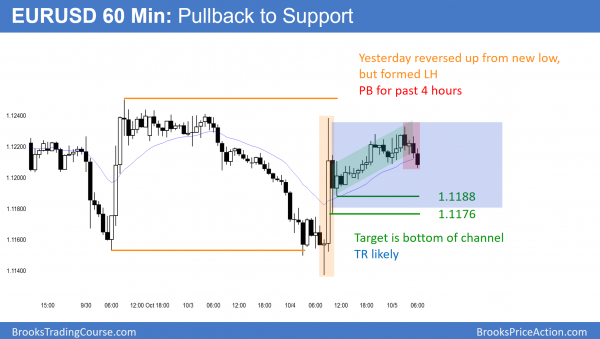

Forex: Best trading strategies

The EURUSD 60 minute chart has been pulling back for 4 hours. It formed a weak bull channel after yesterday’s strong bull breakout. Therefore, it will likely form a trading range for a couple days.

While the EURUSD Forex market sold of 2 nights ago, the bears were unable to break below the month long range. As a result of the strong buying yesterday, the EURUSD is back in the middle of the range and it still is in breakout mode. There is a 50% chance of either a bull or bear breakout. Furthermore, once there is a successful breakout, the target is a 200 point measured move, based on the height of the range.

Overnight Forex sessions

While yesterday reversed up sharply from a breakout below a major low, the rally failed to get above a major high. There was a deep pullback after the bull breakout, and then a weak bull channel to another lower high. While the EURUSD chart sold off for the past 4 hours, it only fell 40 pips. Since yesterday was a Spike and Channel Bull Trend, it is probably working down to test the bottom of the pullback. It typically then enters a trading range for a couple of days.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

While the Emini reversed up yesterday, it spent most of today in a tight trading range, deciding between trend resumption uo and trend reversal down. It sold off a little in the last hour.

The Emini gapped up and traded sideways all day. It was therefore in Breakout Mode, deciding between trend resumption up and trend reversal down. The bulls gave up in the final hour. As a result, they created a double top 1 tick below yesterday’s high. Yet, the selloff was minimal.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.