2018 January barometer indicates Trump rally continuing

Updated 6:47 a.m.

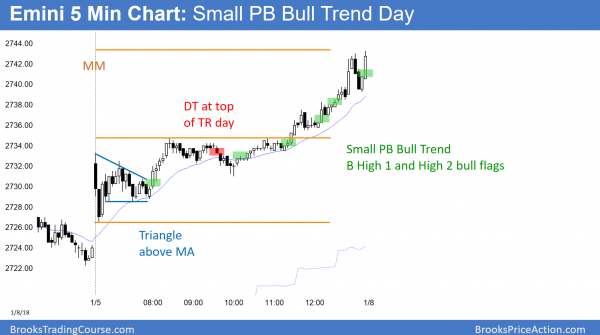

Friday ended with a buy climax. There is therefore only a 25% chance of a strong bull trend today. Yet, there is a 50% chance of some follow-through buying in the 1st 2 hours. The buy climax was a spike and channel bull trend. It began with the break above the trading range of the 1st half of the day. That breakout point is therefore a target.

The day after a buy climax has a 75% chance of at least 2 hours of sideways to down trading that begins by the end of the 2nd hour. The bears are trying to start it on the open.

Friday ended with big up and down moves. Today began with a continuation of this reversal behavior. The bulls want an opening reversal up from the early selloff, like on Friday. However, the big reversals that began on Friday increase the odds of an early trading range. Even if the bulls get an early rally, there is a 75% chance of at least 2 hours of sideways to down trading beginning by 8:30.

The reversal up on the 3rd bar and Friday’s tight bull channel make a strong bear trend day unlikely. At the moment, the market is deciding whether to get a 1 hour rally or enter a trading range. This looks like the start of a trading range day.

Pre-Open market analysis

A popular version of the January barometer uses the 1st 5 days of the year. If they are up, the rally increases the odds that the year will be up. However, most years are up anyway. This is because all financial markets have been in bull trends on the yearly charts forever. The January barometer does not help traders make money. Traders talk about it for entertainment only.

Whenever the strongest leg of a bull trend comes late in the trend, it is more likely an exhaustive buy climax than the start of an even stronger leg up. While last week was strongly bullish, it was extreme on the daily and weekly charts. Hence, there is a risk that last week was the start of a blow-off top.The odds therefore favor some sideways trading early this week. While the bulls might get a brief 2nd leg up after a 1 – 3 day pullback, the odds are that the Emini will begin to test down to last week’s low within a couple of weeks.

Once there, the bulls will try to rally again. Yet, the bears will look for a reversal below last week’s low. In addition, they want a measured move down based on the height of last week’s rally.

Overnight Emini Globex trading

The Emini is down 3 points in the Globex session. Since last week’s rally was exceptionally strong, the odds favor at least a micro double top on the daily chart before there is a reversal down. If today is the start of a selloff, the selloff will probably end within a few days. Then, the odds favor a 1 – 3 day rally. If the bears get a reversal down at that point, they would have a micro double top after a buy climax. The odds would favor a test down to last week’s low over the following couple of weeks.

Friday’s setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

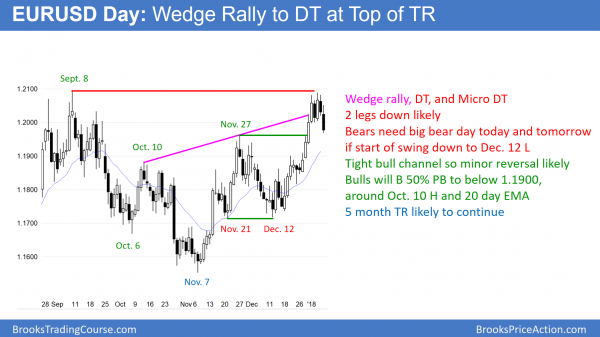

The EURUSD daily Forex chart is turning down from a double top with the September 8 high. The 3 month rally is a wedge. In addition, there is a micro double top. Support is at the cluster of highs below 1.1900.

The wedge rally to the top of the 6 month trading range is likely to lead to a couple of legs down, lasting about 10 days. The December bull channel was strong. Consequently, a bear leg in the trading range is more likely than the start of a swing down to the 1.1600 bottom of the range. If the bears are instead creating a trend reversal, they will need a big bear day today and again tomorrow. If there is bad follow-through selling tomorrow, today’s bear reversal will probably be a the start of a pullback to support than the start of a bear trend.

I said on Thursday and Friday that the bears would sell above Friday’s high. They should expect 2 legs down and a test of 1.1900. The bulls will buy again where the bears will take profits. They, too, will wait for a couple of legs down to support.

Since the November 27 high is a breakout point, the selloff might stall and bounce there. However, the context is good for a 2nd leg down. The bears will sell the bounce, and many bulls who did not exit above Thursday’s high will use the bounce to exit. Therefore, with both bulls and bears looking to sell a rally, the odds favor a 2nd leg down.

The daily chart is still in a bull trend. Consequently, there will probably be a rally from below the 1.1900 support area. However, the 60 minute chart is in a bear trend. Therefore, day traders will sell rallies.

Overnight EURUSD Forex trading

The 5 minute EURUSD Forex chart sold off 80 pips in a tight bear channel overnight. The selloff is close to the November 27 high, which is the breakout point. Consequently, the bears will take partial profits and bull scalpers will begin to buy today. However, the both will sell around Thursday’s low at around 1.200. The bull scalpers will take profits and the bears will short for a test down to 1.1900. As a result, the 5 minute chart will probably begin to enter a trading range for a day or two before having a 2nd leg down.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

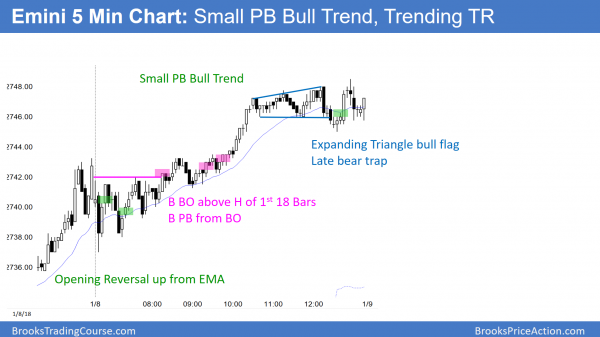

Today was in a trading range for the 1st 3 hours, and it then had a bull breakout. It tested the top of a 3 day wedge bull channel. It formed a Trending Trading Range Day and a Small Pullback Bull Trend Day.

Today broke above a 3 hour trading range and tested the top of a 3 day wedge bull channel. That increases the odds of a pullback tomorrow. Despite the buy climax last week on the weekly chart, there is no sign of a top. The bulls will buy the 1st 1 – 2 reversal down on the daily chart.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Hi Al, I found today 1-8-17 trading to be very difficult. The 5 min bars seemed different (maybe because of low volume?) for the first 2 hours I did identify it as a ranging kind of day and traded it accordingly, but after 11:30 or so, it seemed impossible to read the price action. Was there something different about today trading that you know of that can help us identify or relate to the price action for when these days do occur? Thanks.

Sorry today’s date is 1/8/18!!!