Dow 20,000 big round number within reach

Updated 6:52 a.m.

The Emini opened in yesterday’s tight trading range. Furthermore,it failed to get consecutive strong trend bars on the open. Finally, it failed to break strongly above the top of the 4 week tight trading range. Hence, the odds favor a lot of trading range price action again today. This is a trading range open. The Emini lacks conviction. The odds are that it will be another trading range day. In addition, the lack of movement on the open increases the chances of a trading range open that could last for 1 – 2 hours.

The Emini is Always in long but the trend is weak. Furthermore, it is stalling at the top of the 4 week trading range. There is no credible top yet. However, a trading range is most likely today.

Pre-Open Market Analysis

After Tuesday’s bull breakout, yesterday was a bull channel day. Yet, the channel was weak. Furthermore, the Emini is still within its month long trading range. While the odds still favor a new high and Dow, 20,000, every day that fails to get there reduces the probability.

In addition, the gap below the range and the August 2195 high is still open. Gaps late in trends usually close. As a result, even if the Dow gets above 20,000, it probably will not get far above it. This is because the magnetic pull of the August high will probably pull the Emini down within the next month.

Overnight Emini Globex trading

Yesterday had a weak bull channel after Tuesday’s strong bull breakout (spike up). The bulls have failed several times around the all-time high, which corresponds to Dow 20,000.

Because the 240 minute chart has several bars completely below the moving average, the bears are getting stronger. The rally after gap bars usually leads to a major trend reversal attempt. The bears need a good signal bar, a micro double top, and a big bear bar. If they get it, they would have a 40% chance of at least a few days and a couple of legs down. The selloff could reach the magnet of the August high.

The Emini is down 2 points in the Globex session. It traded sideways overnight. This is a breakout mode situation. Yet, a bull breakout will probably not get far because of the magnet below at the August breakout point. Furthermore, a bear breakout will probably reverse back up from the August trading range high. The Emini will probably reach both targets in the next 1 – 2 months. It is deciding which to reach first.

EURUSD Forex Market Trading Strategies

The weekly EURUSD Forex chart is stalling after breaking to a new low. The bear leg had 3 pushes down and is therefore a wedge bottom. A strong reversal up in the next few weeks would therefore trigger a major trend reversal.

The EURUSD daily Forex chart continues to hold at the December 2015 low. While the trend is down, the bears continue to fail to get follow-through selling. At some point, they therefore will give up and wait to sell higher. Since there is no strong bull reversal yet, the bears are still more likely to get a breakout than the bulls. Yet, one big bull day is all that the bulls need to take control.

Overnight EURUSD Forex trading

While the EURUSD sold off for several hours overnight, it has bounced back 50%. The weekly chart so far has a bull body. If it closes the week with a bull body, that would therefore be consecutive bull bodies. Furthermore, it would be the 3rd push down. Hence, it would create a wedge lower low major trend reversal setup. The bulls would therefore need 1 – 3 weeks up to trigger a buy signal.

The weekly and daily charts are still in bear trends. Yet, the selling is weak and most trading range breakouts fail. Traders will watch for a strong reversal up in the next few weeks. It would therefore trigger a buy signal. The bears need a strong breakout below the 4 week trading range. If they get it, the next target is par.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

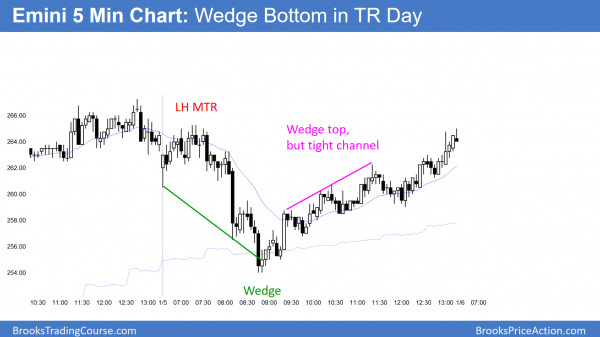

The Emini sold off to the 60 minute moving average and below yesterday’s low. It then reversed up from a wedge bottom.

The Emini sold off to the 60 minute moving average. Yet, it reversed up. The bulls are still trying to get above Dow 20,000. Because the Emini is so overbought, the odds are that the upside is limited. Hence, it will probably pull back to the August high whether or not it does a little higher first.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hello Al.

I hope you doing well . Thank you so much for commentary. Al please if possible can you post for us the commentary early as before , i notice that the past a few weeks the daily commentary coming out late .

We really want to know your insight within opening hour to use as guidance .

Thank You so much for your understanding much appreciated

Hi Al

you said ” The rally after gap bars usually leads to

a major trend reversal attempt. The bears need a good signal bar, a micro

double top, and a big bear bar. ”

Do you mean a good signal bar for the micro DT & a strong bear bar as the entry bar ?

and when do you usually enter: above the signal bar or at the close of the strong entry bar ? Thank you. reading the daily analysis help me a lot to understand your methodology

If the rally is in a tight channel, the bears need a micro double top. To sell a rally in a bull trend, it is better to have a strong sell signal bar. It is higher probability to sell after a strong bear breakout, which is the sign that the top is trying to unfold. If the stop entry setup is strong, I sell below the sell signal bar. If the setup is not strong, I wait to sell the close of a strong bear bar or a strong bear follow-through bar, or at or above the high of a prior bar.