Trading Update: Thursday February 8, 2024

S&P Emini pre-open market analysis

Emini daily chart

- The Emini gapped up yesterday and broke above the 5,000 big round number. The market is near the all-time high and will likely reach it soon.

- It is possible that the market has to pull back for a couple of legs before reaching an all-time high. The reason for this is traders selling just under it.

- There Some bulls will be long and looking to take profits around the all-time high. The risk is getting big for the bulls, who will be looking for reasons to reduce their positions. The all-time high is a reasonable location for those bulls to sell out of longs, just in case the market gets a deeper pullback than traders expect.

- Even if the market gets a deep pullback before reaching the all-time high, the odds will favor a test above it. Similar to what happened on the test of the 5,000 round number. The market may get close to it and pull back for a few days before reaching the magnet.

- Overall, the all-time high is such an obvious magnet that traders will expect a test of it soon.

Emini 5-minute chart and what to expect today

- The Globex market has gone sideways for most of the overnight session.

- The market is about 18 points away from the all-time high, which means traders should be open to the possibility of a buy vacuum test of the magnet on the open.

- As always, traders should expect a trading range to open and for the market to move sideways. This means that most traders should avoid trading the first 6-12 bars unless they can use wide stops, limit orders, and make quick decisions.

- 50% of the time, the initial direction up or down is wrong. There is only a 20% chance of a trend from the open.

- Most traders should look for the opening swing that often begins before the end of the second hour after forming a double top/bottom or a wedge top/bottom.

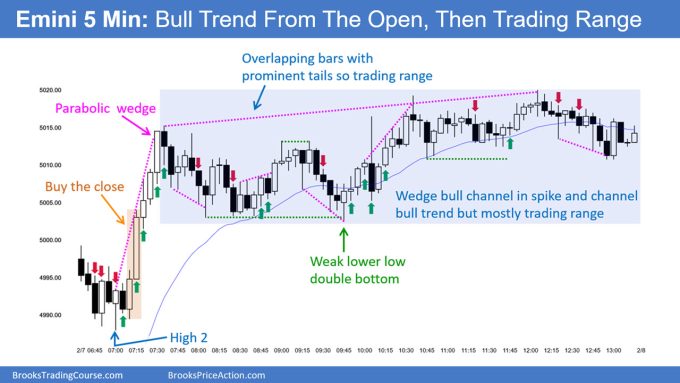

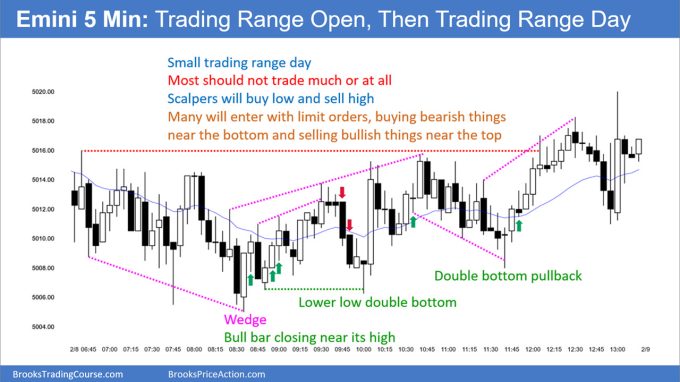

Yesterday’s Emini setups

Al created the SP500 Emini charts.

Here are reasonable stop entry setups from yesterday. I show each buy entry bar with a green arrow and each sell entry bar with a red arrow. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a near 4-year library of more detailed explanations of swing trade setups (see Online Course/BTC Daily Setups). Encyclopedia members get current daily charts added to Encyclopedia.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro Emini.

EURUSD Forex market trading strategies

EURUSD Forex daily chart

- The bulls were able to get follow-through buying after Tuesday’s bull reversal bar.

- While this is good for the bulls, the odds favor the bears getting a 2nd leg down. Because the market is late in a bear channel and far from the moving average, the pullback could be deeper than what the bears want.

- Today triggered a Low 1 short below yesterday’s low. Because it is a bull bar, there are probably buyers below, and the market will pull back closer to the moving average.

- The market is at the December low, which is support. This increases the odds of the bears getting disappointed and the market getting a bounce closer to the moving average.

Summary of today’s S&P Emini price action

Al created the SP500 Emini charts.

End of day video review

See the weekly update for a discussion of the price action on the weekly chart and for what to expect going into next week.

Trading Room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room days. We offer a 2 day free trial.

Charts use Pacific Time

When times are mentioned, it is USA Pacific Time. The Emini day session charts begin at 6:30 am PT and end at 1:15 pm PT which is 15 minutes after the NYSE closes. You can read background information on the market reports on the Market Update page.

Please could you comment on exactly where this ATH is, as far as you’re concerned? Different charting platforms calculate back adjustment differently, and show different ATHs. As far as the cash index is concerned, we have broken above the ATH some time ago.

Thanks.

There was a discussion about this topic in post-6728 in the forum.

The subect is All Time High? in the GENERAL TRADING DISCUSSION secti0on.

I don’t believe that forum discussion reached a conclusion, apart from agreeing that back adjustment gives a different ATH from non-adjustment. There is still the issue that different methodologies of back adjustment gives different values, and in effect then we’re talking about an ATH band rather than an ATH value. I am not in the trading room, so don’t know if it’s been discussed there. Just wanted to know what value(s) the presenters are using.

I’ll give you my conclusion FWIW. Due to the inherent nature of futures contracts they are not well suited for long term analysis and any such analysis done on them will always be subjective. If you want objective analysis then use the cash index which has no rollovers from different expirations like futures or dividends like SPY. Futures charts are fine for short term trading of minutes to weeks but if you are investing for months to years then to me cash charts are much more useful.

It’s not about long-term analysis, investment, etc. It’s about knowing precisely where resistance might be. Isn’t that what we’re aiming for with BTC – precision, with a market as efficient as the ES? Example, if you look at the enctclopaedia, part 1, chart 50 (8.7 under section ATH), you’ll see Al has marked the ATH line as resistance and indicated how the market bounced off it. So knowing where the ATH is might be somewhat important in my opinion.

I’m looking at that chart right now. While the market did bounce off the ATH line, I would not call that “precise”. The market clearly went above the line before stopping and reversing. Yes, knowing where the ATH lies is very important but when dealing with long term futures charts, it cannot be a precise number as that chart clearly shows. One of the things that took me a long time to learn is that you need to become comfortable being uncomfortable when trading because there is always some degree of uncertainty, and this issue is a perfect example. Algos programmed with math will create precise patterns on an intraday chart but as the time frame increases that precision will erode.

Brad hey, I assume the ATH is also a reasonable stop location for bears, so wondering if bulls push that ATH area further will it create a squeeze action over the bears stops?