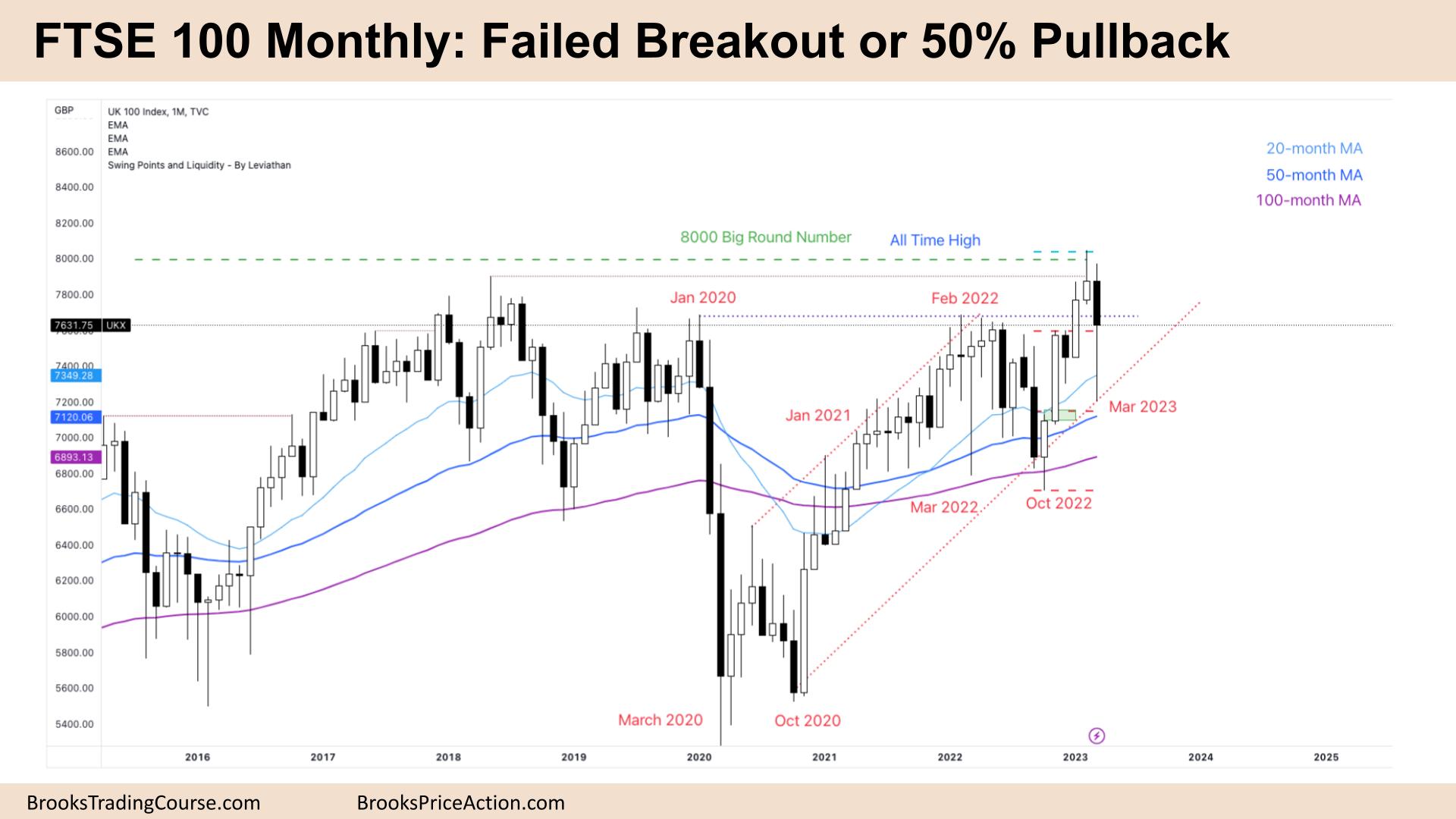

Market Overview: FTSE 100 Futures

The FTSE futures market moved lower last month with a FTSE 100 failed breakout, a bear doji bar with a big tail. It is a pullback from the bull trend, and there were buyers below the moving averages. Some traders bought the breakout early and needed to scale in to make money. Some bears were trapped below and needed to sell higher to make money. We are still on the bull swing buy from October last year, so directional probability is still up, but likely to be an inside bar next month.

FTSE 100 Futures

The Monthly FTSE chart

- The FTSE 100 futures moved down last month with a bear bar closing above its midpoint and a big tail below.

- Some computers will see the bar not as a failed breakout but as a bull bar and a sign that the bull trend is continuing.

- It is the first bar to go below the low of a prior bar in a 5-bar bull micro channel, so traders expected buyers below.

- The tail last month went all the way down to the swing buy entry point, suggesting that many bears were trapped there and got out – limit bears made money selling there and higher.

- If limit traders make money, then the bull trend is not strong.

- The bulls see a breakout above a trading range – but they needed one more bar.

- We never traded above the high of February to confirm the breakout – which suggests that a further bear bar this month in April would be a failed breakout with follow-through.

- The problem is the location – the middle of a trading range.

- The bulls see we closed above the prior breakout point – a small body gap. They want April to close above it again and a buy signal above for a move higher.

- The bears see a failed breakout of a trading range and a possible HH Double Top sell setup. They needed a small bear bar to sell below – it is unclear.

- Trading ranges often disappoint traders – here, the bulls didn’t get follow-through, and the bears didn’t get a good sell signal – trapping late buyers high and forcing weak sellers low.

- It is a bear doji bar, so it’s a bad buy or sell signal and likely sideways to up next month.

- The micro channel was tight, so traders might expect a second leg – so directional probability is still up.

- Some bears might see the whole COVID rally as three pushes up – with the February 2023 bar as the 3rd push.

- Bears might look to sell a wedge top down – but reversals would typically be 2 legs and 10 bars, which would be the remainder of the year sideways to down.

- There are not enough bear bars yet on this timeframe, so it is still likely low probability. The higher probability is sideways to up.

The Weekly FTSE chart

- The FTSE 100 futures moved back up last week with a strong bull bar closing on its high at the 20-week moving average (MA.)

- Some relieved bulls! After a strong bull channel, it was reasonable to buy at the MA – but this is why we don’t recommend beginners use limit orders – they had to sit through a huge drop.

- The correct technique was to buy small at the 20-week, more at the 100-week MA – a 50% pullback which had been acting as support for several years and scale in, getting let out of their first position breaking even and making money on the second position.

- So if limit-order bulls are making money, the bear trend is not strong.

- It was 3 pushes up, so traders expected 2 legs sideways to down – this could be the strong first or second leg.

- Bulls see a 50% pullback and a reasonable place to scale into the bull move. But many would have exited after the bear surprise.

- We are right back in the middle of the trading range where a reasonable buy and sell case exists – bulls wanting trend resumption above a bull bar – maybe 60% as a higher probability.

- The bears want a second leg down – but they need a bear bar to sell under.

- Stop-entries are difficult to find in trading ranges and often trap traders, so most traders should wait for more clarity.

- Most bulls should wait for a second reversal up and a good bull bar. Bears should exit above this month’s bar, but some will scale in higher.

- Always in bulls can enter above this week’s bar, and it might gap on Monday. But the bear surprise is likely to get at least a small second leg sideways to down so most traders should wait.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.