Posted 7:52 a.m.

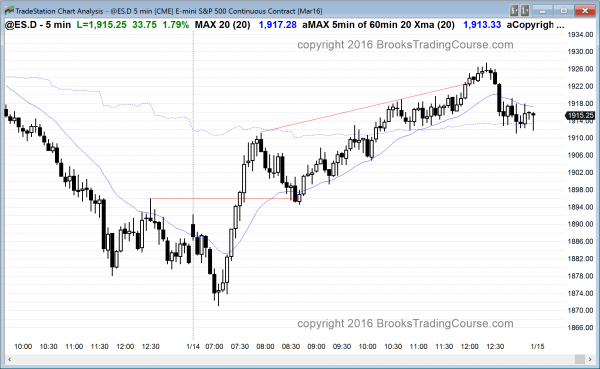

The Emini had a strong reversal up. I was trading actively and was delayed in posting this. The Emini is clearly Always In Long, but the rally is a buy climax at the 60 minute moving average. The odds are that it will go sideways to down for at least an hour or two. The reversal up is strong enough so that there is a 60% chance of a 2nd leg up, even if the pullback is deep and falls below the breakout point at the top of the trading range at the end of yesterday. If the Emini enters a trading range and begins to have bear bars, bears will scalp above bars. Bulls will buy below bars and at support, like the moving average and the top of yesterday’s trading range. However, the bulls will probably only scalp for the next couple of hours after a buy climax to the 60 minute moving average.

Pre-Open Market Analysis

S&P 500 Emini: Day traders expect trading range price action after sell climax

Yesterday had a pair of big sell climaxes after a small pullback bear trend. There is a 50% chance of follow-through selling in the first hour or two, and a 70% chance of at least 2 hours of sideways to up trading that will start in the 1st 2 hours. After 2 hours of pulling back or pausing, the bears will see a big bear flag. There are several measured move targets between 1865 and 1870, and they will probably be reached over the next several days before the Emini gets back above yesterday’s high.

The bulls will see a major trend reversal within the 2 hour trading range. They will have a 40% chance of a swing up. As dramatic as yesterday’s selling was, it was also unsustainable. The odds favor at least a pause over the next few days. I mentioned on Monday that the 1st reversal up from the 60 minute wedge bottom would probably be minor because the channel down was so tight. I said that the bulls would need at least one more test down before they could get a bounce up to the bottom of the 3 month trading range around 1980. Yesterday’s selloff might be that 2nd leg down.

The bulls see a big triangle and higher low on the monthly chart. As long as this leg down does not fall below the August bear low, the bulls see at least a double bottom higher low major trend reversal. It is easy to focus on the strong selloff on the daily chart, but those who trade for a living always pay to context in addition to momentum. This selloff is still in a bull flag on the monthly chart.

The Emini is up 11 points in the Globex session with 45 minutes to go before the day session opens. There was no significant follow-through selling overnight. The Emini was in a trading range. The odds are that there will be a lot of trading range price action today. Those learning how to trade the markets should understand that bear trends usually transition into trading ranges before reversing into bull trends. Once a trading range lasts 20 bars, the probability of a bull breakout and measured move up becomes about the same as that for a bear breakout and measured move down. Day traders today will look for swing trades up and down. If there is a strong trend day, they will mostly swing trade. The range will probably be big enough for scalpers to also do well.

Forex: Best trading strategies

The 240 minute and daily charts of the EURUSD are in breakout mode. The month-long 250 pip trading range has about the same probability of a measured move up as it does of a measured move down. On the daily chart, the bulls still have a slightly higher probability of a 2nd leg up from the December 3 bull trend reversal. However, it has been forming lower highs and lows since December 15. This means that the bull flag since then is also a bear channel, and a single huge bear day could make the odds of a break below the December 3 low higher than the odds of a 2nd leg up.

Day traders will continue to scalp for 10 – 20 pips until there is a strong trend with follow-through. the 5 minute chart had a modest rally overnight, there was also a reversal down about an hour ago, and the EURUSD has been in a tight trading range since. Most day traders will not trade when a trading range is only 20 pips tall.

If today is another trading range day, day traders will frequently use limit orders to enter, looking to sell strong bull closes near the top and reversals down from the top, and looking to buy strong bear closes near the bottom and reversals up from the bottom. When a reversal is strong, they will often enter in the direction of the reversal, especially after a pullback, looking for a 2nd leg. Trading ranges are filled with 2 legged moves up and down.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini had an exceptionally strong lower low major trend reversal today, followed by a bull channel.

The reversal up from a micro double bottom on the daily chart at a higher low on the monthly chart is bullish for possibly several more days, whether or not there is a pullback first. The odds are the Emini is going higher, probably to the 1950 area and maybe higher. However, because today was a spike and channel bull trend, it might have to test the bottom of the channel at around 1895 and form a double bottom bull flag first. The neck line is today’s high, and a measured move up from that double bottom would be around 1960.

Tomorrow is Friday so weekly support and resistance are magnets, especially at the end of the day. Last week’s close and low, and this week’s open are all nearby.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.