Emini ignoring FOMC report, but stalling at 2500 Big Round Number

Updated 6:45 a.m.

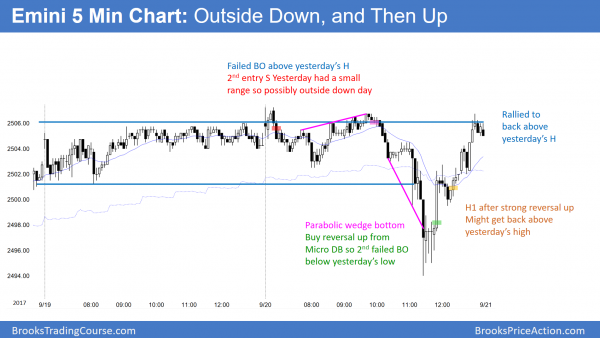

Yesterday’s rally was a spike and channel bull trend. Since the channel usually evolves into a trading range, and early trading range is likely today. Because yesterday was a doji day, today will probably be mostly a trading range day. Since it was a big outside day, there is an increased chance of an inside day today. Even if today goes above or below yesterday’s range, the odds are that the breakout will not get far.

This looks like a trading range open. The bulls want an opening reversal up from the 60 minute moving average. But any rally will probably fail around yesterday’s high. The bears want a 2nd leg down from yesterday’s selloff. However, the rally was so strong that a selloff will probably fail to get much below yesterday’s low.

Since today will probably be a trading range day, it will likely have at least one leg up and down, each lasting 2 – 3 hours. It is now deciding which will be first.

Pre-Open market analysis

Yesterday was an outside down day. It therefore formed a micro double top. In addition, the daily chart has a parabolic wedge bull channel since the August 21 low. Because of the buy climaxes on the daily, weekly, and monthly charts, the Emini is likely to pull back soon. However, even if the Emini falls 100 – 200 points, the pullback will be a bull flag on the weekly and monthly charts. Therefore the downside risk is small over the next few months.

Yet, because of the buy climaxes and the parabolic wedge, the upside is small as well. Sometimes the market goes sideways to down for 10 or more bars after a parabolic wedge top. This is especially true after yesterday being a doji day. If it does, there is a 50% chance of a bear break below this bull flag on the daily chart. There is also a 50% chance of a bull breakout. However, most bull breakouts last about 5 bars and then fail. Hence, the odds favor the start of a 1 – 3 month pullback within the next few weeks.

Overnight Emini Globex trading

The Emini is down 1/2 point in the Globex session. Yesterday was a reversal day, but most reversal days lead to trading ranges. Yet, the range was big, and therefore the odds are that today will have at least one swing up and one swing down. Because the month-long rally was strong, the Emini might continue sideways for another week or two, like it did after the big doji days on June 9 and July 27. Both eventually led to a minor reversal on the daily chart. That is likely here as well.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

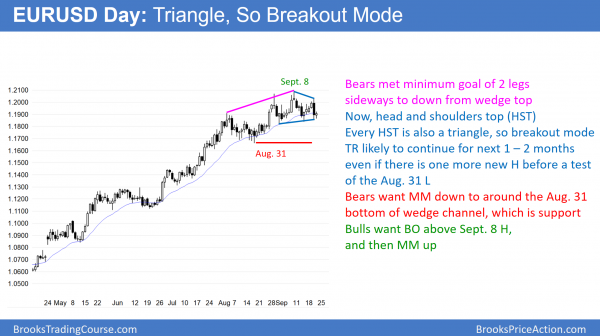

The EURUSD daily Forex chart has evolved from a wedge top to a head and shoulders top. Since every head and shoulders top is also a triangle, the chart is now in Breakout Mode.

After the wedge top, the bears achieved their minimum objective of 2 legs sideways to down. The pattern is now a head and shoulders top, which is always a triangle. This is therefore a breakout mode pattern. Consequently, there is a 50% chance of either a successful bull or bear breakout. Furthermore, there is a 50% chance that the initial breakout will fail and reverse.

The rally on the monthly chart is climactic and at major resistance (the bottom of a 13 year trading range). Therefore the odds are against a big rally from here without a pullback first. Hence, even if the bulls get a breakout above on the daily chart, the rally will probably fail and the month-long trading range will probably continue for another 1 – 2 months. Therefore bears will sell above the September 8 high.

In addition, the rally is in a tight channel. This means that any reversal down by the bears will probably be minor. As a result, the best the bears will probably get is a test of the August 17 major higher low (beginning of the wedge rally). Therefore, whether the bulls or bears get a successful breakout over the next week does not matter. The month-long trading range might get a little taller, but the odds are that it will continue.

Overnight EURUSD Forex trading

The 5 minute chart has been in a 30 pip rang for the past several hours. It is testing the bottom of the month-long trading range, which is the neck line of the head and shoulders top. While yesterday’s momentum down was strong, the bears need follow-through selling today or tomorrow. Without it, yesterday will simply be a brief, strong leg down in a trading range.

The bulls want today to have a bull body on the daily chart. This would be a bad follow-through bar for the bears. It would therefore erase some of the bearishness of yesterday’s selloff.

Since the momentum down yesterday was strong, the bears still are more likely to get a breakout below the 1.1850 neck line of the head and shoulders top. Yet, if the bulls break above yesterday’s lower high on the daily chart (right shoulder), the probability will slightly favor the bulls.

Because the selloff is stalling at support, the odds favor a trading range day. Yet, yesterday’s momentum was strong enough so that there is an increased chance of a strong bear breakout today or tomorrow. Less likely, the bulls will get a strong rally that reverses yesterday’s selloff.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After yesterday’s reversal, today was likely to be a trading range day. It was also an inside day.

After yesterday’s bull reversal, today was likely to be a trading range day. Since yesterday was an outside day in a tight trading range, there was an increased chance that today would be an inside day. Because it had a bear body, it is a bear ioi sell signal bar for tomorrow. The bears want the breakout above 2500 and the August high to fail. An ioi is also a buy signal, but because it has a bear body, the odds are they will be sellers above.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Greetings Al on Monday around bar 8 or so you kept saying you thought price would return back to the open(it did ) What made you believe this ??

I wish I could remember all of what I said 3 days ago, but when I believe that a day is behaving like a trading range day, then I expect both a bull and bear leg. Since there was a bull leg, but not yet a bear leg, the odds favored a bear leg. Also, if the Emini is within 5 pts or so above the open and a bear leg is likely, the Emini usually has to test the open. When a day is likely a TR day, the open is a magnet, and the market usually closes near the open.

Thankyou Friday sept 22nd was absolutely amazing may I suggest a chapter on targets for your course!!.

Greetings Al I wasnt sure where to ask you this question about options. I’d like to swing trade options with( a week or so time horizon) and I’m trying to find a strategy. Example If I were to buy a call(30 days out) at the bottom of a 60min TR and it goes against me should I ( A ) hedge against the position by selling scalps on a 5 min chart if it goes always in short or (B) wait until next support and buy another call or scalp a long if it goes always in long looking to break even ( or close) on1st call profit from second support level. The biggest risk I see is a chop ? I want to trade gold and oil but find sleeping with a full contract is not an option lol !! Thankyou

Central banks are pouring hundreds of billions of dollars into US stocks. It’s a rigged market http://www.zerohedge.com/news/2017-06-26/central-banks-buying-stocks-have-rigged-us-stock-market-beyond-recovery

I’m smiling because anything that is legal is okay with me. Also, if a trader is confident that the central banks are rigging the market to make sure it will keep going up, he should buy with every dollar that he has. It would be great if it were true because then all of us could buy and have a guaranteed significant profit. Because we do not believe that there is a guaranteed profit, then we don’t believe the markets are rigged. As rich as central banks are, they cannot prevent 20 – 50% corrections. They will keep coming forever, even though powerful countries with strong central banks lose a fortune in taxes when there are huge corrections.

Yes it is legal (Quantitative Easing), although it is morally questionable. I’m definitely not suggesting that we should bet on it going up forever. Intervention will only exaggerate the climax and its subsequent correction. It’s fascinating to consider these massive forces in the market which have potentially unlimited funds to play with (QE money is created out of nothing).