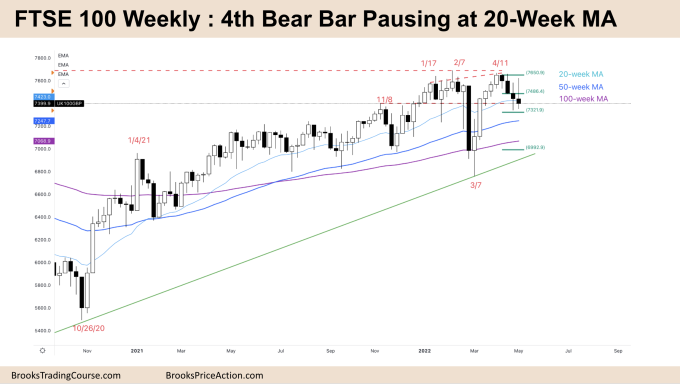

Market Overview: FTSE 100 Futures

The FTSE futures market had a 4th bear bar pausing at the 20-week moving average (MA). We are moving down from a wedge reversal at the top of a trading range. Traders are deciding if we will get a measured move down to the March lows or get a second leg up to the February highs. Bears need a close below the last 2 weeks and the bulls need an inside bar or good reversal bar to setup a High 1 buy.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures closed lower without a new low last week. It is 4th bear bar, which the FTSE has not had since the COVID crash.

- The bulls see this as a pullback from a 5-week bull channel which started on March 7th and a reversal up from the 100-week MA.

- The bulls want a High 2 buy setup around the 20-week moving average. It was a failed High 1 buy from last week, so the bulls want a High 2 or High 3 wedge buy setup for a test of the April highs.

- They know traders bought any MA gap bar in the last 18 months so even if get a bar completely under the moving average, traders are likely to buy it again.

- So what is the problem here for the bulls? No one wants to buy after the 4th bear bar.

- The bears see a tight bear channel and reversal from a wedge top at the top of a trading range. They also see the failed breakout above the November 8th high and looking for a possible measured move down to the 100-week MA.

- If the bulls can get a close above the moving average, even a bull inside bar to confirm the micro-DB with last week, traders might start scaling in.

- Is it always in short or long? When you’re confused, think trading range – buy low sell high and scalp (BLSHS.)

- We are pausing here at the mid-point between the trading range from the March 7th low and the April 11th high.

- As the math starts to favor buying, the bears will continue to scalp and the bulls will start to scale in, hence the tails on the bars.

The Daily FTSE chart

- The FTSE 100 futures moved lower last week finishing Friday with a pair of consecutive bear bars closing below their midpoints so we should move lower next week.

- The bulls see a second leg pullback from a 30-day bull trend, now forming a broad bull channel. They want a double bottom buy setup with April 27th for a resumption back up to the April highs.

- The bears see the harmonic from the April 8th to the April 27th move as a possible measured move target to 7200. This might form the middle of a longer-term trading range

- The bears see another break below the 20-day MA as the reversal down from the top of a long-term trading range looking for a measured move that would end at that potential trading range midpoint.

- The problem with both cases is we are going sideways. The more bullish it gets, they sell. The more bearish it seems, they buy.

- It’s likely we are always in short, with more stop order sells than buys recently. But there have been reasonable swings in both directions. If the bears can get another strong bear bar Monday then we might fall to that target.

- If the bulls can reverse here with an inside bar, a possible High 1 or at least a big tail on the bottom, that might convince traders we can get back to the April 29th high.

- With buyers below and sellers above it is difficult stop order trading. If the bears can get a third consecutive bear bar, that might force bulls to buy lower at the 200-day MA.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.