Market Overview: S&P 500 Emini Futures

The S&P 500 Emini futures formed an Emini wedge bull flag on the Monthly chart. On the weekly chart, it is in a pullback phase after a strong rally from October low. Odds slightly favor a retest of the October high. The bears on the other hand want a retest of the October low. If next week is a consecutive bear bar, the odds of retesting the October low increase.

S&P500 Emini futures

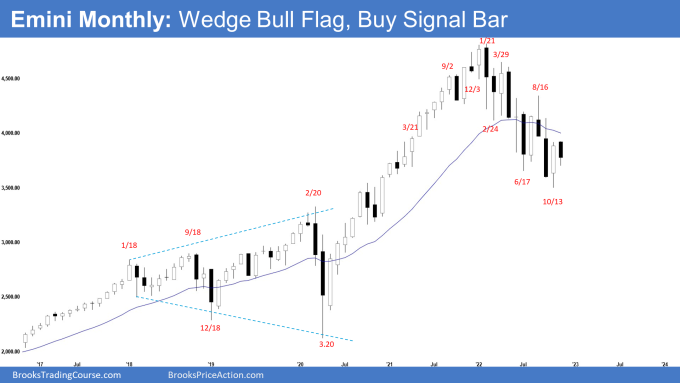

The Monthly Emini chart

- The October monthly Emini candlestick was a big bull bar closing near the high.

- Last month, we said that odds slightly favor the Emini to trade at least slightly below October low. Bears want another big bear bar closing near the low while the bulls want October to close with a bull body even though the Emini may trade slightly lower first.

- The bulls got what they wanted.

- They see the current selloff from January as a wedge bull flag (February 24, June 17 and October 13).

- They need to create a follow-through bull bar in November to increase the odds of higher prices.

- They failed to create follow-through buying following the last 2 bull bars in March and July. Will this time be different?

- The bears wanted the 3rd leg down forming a larger wedge pattern. That 3rd leg down formed in October but reversed into a bull bar.

- The move down since January has a lot of overlapping bars. The bears are not as strong as they hope to be.

- They want a continuation of the measured move down to 3450 or the 3400 Big Round Number which is also 2020 high.

- They hope that October was simply a pullback and want a second leg sideways to down, retesting October low.

- Since October was a big bull bar closing near the high, it is not a strong sell signal bar for November.

- Traders will see if the bulls can create a consecutive bull bar in November. If they do, the 2-legged sideways to up pullback may likely be underway.

- While November has traded above October high by a few points, traders may feel October high has not been sufficiently tested.

- Odds slightly favor the Emini to test October high again in the first half of November.

- However, if November reverses into an outside bear bar closing near the low, it would be a breakout below a wedge bull flag and could lead to significantly lower prices.

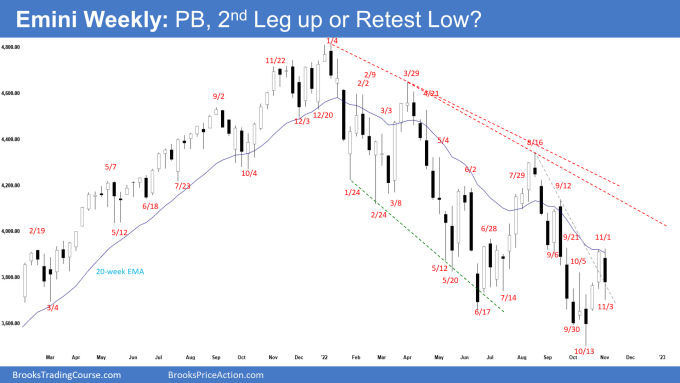

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was an outside bear bar with a long tail below closing above last week’s low.

- Last week, we said that the odds slightly favor the Emini to trade at least a little higher. Traders will see whether the bulls can get a strong bull bar closing above the 20-week exponential moving average.

- This week traded a couple of points above last week’s high but reversed into a bear bar.

- The bulls got strong follow-through bull buying recently but the Emini is stalling around the 20-week exponential moving average.

- They see this week simply as a pullback and want a second leg sideways to up from a higher low major trend reversal (Nov 3).

- They have a wedge bottom (Feb 24, June 17 and Oct 13) with a nested wedge (Sept 6, Sept 30 and Oct 13).

- The bulls need to create consecutive bull bars closing near their highs, trading far above the bear trend line and 20-week exponential moving average, to convince traders that a reversal higher may be underway.

- The problem with the bull’s case is that the recent selloff from August was very strong. The sideways to up leg may only lead to a lower high. For now, this remains true.

- However, if the bulls can create strong consecutive bull bars closing near their highs, it could signal the end of the correction.

- The bears got a tight bear channel down testing the June low. That means strong bears.

- However, they failed to get follow-through selling below the June low.

- The bears hope that the current pullback is simply forming a double top bear flag (with Sept 21 or Sept 12).

- They need to create a follow-through bear bar next week to increase the odds of retesting the October low.

- They then want a strong breakout below June low and measured move down to around 3450 or the 3400 Big Round Number which is also 2020 high.

- Since this week was a bear bar, it is a sell signal bar for next week. The long tail below makes it a weaker sell signal bar.

- The Emini is forming a small trading range around the June low between 3500 and 3900.

- Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction.

- If the retest of the October high is weak, we will likely see sellers return.

- If the bears get a strong bear bar follow-through bar, the odds of a retest of October low increase.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Anyone else think the daily looks like it is an expanding triangle?

This week was an outside bar. Outside bars are expanding triangles on a lower time frame.

It will be interesting to see if the 10/13 low becomes like the 1/24 & 5/20 lows which led to a second bottom shortly afterwards.

Dear Andrew, sorry for the late reply.. was dealing with a family matter..

Yeah.. continue to monitor and see how it plays out..

Take care over there..

Best Regards,

Andrew