Market Overview: FTSE 100 Futures

FTSE 100 futures moved sideways to up last week after a slight pause above the MA. The bulls managed to get a strong spike earlier, and now it looks like we have bull follow-through. Most traders are hesitant to hold while in a triangle and BOM. I think we are in a small pullback bull trend right now.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures moved sideways to up last week with a pause, a doji bar above the MA.

- It is a bear bar, so it is a weak buy signal and a weak sell signal for next week.

- It follows a bull outside up bar closing on its high and above the MA. So some bulls see it as a swing entry up.

- Why did all the bulls not buy? Because it is high in a trading range.

- The bulls see a TR, a broad bull channel with support off of the HTF MA like the 200 MA.

- The bears see a DT wedge bear flag, a triangle and BOM.

- Because we are above the MA and we set a higher high, the probability is with the bulls for a breakout up.

- Swing bears likely had their stops hit in December. The new swing bears selling the consecutive bear bars looking for a larger leg down probably exited above the strong bull bar.

- Other limit bears will sell above the 3 consecutive bear bars – most traders should not I believe as we are in BOM, have had 5 legs and so the breakout can be fast.

- Swing bulls buy above that bull bar and hold for 2 legs up.

- Is last week disappointing?

- It was expected because the bull bar didn’t create an above-the-bear spike. If it is another bear doji next week, that would be disappointing, and some bulls might exit.

- Traders can be long or flat, we might be always in long with that entry for a swing up.

- Other traders can buy the MA if we get down there.

- Expect sideways to up next week.

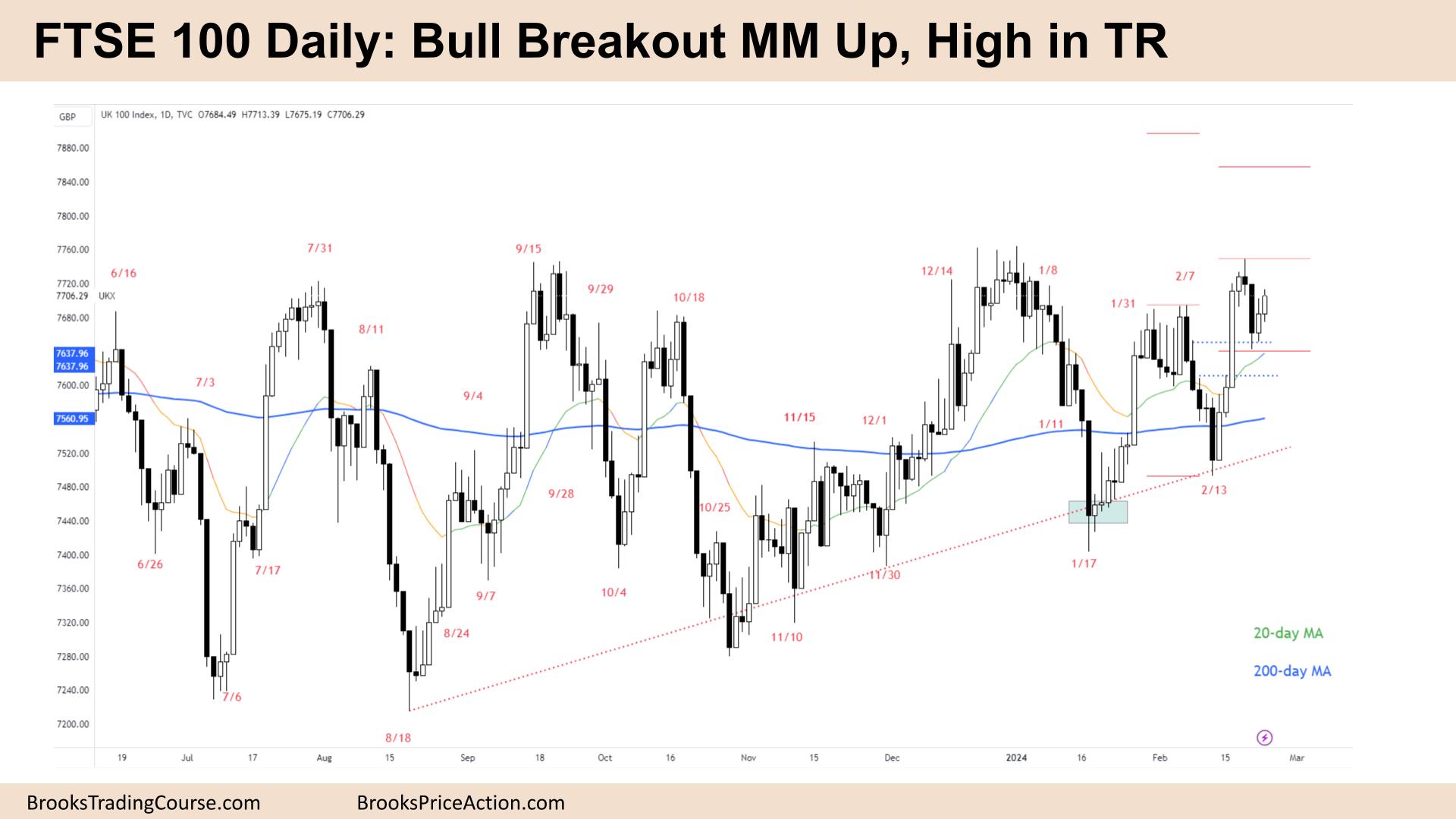

The Daily FTSE chart

- The FTSE 100 futures went up Thursday and Friday with the start of a second leg.

- The bulls saw a strong breakout above a minor high and now have a big gap.

- The bears got a surprise bar and might get one more sideways to down bar, but probably not enough to reverse the move.

- The bulls see a broad channel, an HTF trend line with higher lows. They keep breaking minor highs.

- We need to go up and test the major lower high again at 7700. It looks like it will break soon.

- The bulls want a measured move up, but it has not been easy to get strong buying above 7700.

- The bears want another trap and a strong reversal down.

- Traders should BLSHS and take quick profits in this kind of environment.

- It is a High 1 buy above Thursday. Traders will take this or a second entry buy above the MA for a swing up.

- Bulls don’t want to buy high, so they might enter with a partial position and add on if it starts working.

- Consecutive bull bars above the MA and open gaps, so likely always in long.

- Most traders expect a second leg to be similar to that bull leg just passed.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.