Posted 7:22 a.m.

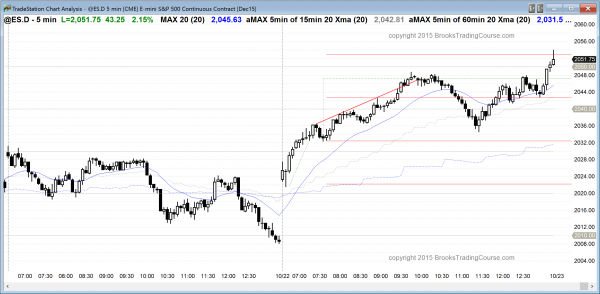

The bulls got a trend from the open bull trend and then began to form dojis. That is a sign that it is probably entering a tight trading range, and that it might be sideways for 2 or more hours. If so, the bulls will try for trend resumption up later in the day. The bears will look for a double top lower high major trend reversal within the tight trading range, and then a bear breakout. Although the Emini is clearly Always In Long, sideways is likely for at least a couple of hours, and the downside risk is small until after that. Then, the bears would need a strong bear breakout with follow-through. In the meantime, bulls will continue to buy, especially below bars, and the bears are starting to sell above bars. Both are starting to scalp, nd the result will probably be a tight trading range.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade the markets when a pullback as it unfolds

The Emini bears tried to begin a 2 – 3 day pullback yesterday. Although they created a strong 60 minute breakout, they were unable to create a follow-through bar. This reduces the chances that the selloff was the start of a pullback, and the chance of one more new 60 minute high is still 50%. The strong 3 week rally had two clear pushes up, and possibly a third push. The daily chart is overbought and in a resistance zone. This makes a pullback likely. However, the bears need to do more before traders believe that a pullback is underway. They might get the necessary follow-through selling today. Without it, the odds will begin to favor one more push up before he pullback begins. If the pullback has begun, the targets are the higher lows in the 60 minute bull channel, the daily moving average, last week’s low, and the October 5 gap.

In the Globex session, the Emini has been trading sideways and is 9 points above yesterday’s close. The bears had a chance to demonstrate strength overnight. If they could have continued yesterday’s selloff and created a gap down today, that would have increased the chances that the pullback had begun. While it is still possible that the pullback is underway, the bears now need either a lower high major trend reversal on the 60 minute chart, or a strong bear breakout with strong follow-through.

The chance that the Emini continues up in a tight bull channel or has a bull breakout above the bull channel and a new leg up are about 25%. That is enough to be prepared to buy, if this happens, but the odds are against it.

Forex: Best trading strategies

The EURUSD has been in a trading range for months and it has had many breakouts up and down, but the follow-through has been limited, as is the case within trading ranges. It had another strong bear breakout 20 minutes ago. Traders learning how to trade the markets should realize that the bear breakout bar was big enough to make it likely that there will be follow-through selling today and at least a measured move down. The bottom of last month’s trading range is 70 – 100 pips lower, and that is a reasonable target.

The bulls hope that this is just another failed breakout within the range. They need to halt the selling and then create a 60 minute reversal within the next hour or two before those who trade the markets for a living will believe that they have taken control.

I have written repeatedly over the past couple of weeks that a selloff was likely in the USDCAD. At the end of last week, I said that a reversal back up for a few days was likely. Yesterday was the 4th day up, but the bulls created a strong breakout above a 60 minute head and shoulders bottom yesterday, and there might be more buying today before there is a pullback.

The bulls are hoping that the selloff was just a bear leg in a broad bull channel on the daily chart, and there is a 50% chance that they are right. However, the 4 day rally is now at a 50% pullback from the 3 week selloff, and there are always sellers at a 50% pullback. Bulls take profits and bears begin to sell, and the rally either stalls or begins to turn back down.

The overnight trading was sideways, and the rally has been climactic. The odds are that the bull breakout above this 10 hour trading range will not get very far and that the trading range will become the final bull flag before a bigger pullback forms over the next couple of days.

The momentum up on the 60 minute chart is still strong and there is no sign of a top yet. Bulls are continuing to buy. However, the rally will probably transition into a trading range today or tomorrow, and then have a pullback for a day or two.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini had a trend from the open bull trend and then a deep selloff that reversed up sharply from a higher low.

The Emini tried to selloff from the breakout above the 2 month trading range, but reversed up sharply. This is bullish price action. The bulls are creating a strong follow-through bar on the weekly chart, which increases the chances of higher prices. Because the Emini is at the bottom of the 7 month trading range, a big move up or down can happen suddenly, but the bulls are now in control.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al,

Thank you so much for your time and dedication to the new video course. Judging based on the high quality of your content in the past, I cannot imagine how much time the new course is taking you to complete. Your trading material is truly some of the best I have ever seen. Again thank you for everything that you do.

Both are starting to scalp, and the result will probably be a tight trading range. This is your take a quote this am sir.. That was quiet a misread on the action I must say,, the ecb and the globex overnight breach was a tell of impending mega bear squeeze,,,,, I am not sure what you were thinking this am AL. That was all in long from last nights open and glad I did,,,,

best

Ken

The biggest trends always happen when the odds are that they will not. That is the only way a small pullback bull trend day can form. It always looks like it is probably transitioning into a trading range, and this makes bulls buy only small, hoping for a pullback. So many bulls are doing the same thing that a pullback never comes. The bears see the likelihood of a trading range and decide to sell above bars. The pullback does not come and they have to quickly buy back their shorts. This creates the next pullback.

Part of the fun of trading is quickly realizing when the market is following an unlikely path and then correctly making adjustments to make money. Traders do not get upset because low probability events are not zero probability events. They are simply math and part of trading. As long as traders understand what the market is doing, they can simply change what they were doing to fit what they now need to do.

Well said Sir, well said, thanks.

Hi Al, do you often determine that the market is trending or in a trading range by assessing the strength of the buyers/sellers or by paying attention to important SP and RS?

Of course both are important, but say you get a chart like this: https://www.tradingview.com/x/1RG6loVM/. I am looking to buy above H2s in a bull trend and sell above H2s near the top of a trading range, so in this case it was very difficult to determine the probabilities.

Any advice would help

thanks!

Support and resistance are always important. They pull the mkt. However, if it it far enough away, a leg in a trading range can be a strong trend. I do not want to buy a bull flag just below resistance unless there is a very strong trend.