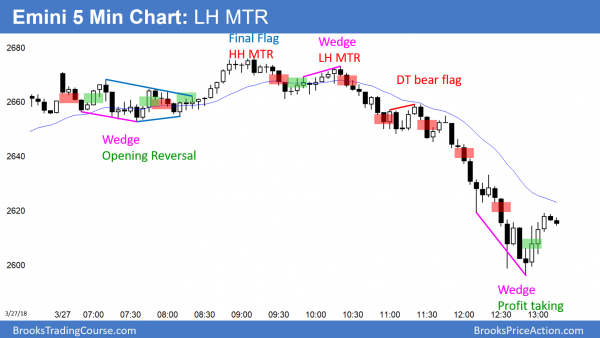

Emini Low 1 bear flag for test of February low

Updated 6:45 a.m.

The Emini reversed down from a wedge bear flag at the EMA on the open. It sold off to test yesterday’s low and 2600. Since 50% of strong moves on the open fail, the bulls will look for an early reversal up from around yesterday’s low.

The bears want a strong break below 2600, which is where the bulls took control after the early February collapse. This is therefore an important level. That means that the Emini might enter a trading range here before deciding on the direction of the breakout. A strong bear breakout and bear trend is less likely than a trading range or a bull trend today because yesterday was an outside down day at support.

Pre-Open market analysis

The bears got a reversal down from a higher high major trend reversal on the 5 minute chart. This was followed by a lower high major trend reversal. Yesterday then collapsed into the close.

On the daily chart, the bears see Monday as a pullback from a strong bear break below the March 1 low. Tuesday is therefore a bear flag. Because yesterday was a bear bar on the daily chart, it is a Low 1 sell signal bar. If today trades below yesterday’s low, which is likely, it would trigger the Low 1 sell signal.

However, the monthly chart is still in a strong bull trend. The monthly bar closes on Thursday because the markets are closed on Friday. At the moment, the month has a bear body, but a tail below. The bears want the month to close on its low.

The bulls would like a rally today and tomorrow. They want a close above the open of the month, but that is unlikely since the open is far above. At a minimum, they do not want the week or month to close on the low.

Next few days tell traders if reversal up or new leg down

The next few days are important because they will affect the probabilities for the next month. If the bears get a couple of big bear days, the odds favor a break below the February low. If they break strongly below, the odds of a 20% correction would be about 40%.

Alternatively, if the bulls can hold around 2600, the odds would favor a rally back up to the all-time high.

Overnight Emini Globex trading

The Emini is up 5 points in the Globex market. Because yesterday was a huge bear day and today will open near its low, today will probably trade below yesterday’s low. That would trigger a sell signal on the daily chart. Yet, if it reverses up strongly over the next few days from around yesterday’s low, the sell signal will have failed.

Because yesterday was a big outside day, there is an increased chance of an inside day today. Therefore, traders will look for a reversal up after an early selloff to just above yesterday’s low. If so, that could lead to a bull trend day. Since yesterday was huge, the bulls would be lucky to get a rally back to just the middle of yesterday’s range.

If today triggers the sell signal on the daily chart by going below yesterday’s low, there is less than a 50% chance that it would be the start of another leg down.

This is because the Emini has been in a trading range for 2 months, and most breakouts while in a trading range fail. Consequently, even if there is a strong break below yesterday’s low, traders will be ready for a reversal up. If there is a strong bear breakout, traders will swing trade their shorts until there is a convincing reversal up.

Yesterday was climactic. Therefore, there is a 75% chance of at least 2 hours of sideways to up trading starting by the end of the 2nd hour.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

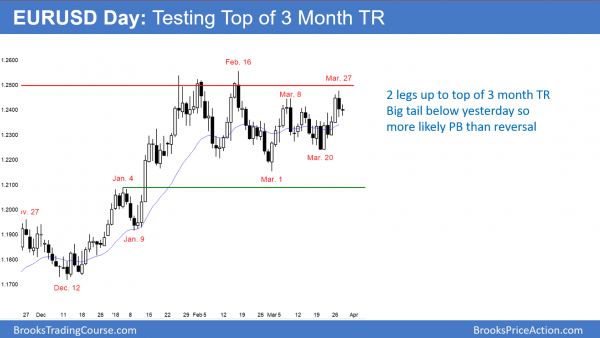

EURUSD 2 day bull flag more likely than bear reversal

The EURUSD daily Forex chart has had a 3 week, 2 legged rally to the top of the 3 month trading range. Since yesterday had a big tail below and the 3 week momentum up is strong, the rally will probably continue at least a little higher.

The EURUSD daily Forex chart has been in a trading range for 3 months. It was in a strong bull trend last year. Therefore the odds favor a bull breakout. Furthermore, there is a monthly bear trend line around 1.2650. Since that is resistance and it is close, it is a magnet. Consequently, the odds favor a breakout above the range, which is a bull flag on the weekly chart.

However, the range has lasted far more than 20 days on the daily chart. That means that there is almost a 50% chance of a bear breakout on that chart before there is a bull breakout on the weekly chart.

The bears got a reversal yesterday on the daily chart. But, there was a prominent tail at the bottom of the bar and the 5 day rally has been strong. In addition, there is room to the top of the range, which is about 80 pips above yesterday’s high. As a result, yesterday was more likely a pause in the rally than a reversal. If the bulls can hold above 1.2350, they will make another attempt at the top of the range around 1.2550.

The bears need a strong reversal down. In addition, they need to break below the March 20 major higher low of 1.2239. If they succeed, they then can try to break below the March 1 low. That 1.2153 low is the neck line for the February 16 and March 27 double top.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart has been in a 40 pip range for 24 hours. Traders are deciding if yesterday’s selloff was the start of a reversal down to the March 1 low, or a pullback from the break above the March 8 high. As long at it holds above 1.2350, the odds are that it is a pullback. That means traders will more likely see a bull breakout within 3 days than a bear breakout.

Since the range has been only 40 pips since yesterday morning, day traders have been scalping. They are waiting for a breakout up or down to swing trade.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After yesterday’s huge bear day, today was a trading range day. The bears got some trend resumption down in the final hour.

Today was a trading range day after yesterday’s huge outside down day. It closed near the open and was a bear doji day.

The markets are closed on Friday. Therefore, tomorrow is the final trading day of the week and month. Consequently, weekly and monthly magnets will be important, especially in the last hour.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

It was a reasonable Sell The Close, but low probability. The odds favored a 2nd leg up after yesterday’s wedge bottom and sell climax. You can see that traders who did sell it and put a stop above the EMA and then scaled in at the EMA or the high of 1 made money. Most would have exited above 3 since that was a reasonable buy. The bears then would have sold again around the EMA.

part 2 question

Sorry forget to say main reason for the question 🙂 I did not sell there, but as I was thinking of trapped bears I was expecting some bail out for bears, which kept me out of buying above bull bar 3.

thx

Al, would you consider bar 2 being big enough to be considered – sell the close, with context of testing yesterday low?

Bar 9 allowed scaled in bears (below bear bar 8) to get out be and market paused there for 2 points scalp, which made me think dis. bears were covering?

thx

Took trial today Al.

Had to be in and out of the room.

Caught part of your comments after the trading day but could watch or listen.

Is their an archive to go to to hear this and as your explained the candles at the same time.

Good work Al

Walt Mucha

Archives are here: http://www.brookspriceaction.com/groupcp.php?sid=524e57a2267762c71faf35936129f5b7