Dow 20,000 big round number and January Effect | Brooks Trading Course

Updated 6:44 a.m.

Today opened in the middle of yesterday’s range and tested yesterday’s low. Yesterday was a sell signal bar on the daily chart for a failed breakout above a 6 week trading range. Yet, this week’s rally was strong. Therefore, the sell signal is weak and the probability is that the selloff will not fall far.

The bears want a big bear trend day to reverse the rally earlier in the week. While that is possible, the odds are against it. Yet, if they begin to create a series of strong bear trend bars, then the odds of a bear trend day would go up.

The bulls do not mind the sideways trading because they know the momentum up was strong enough to make a 2nd leg up likely. But, there is no sign that they are willing to buy again yet.

At the moment, the initial selloff made the Emini Always In Short. However, without a strong break below yesterday’s low, the odds are that today will be another trading range day.

Pre-Open Market Analysis

Since yesterday traded below a major higher low from Tuesday, it was a trading range. Furthermore, it was a small doji day on the daily chart. While the bears see it as a sell signal bar for a failed breakout, the bull breakout on Tuesday was strong. Hence, any reversal down today will be minor. Therefore, a selloff will more likely create a bull flag than a bear trend.

Today is a Friday and therefore weekly support and resistance is important. The only nearby targets are the high of this week and the high of the 6 week trading range. Dow 20,000 is also important.

Overnight Emini Globex trading

The Emini is down 0.05 in sideways trading. While yesterday is a sell signal bar on the daily chart, the odds are that there will be buyers below yesterday’s low. This is because the momentum up on Tuesday and Wednesday was so strong.

While it was climactic, most buy climaxes lead to trading ranges, like yesterday, not bear trends. Because yesterday and the overnight trading was in a range, today will probably also be a trading range day.

EURUSD Forex Market Trading Strategies

The 240 minute EURUSD Forex chart had a bear breakout below a wedge bull channel. Therefore, two legs down is a likely goal. In addition, the bear breakout was strong enough so that a 2nd leg down is likely. Yet, unless the bears break below the most recent major higher low, the bulls still correctly see this as a pullback in a now flatter broad bull channel.

While the bears got a reasonably strong break below the bull trend line of a wedge top on the 240 minute chart, the selloff is still above the bottom of the most recent higher low. The chart is therefore still in a bull trend. Yet, the selloff was strong enough to make at least a small 2nd leg likely. Hence, the bears will probably have one more chance at converting the bull channel into a trading range.

The bear breakout only lasted a couple of bars. It therefore was not especially strong. Hence, if the bears get their 2nd leg down, a trading range is more likely than a bear trend. Furthermore, a wedge rally usually evolves into a big trading range.

The bulls want the broad bull channel to continue up above the top of the December 8 major lower high around 1.0873. While they still might succeed, the rally on the daily chart does not look strong enough to get there without a bigger pullback 1st.

Overnight EURUSD Forex trading

The EURUSD Forex market traded sideways in a 40 pip range overnight. This is a lack of follow-through selling after yesterday’s bear breakout. Hence, it reduces the chances that the selloff is the start of a bear trend.

Furthermore, after last week’s strong 3 day rally, it creates confusion. Therefore, the chart will probably go sideways for another day or two before deciding whether the broad bull channel will continue or test further down. At the moment, the odds slightly favors the bears.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

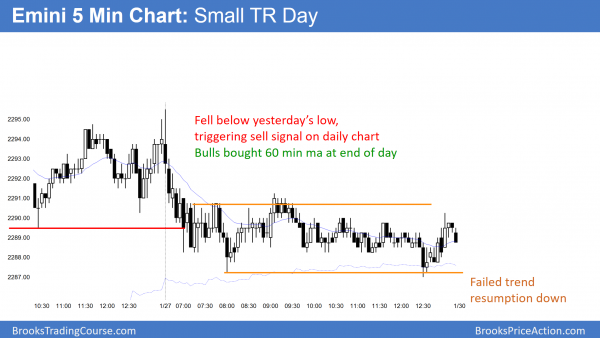

The Emini fell below yesterday’s low. It therefore triggered a sell signal on the daily chart. Yet, there was a 20 Gap Bar buy setup on the 60 minute chart, which prevented a strong selloff.

The Emini has been sideways for 2 days as it awaits Wednesday’s FOMC announcement. While there are measured move targets between 2340 – 2375, the odds are that the Emini will pull back 1st. The downside targets are the 2016 close, and then the August high. Therefore, the odds favor a 2 – 5% correction in February or March.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Al,

Hope all is well. I’ve been following the YEN and found some good trades. Does all of your trade tactics apply to all markets…. i.e. 3 push wedge, etc. ? I noticed the Yen has some strong volatility… do you find currency futures having the same market cycle as the eminis? Any advise is appreciated.

Thank you-Richard

Yes

Al says in his course that the market cycle and trade tactics applies to all markets, all time frames, for all of history. I primarily trade USDJPY. It’s one of the most volatile and interesting markets these days. In the 2014 edition of the course, Al says that currencies have fewer good trade opportunities than the E-minis. However, 2014 was a year of record low volatility for currencies. That is certainly not the case in 2017.