Emini measured move target at 2860 so magnet and minor resistance

Updated 6:52 a.m.

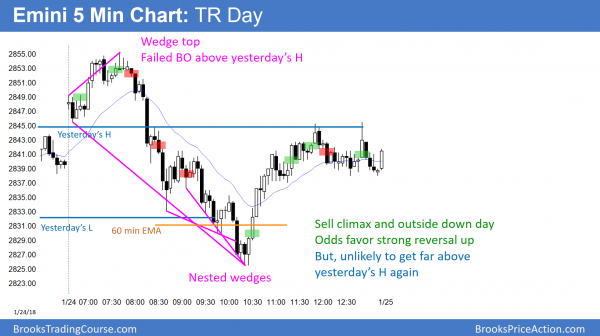

The Emini gapped up, but began with a doji. The bulls got an opening reversal up from above yesterday’s high and want a trend from the open bull trend. Yet, the doji on the open, big bear bar, and the tail on top of the bull reversal bar increase the odds of a sideways open. In addition, they reduce the chance of a strong trend day up or down.

This is a trading range open. In addition, the Emini can’t break far above yesterday’s high. This increases the chances of the Emini selling off to yesterday’s close and trading back in yesterday’s range. However, as always, if there are consecutive strong trend bars up or down, traders will look for swing trades.

Pre-Open market analysis

Monday broke above a wedge top on the 60 minute chart. The target for the bulls is a measured move up, which is around 2860. However, the daily, weekly, and monthly charts have never been this overbought so a reversal down can come at any time. Yet, the bull trend is so strong that the 1st reversal down will be minor, even if it is 5 – 10 %.

Yesterday had an early reversal down on the 5 minute chart, but the day then was a trading range day. It was therefore weak follow-through buying day after Monday’s buy climax. Hence, it increases the chance of a selloff into the end of the week.

The bears want the week to be a reversal bar on the weekly chart. It would then be a doji bar with a big tail on the top. This would be the opposite of last week, which was a doji bar with a tail on the bottom. While not the start of a bear trend, the 2 weeks would represent a loss in the bull’s momentum.

Overnight Emini Globex trading

The Emini is up 9 points in the Globex market. It therefore will probably gap up to another all-time high and above the 2 day bull flag on the 60 minute chart. Because a tight trading range is a magnet, the bull flag on the 60 minute chart might be a Final Bull Flag. Consequently, there is an increased chance of a reversal back down to the range today or tomorrow. The bears need to see consecutive strong bear bars before they will swing trade their shorts.

Because the higher time frames are in a blow-off top, there is an increased chance of an acceleration upwards. This means that today might be another trend from the open bull trend day. However, this is unlikely after a tight trading range on the 60 minute chart.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

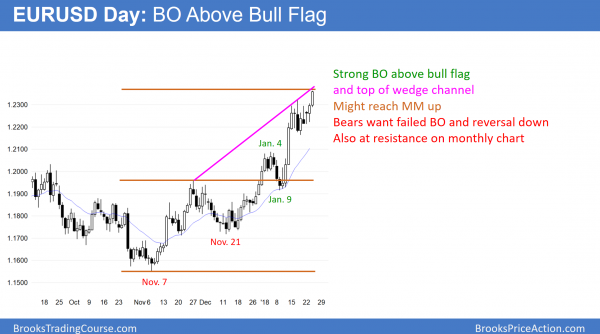

EURUSD daily Forex chart breaking above bull flag

The EURUSD daily Forex chart broke above a bull flag in a strong bull trend. It is now near a measured move target and the top of a wedge channel.

The EURUSD daily Forex chart resumed its bull trend yesterday. So far, the bull flag breakout is continuing. The bulls achieved their minimum objective of at least a small leg up after the strong rally from January 11 – 15. While they hope this breakout will be as strong as that one, it is more likely to pause before going as far. This is because last week’s bull flags had prominent tails, which means traders thought the price was fair. In addition, the bulls are now at the next resistance level. That is a measured move target and the top of a wedge bull channel. Consequently, this rally will probably stall by tomorrow.

Overnight EURUSD Forex trading

The EURUSD 5 minute chart rallied 80 pips in a broad bull channel overnight. This is not a strong bull trend. It is therefore likely to evolve into a trading range today or tomorrow. Less likely, it will accelerate up in a big bull breakout.

Aggressive bears are scalping by selling above prior highs in the channel and scaling in higher. Bulls are buying reversals up from pullbacks.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini traded down from above yesterday’s high to below yesterday’s low. That made today on outside down day. However, it traded back above yesterday’s high, and therefore was a neutral day.

After forming an outside down day, today reversed back up to above yesterday’s high. Since it closed in the middle, it was therefore neutral. It might be the start of several sideways days.

The bears want the week to close around its open. It would therefore be a 2nd consecutive doji bar on the weekly chart. This would increase the chances that the rally will stall. The bulls want the week to close on its high. Since today had big swings up and down, there is an increased chance of a trading range day tomorrow. Because today had a big range, tomorrow might be an inside day.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al, after the big mo e down yesterday, does the 2860 magnet then become obsolete? or is still a possible weaker magnet?

Hi Al I have a couple questions, i have been studying your trading for a while now, My first question is on SPY today why couldnt u short below the first 5 mint bar doji in the morning on anticipating a sell of to yesterdays high closing the gap??? Question number 2, On bar 40 also on the SPY today at yesterdays low and the 60 EMA u have a doji followed by an inside bull bar closing at its high, followed by a 2 leg trend line break at 845am to 9am. bars 39 or 40 u can also draw a wedge connecting the lows. why would that not be a entry point on bar 41?? or can it be?

Thanks.