Market Overview: FTSE 100 Futures

FTSE 100 futures moved higher last week with a two-bar strong reversal, closing above the 20-MA. The bulls need a good follow-through bar here to convince traders it is always in long. But the bears got 3 bars in a row, so they probably need one more bar themselves. We should go sideways to up next week.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures last week was a big bull bar closing on its high, a strong reversal.

- The bar also went above the high of last week’s big bear bar but did not close above it. So, it is not as bullish as it could be.

- The bears see 3 consecutive bear bars, one big and closing on its low below the MA. But traders needed to see one more bar to conclude it would be always in short.

- It was also a bear microchannel with a micro gap between the first and third bars.

- It is a High 1 sell signal – but the reversal was so strong I would not take it here.

- The bulls see a strong bull spike, a BO of a triangle and a test back down to the apex. They expect a second leg, so its unlikely this bar is the completion.

- If you look left, you can see we are in a trading range – so who has the market control? Big sets of consecutive bull and bear bars.

- It is a disappointing environment, so traders will likely BLSHS and take quick profits.

- The bulls want a follow-through bar to get always in long and start a three-push move up to the ATH. But it probably won’t go straight up.

- The bears want a lower high for a head and shoulders reversal.

- The problem for bearsis the 200-MA which has been support for so long, it limits the downside.

- Expect sideways to up next week if the strong reversal gets follow-through.

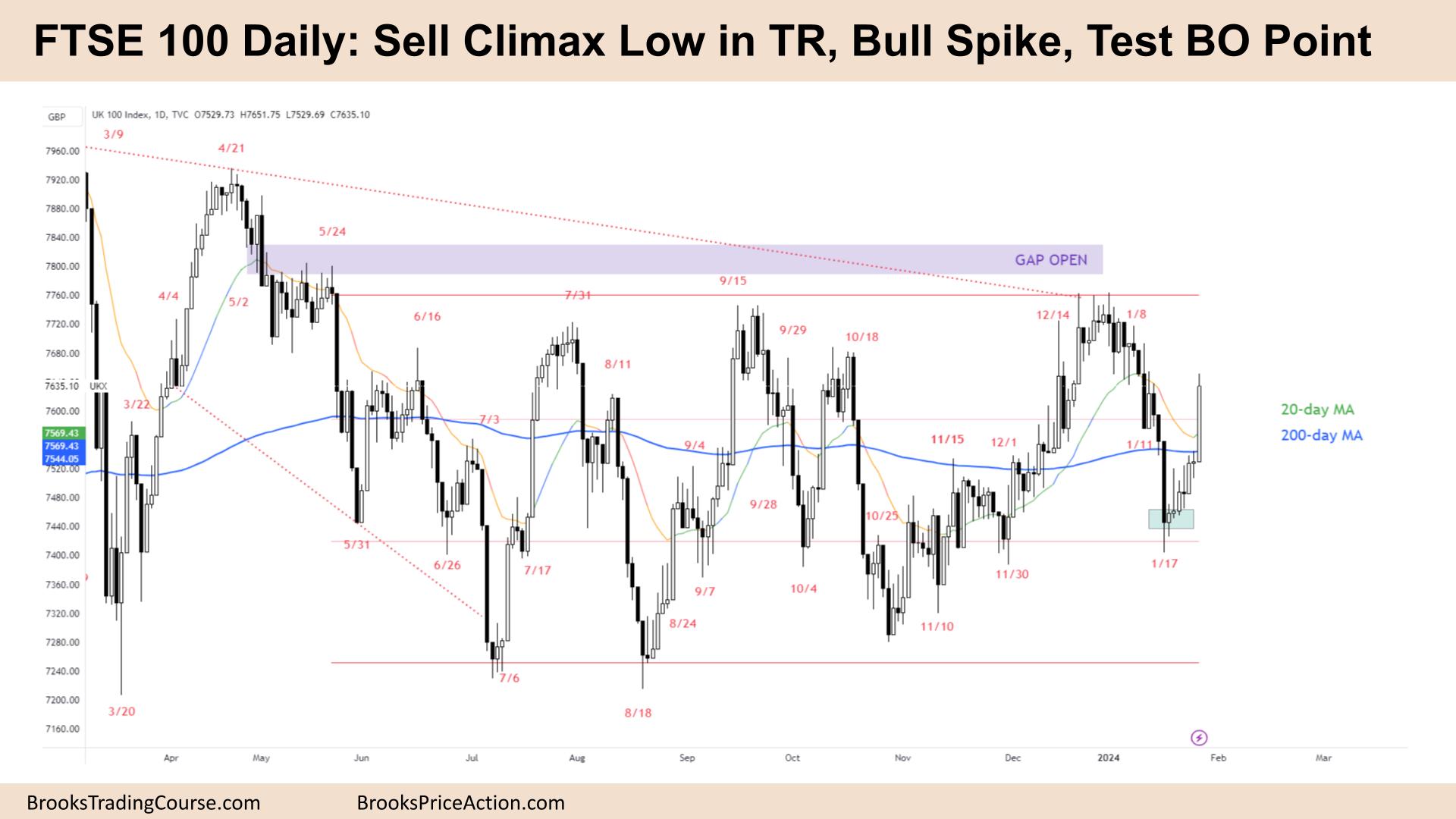

The Daily FTSE chart

- The FTSE 100 futures on Friday was a big bull bar closing near its high, so we might gap up on Monday.

- It is the seventh consecutive bar in a bull microchannel, so a spike, and will likely we followed by a channel up.

- The bulls see a break above a bull channel and now a test below it. But we were in the lower third of a trading range, which is a reasonable buy zone for the bulls.

- It was also a High 2 buy, the High 1 was the Friday before with the big tail.

- The bears see a sell climax after a strong bear spike. They wanted another leg down.

- Bears might have sold the highs of the last 2 strong bear bars – they are all trapped right now.

- But it was a deep pullback for them, after a deep pullback for the bulls – so TR price action.

- Bears see the big bear bar as a fade setup. It is climactic as is unlikely to get follow-through without a pullback.

- Thursday was a weak signal bar, so some traders might expect us to go back and test it.

- But the HTF context is good for a swing up, so if the bulls get FT, then those bears will have to panic out.

- The bulls are testing those traders who bought the MA in a bull channel and it failed. They bought lower and now can get out breakeven on their first trade and a profit on the second.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.