Emini monthly sell signal with February low support below

Updated 6:42 a.m.

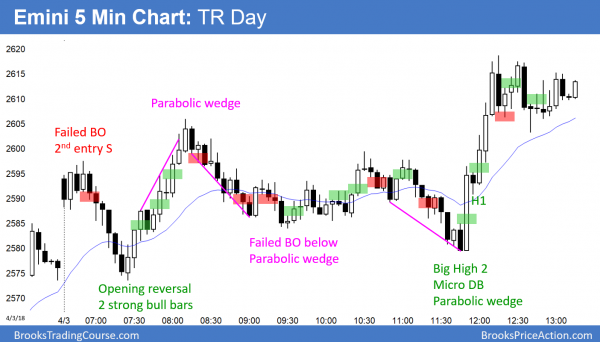

Today opened in the middle of yesterday’s range, and yesterday was huge. Therefore, today will probably be an inside day, or fail to get much above or below yesterday’s range. Consequently, traders will sell near yesterday’s high and buy near yesterday’s low.

While the Emini is Always In Long, the odds are that the opening rally will fail to get above the 60 minute moving average. This would be a Low 4 sell signal. Therefore, traders will look for an Opening Reversal down to test yesterday’s close. Since the bull channel up from yesterday was strong, bulls will probably buy around yesterday’s close. The result will probably be an early trading range.

Pre-Open market analysis

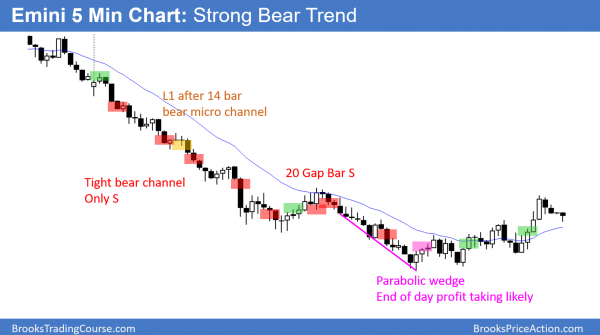

Yesterday was a big bear trend day. By falling below the March low, the Emini triggered a monthly sell signal. However, there was a 15 bar bull micro channel on the monthly chart. That is a strong bull trend, even though it is a climax. Therefore, the odds are that the selloff will not continue much longer on the monthly chart. But, the bulls need a reversal up in April or May before traders conclude that the bull trend is resuming.

Yesterday was the 1st trading day of the month. The Emini could fall for 2 more weeks before the bulls get an April reversal. In addition, the February 2535.25 low is a magnet, and it is only 27 points below yesterday’s low. Therefore, the Emini might fall below it before the bulls buy again. The 20 month EMA is around 2450 and it is another magnet below.

Since yesterday was a sell climax, there is a 70% chance of at least 2 hours of sideways to up trading beginning by the end of the 2nd hour today. It probably already began with yesterday’s low. In addition, there is only a 25% chance of another big bear day.

Finally, yesterday triggered a sell signal on the monthly chart. When a sell signal triggers on a higher time frame, there is usually a pullback above the entry price. Consequently, today or tomorrow will probably trade back above the March 2586.00 low.

Overnight Emini Globex trading

The Emini is up 17 points in the Globex session. It is therefore back above the March low. Furthermore, it is near the 2600 Big Round Number, which has been a magnet since early February.

Since yesterday was in a tight bear channel, the reversal up that began at 11:10 am is minor. This is true even if it continues to well above the 60 minute EMA and 2600 on the open today. However, it has been strong enough so that the bulls will look for a major trend reversal. Therefore, they will look to buy a selloff that tests yesterday’s low. That would be a major trend reversal buy setup, and it would have a 40% chance of leading to a swing up today. But, yesterday was a strong bear trend. Hence, the bears will look to sell a reversal down from any rally lasting 1 – 3 hours.

The bears want a resumption of yesterday’s bear trend. Since yesterday was a sell climax, there is only a 25% chance of another big bear trend day today. Consequently, the bulls will look to sell rallies.

With the bulls wanting to buy a 1 – 3 hour selloff and the bears looking to sell a 1 – 3 hour rally, the odds are that today will be mostly sideways. However, yesterday’s range was huge. Hence, even if today is a trading range day, it will probably have at least one swing up and one down.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

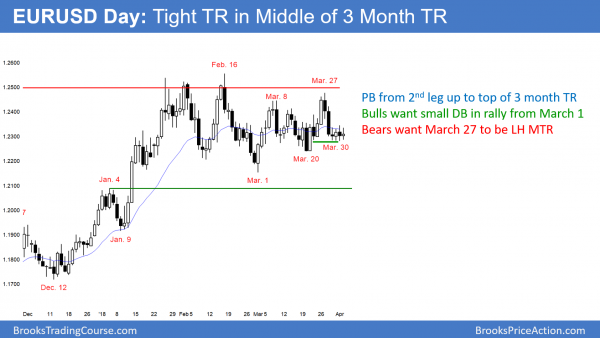

EURUSD in Breakout Mode

The EURUSD daily Forex chart has been in a tight trading range for 4 days. This is a Breakout Mode pattern, especially since it is in the middle of a 3 month trading range.

The EURUSD daily Forex chart has been in an extremely tight trading range for 4 days. This is a sign of intense balance. Furthermore, this range is in the middle of a 3 month trading range. That is an additional sign of neutrality.

While the weekly chart is in a bull trend, this pattern on the daily chart is intensely neutral. It will lead to a breakout, and there is no indication of the direction. There is a 50% chance that a successful breakout will be up and a 50% chance that it will be down. Additionally, there is a 50% chance that the 1st breakout attempt will reverse within a couple of days.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart has been in a 50 pip tall tight trading range for 4 days. Therefore, day traders are unwilling to swing trade. They are looking for 10 – 20 pip scalps, buying reversals up from the bottom and selling reversals down from the top. Some prefer limit orders, like buying at a prior low or 10 pips below, and scaling in lower, or selling above a prior high and scaling in higher.

While there is no sign of an impending breakout, 4 days in an extremely tight trading range is unusual. Consequently, there will probably be a breakout soon. Swing traders will wait for the breakout before looking for 50 or more pips profit. The bigger the breakout, the more likely it will lead to a swing that will last at least a few days.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After trading sideways for 5 hours, the bulls got a strong breakout. Yet, it failed to get very far before stalling.

Today is a bull inside bar on the daily chart. It is therefore a buy signal bar for a higher low double bottom with the February low. Furthermore, there is a wedge bottom that began with the March 2 low. Since the bear channel since the March high is tight, this is a minor buy setup.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al Brooks often mentions this sentence in trading ranges:

“There is a 50% chance that a successful breakout will be up and a 50% chance that it will be down. Additionally, there is a 50% chance that the 1st breakout attempt will reverse within a couple of days.”

Sometimes I feel dumb understanding things, but Is there supposed to be an edge in this statement? Or is it equal to saying price can go either way with no clear probability?

If there’s a 50% chance the first BO will fail, should be bet against it on first signs of trouble (no follow through)?

You are exactly right. There is no edge. The market is in breakout mode. If there was an edge, the breakout would be underway because traders would see that one side had an advantage.

It is usually best to wait for the breakout, especially if the range is tight. If it looks strong, traders trade in the direction of the breakout. If it looks weak or if it reverses immediately, they will trade in the opposite direction. If the range is big enough, traders can buy above a small bull bar at the bottom or sell below a small bear bar at the top. Experienced traders will often scale into longs in the bottom third and scalp out on a rally back into the middle third, and scale into shorts in the top third and scalp out on a drop to around the middle.

Hello Mr. Brooks, thank you for your answer, this helps and is consistent with the lessons about trading ranges.