Market Overview: Weekend Market Update

Traders should expect the Emini to fall to 2600 in June. However, there is a 50% chance that it will rally to the 200 day moving average and 3,000 first.

Bond futures have been in a tight trading range for 8 weeks. They should fall to the March 18 low by this summer, but they might have a test of the March high first.

The EURUSD Forex market has been in a weak bear trend for 2 years. However, it has been sideways for 4 months. The odds of a bear breakout are slightly greater than for a bull breakout.

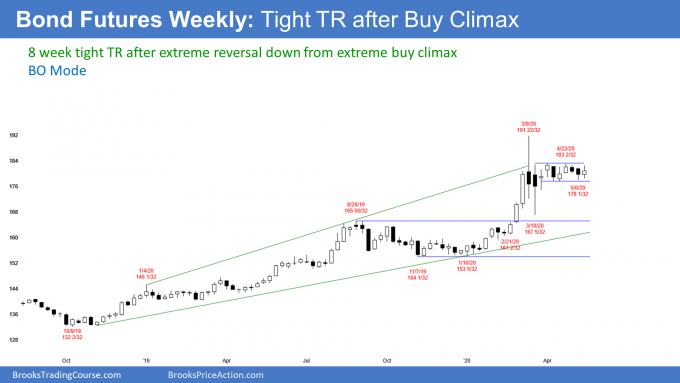

30 year Treasury bond Futures weekly chart:

Tight trading range after reversal down from extreme buy climax

The 30 year Treasury bond futures has been in a very tight trading range for 7 weeks. This is coming after a sharp reversal down from the most extreme buy climax in history.

The tight trading range represents balance and indecision. Traders are deciding if the March high will be the start of a bear trend. The alternative is the reversal down is a bull flag and the bulls will get a rally from here to a new all-time high.

A tight trading range means that the bulls and bears are equally strong

A tight trading range is a balanced market. The bond market could not be going sideways for 7 weeks if traders believed that it would ultimately break to the upside or downside.

Think about it. Let’s say everyone believed bonds were going higher. They would immediately buy because if they wait, they would have to pay more.

The reason why bonds are not going up or down is that there is no indication of the direction of the breakout. This is Breakout Mode. Traders know that there is a 50% chance of a bull breakout and a 50% chance of a bear breakout. Furthermore, they believe that there is a 50% chance that the 1st breakout up or down will fail.

Interest rates control the bond market

The problem that the bulls face is interest rates. They are preventing a further selloff because traders think that the U.S. might join many other countries and have zero interest rates. If traders become more confident that it will happen, they will buy bonds aggressively again.

Remember, interest rates move in the opposite direction of bonds. Here’s a simple explanation. If you lend someone $100 and he agrees to pay you $2 interest every year, that is 2%. But if interest rates fall to 1%, then other people selling bonds that pay $2 interest will sell them for $200. You could sell your bond for $200 because of the drop in interest rates.

Are we headed for zero interest rates?

There has been a lot of discussion about this lately. Many institutional investors are betting it will happen. President Trump has said many times that he wants it to happen. He believes it would help the stock market in the short run, which would improve his chance of re-election.

If interest rates fall to zero, many people will look for alternative investments. An obvious one is the stock market. Most stocks pay at least a small dividend. Even Apple pays a 1% dividend. That is better than zero, plus it has the advantage of an increase in the stock price over time.

America will not tolerate zero interest rates

I have been writing for months that I do not think it is possible in America. So many seniors depend on interest paying accounts. If interest rates fall to below zero, seniors have a significant reduction in the quality of their lives. This will make their families will get mad, too. They would see the government as breaking a solemn pledge to make sure that seniors can earn some passive money on their life savings.

If interest rates fell to below zero, you would pay a bank for the right to have a savings account. The value of your home would fall. And I believe the stock market would briefly rally, maybe into November, but it would fall as well.

Negative interest rates represent deflation. Everything goes down in value. Fed Chair Powell knows this and has forcefully said that he does not see it happening. He understands the risks, and he is not worried about a November election.

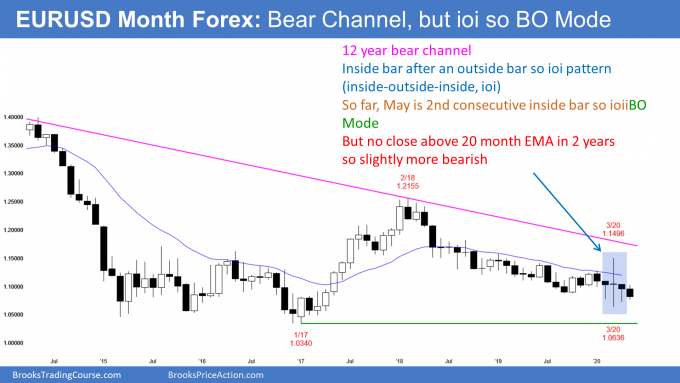

EURUSD monthly Forex chart:

Consecutive inside bars in a bear channel

The EURUSD monthly Forex chart has been in a bear channel for 2 years. It has only closed above the 20 month EMA once since April 2018. And the close was only slightly above (December 2019).

It is interesting to note that the bear trend is not strong. It has not had consecutive big bear bars since it began 2 years ago. There have been several times when it has gone sideways for months months. Most of the bars largely overlap the prior several bars. The bear channel is more of a trading range that is tilted somewhat down than a strong bear trend.

But it is still a bear trend and it has been relentless. Traders expect lower prices.

There are several targets below. The 1st is the March low. March was a huge doji bar. Even though the EURUSD rallied 900 pips off the low in just 3 weeks, it is again back near the low. So far, the reversal attempt has failed.

ioii Breakout Mode pattern

The April high is below the March high and the April low is above the March low. April is therefore an inside bar. Since March was an outside bar, February was inside March’s range. That is an ioi (inside-outside-inside) pattern. Traders see it as neutral and therefore a Breakout Mode pattern.

May so far is inside of April. Consecutive inside bars is an ii pattern, which is another breakout mode pattern. The ioi is now an ioii. But there are several weeks remaining in May. It could break below the April low before the end of the month and trigger the ioi sell signal. Less likely, it could break above the April high and trigger the ioi buy signal.

Most breakout mode patterns are neutral. There is a 50% chance of either a bull or bear breakout. Furthermore, there is a 50% chance that the 1st breakout up or down will reverse.

The Breakout Mode pattern is slightly bearish

The current pattern in the EURUSD is not neutral. May is the 5th consecutive bear bar and all of the closes in the ioi (now, ioii) are below the moving average. Additionally, the EURUSD has been in a bear trend for 2 years. That means that there is a 55% chance of a successful bear breakout and a 45% chance of a bull breakout.

Why not 60%? If it was that certain, the EURUSD would already be breaking out. Why wait to sell if you believe that waiting has a 60% chance that you will have to sell at a worse price?

Targets below

If the bears trigger the monthly sell signal, the 1st target is the March low. Remember, the EURUSD reversed up violently from that price so it is important support.

If the EURUSD breaks below, it will probably test the next support. That is the January 2017 low. That was the start of a 2,000 pip, yearlong bull trend.

If the monthly chart closes below that low, the EURUSD will probably continue down to par (1.0).

What about a bull breakout? There are 5 consecutive bear bars and the chart is in a bear trend. Consequently, it is unlikely that the EURUSD will rally strongly from here. It would probably have to go sideways for a few bars (months) and form some bull bodies.

Traders want signs of buying pressure, like bars closing near their highs and far above the EMA. Without that, the upside is limited over the next several months.

Covid-19 pandemic

The U.S. now has about 1.5 million diagnosed cases of Covid-19 infections. But there are actually at least 10 million Americans currently infected. Why am I disagreeing with the widely covered Johns Hopkins University website? I am not. I think their experts agree with my number.

The reason why they use their number instead of mine is because theirs is the only one that can be determined with certainty. They are using the number of reported confirmed cases in the US, not the actual number of infected people, which is impossible to know.

But they also say that only about 1% of infected people die. While it will be a couple years before we know the precise percentage who die, it will probably be between 0.5 – 2%.

That means for every death, it is reasonable to assume that there are 100 infected people. This is true even if only a small fraction of the infected people actually get tested and diagnosed.

Remember, the White House has said that it does not like widespread testing. They have been clear that their concern is that it would lead to a far greater number of diagnosed cases. Voters would see that as a reflection of how well the White House has handled the crisis. A bigger number would hurt its chances in November.

The purpose of politicians is to help the politicians, not the people

Most people erroneously assume that the goal of elected officials is to serve the people and do what is in the best interest of the country. That is naive and is not in the Constitution or in any state constitution.

The law is simple. It says that the person who gets the most votes wins. Therefore, the way our system works is that a politician’s primary job is to get re-elected by any lawful means of his choice. Some will do things that others will not, and that can help them win.

Many will say, “I would rather not win if I have to do something that I find morally offensive.” The candidate who understands that the primary job of any elected official is to get re-elected gets to be called “Mr. President,” “Senator,” or “Congressman.” The candidate who doesn’t understand the Constitution ends up being called “Professor.” If whatever a candidate does results in more people voting for him than for his opponent, the Constitutions says he gets to hold office.

If enough people feel that putting the economy ahead of saving lives is the right choice, Trump will win. If more say that lives are more important, he will lose.

It’s easy to get angry if you agree with one side and the other wins. But both approaches are acceptable under the Constitution and the losing side is stuck with the result. The voters get to decide.

Trump found himself in an uncomfortable situation

President Trump’s initial instincts in January and February were good. Ignore the pandemic because he would upset his base if he did what was necessary to stop it. His base is anti-government. To stop the pandemic, he would have had to do what China, South Korea, and Taiwan did. They took strong control of everyone’s lives. It is a very effective strategy, but Trump’s base would never agree to that much government interference with their personal choices.

His problem was that many of his science and intelligence people were telling him what I have been saying from the beginning. Coronavirus was going to infect half the country and kill a million people unless he did what China and Taiwan were doing.

Trump had to wait for his base to decide

His base listened to the experts for a couple months and then decided that the recommendations were unreasonable. It took that long for them to coalesce around an opinion. They were unwilling to follow the medical advice when there was no guarantee that there would ever be a vaccine. They concluded that it was better to risk getting infected than have the economy die.

Trump was torn. Stick with his base or follow the experts. After a couple months of hearing the public clamor for him to listen to the experts, he began to take some of their advice. He could not take all of it without angering his base. Unfortunately, taking only half of it was no better than taking none. Both results in half the country getting infected.

He concluded that he has to do what his base wants if he is to get re-elected. They want to return to the lives they had before the pandemic, even at the risk of dying. The result is that half the country will get infected, a million people will die, and several million people will have permanent lung and kidney damage. But we live in a democracy and if enough people want that choice, that is what we get. Fair enough.

Trump is now at peace

President Trump came to understand this a few weeks ago and he has decided to do what his base wants. Re-open the country, tell people to be careful, accept whatever deaths result, and then insist that many more would have died if he did not do all that he did. At the same time, be very respectful of Drs. Fauci and Birx. Claim to be doing what they are recommending, but actually ignore them and push ahead in opening the economy.

Politicians have to make tough decisions and it often takes months for them to become comfortable with a strategy. Trump is there now. Half the country would prefer that he chose Taiwan’s approach, but that half did not vote for him. He made a rational decision, given that half the country would be mad about whichever choice he selected.

My minimum expectation since February is still 500,000 U.S. deaths

Data from Johns Hopkins shows that the U.S. will have around 100,000 U.S. deaths by the end of May. With a death rate of 1%, that means there must be 100,000 x 100 = 10 million infected people in the U.S. If the actual death rate is 0.5%, then there are now 20 million infected Americans. With about 2,000 deaths a day, there are 200,000 more infected people every day. I still believe that 100 – 200 million Americans will get infected.

Since each infected person infects 2 – 3 additional people during the 2 weeks they are contagious, this number will grow… and grow and grow. The growth will continue until there is a vaccine.

If the vaccine comes in January, that is more than 200 days away. If 2,000 people die a day, there will be 400,000 more deaths before there is a vaccine, putting the total at 500,000.

That has been my minimum expectation since my weekend report of February 29 when there was only one American who died from the coronavirus. I still believe that 500,000 to 2 million Americans will die in this pandemic.

Even after there is a vaccine, millions more Americans will get infected because maybe only 50 – 70% will get vaccinated and that will take many months. Why isn’t the media reporting this? They are continuing to under-report and miss the story.

Everyone knows that all governments lie

It is to any government’s advantage to minimize the number of deaths attributed to any problem they are trying to fight. This is true for a war, a hurricane, an earthquake, or a pandemic.

Notice that I said “attributed to.” That means that many governments around the world lie about the true number of deaths. This is especially true of dictatorships and authoritarian regimes where they control the information and the press.

The U.S. cannot lie about the actual number because the medical community is constantly releasing the updated data. And the press will report it as it comes out.

Intentionally misleading forecasts

All along the way, our government has continued to use forecasts that extend out only a month or two. It then tries to mislead the public into assuming that the forecast is for the final count once the pandemic has ended. That is not the case. Americans will continue to die from Covid-19 at least until the end of 2021, even if there is a vaccine in January.

The government sees us as frogs in a pot of water. They are slowly turning up the heat so we won’t jump out of the pot. They are slowly turning up the projections so that we will not be outraged by the 500,000 – 2 million deaths that will be the result of our disastrous response to the crisis.

We have no interest in being the world’s leader in the pandemic

Americans 1st reaction to any problem is that we should always be the world’s leader in everything. We should at least be comparable to Germany, Taiwan, South Korea, and many other nations. But after a few months, a large number of Americans have concluded that we should essentially let the virus go. This is true even though it will result in a percentage of deaths comparable to that in developing nations. We have chosen the economy over life.

As I have been saying, I do not see leadership coming from either political party in Washington. When a problem is as big as this is, everyone in Washington should be doing so much more.

The number dead will surpass the total number of dead in every war and every national disaster since the founding of our country. Do the politicians care? Maybe, but clearly not enough.

Their lack of decisive action shows that they accept that the number of dead Americans will be huge. They accept it because they sense that is what the majority of Americans have resigned themselves to this outcome. Also, big numbers are all the same. Politicians understand one of the tenants of Stalinism, which says, “When one dies, it’s a tragedy. When a million die, it’s a statistic.”

So why is the stock market rallying if 20% of the country is unemployed?

The pandemic will lead to unemployment comparable to the Great Depression that started in 1929. The stock market fell almost 90% from its peak in the 1930’s. Why is the market rallying so strongly now when the unemployment and GDP now is the worst since the Great Depression?

One reason is that we now have a great Fed. They are very smart, bold people who have learned from the past. The Fed Governors have said that they will effectively create infinite dollars to prevent the destruction of the economy. Investors see that as the Fed putting a floor under the market.

I think everyone is getting this wrong. The market is down only 10 – 20%. But I wrote several weeks ago that the Fed’s floor will be around 50-60% down from the high. There have been many selloffs in that range since the Depression and we completely recovered each time. I therefore think that the Fed’s real floor will be about 50 – 60% down from the high. The market is up in part simply because investors believe there is a floor somewhere.

We live in a country with a relatively free market. The Fed wants it to stay that way. They therefore will not intervene as quickly as many investors hope.

Traders who are buying at the current price think they are buying just above the Fed’s floor. They are not. The floor is far below and these traders will discover that the support that they expected is not where they assumed it will be.

The rally is technical

So why is the market rallying so strongly? There is obviously the euphoria that the pandemic is not going to be as bad as the bubonic plague in Europe in the 1300’s. Also, institutions love what the Fed is doing.

These are both necessary for the rally, but the sine qua non is the technical pattern on the daily, weekly, and monthly charts. It is easiest to see on the daily chart.

The selloff on the daily chart was a Spike and Parabolic wedge bear channel. That channel began with the pullback to the March 3 high.

When there is a reversal up from a Spike and Channel sell climax, no matter how strong the selloff is, the rally typically tests to around the start of the channel. The market is simply repeating a behavior that he has done thousands of times on all time-frames. It is no more complicated than that. Experienced chart readers know that, and they are trading with that expectation.

The stock market probably would not be able to do it as strongly as it has without the good news about the pandemic and the Fed. However, I have talked about this many times over the past 2 months. That technical pattern is simply unfolding as it usually does.

The market is now near the March 3 high. Traders should soon expect a test back down, and then a trading range. That range will be a continuation of the 2 1/2 year trading range and it will probably last all year.

Monthly S&P500 Emini futures chart:

High 1 bull flag, but 2 1/2 year trading range

The monthly S&P500 Emini futures chart formed a big bull inside bar closing on its in April. This is after a 2 bar pullback in February and March. May is currently also an inside bar. If May remains within April’s range, there will be an ii (inside-inside) Breakout Mode pattern.

April is a High 1 bull flag buy signal bar in a 12 year bull trend. If a trader only looks at the monthly chart, he sees a good buy setup. Traders want to know what is above the April high.

The bulls know that the 2 big bear bars make a 2nd leg sideways to down likely. However, April was such a strong reversal, traders know that the odds favor at least a little follow-through buying in May.

The bulls want to trigger the buy signal. There is enough room above the April high and below the February high for them to make a reasonable profit. They therefore have bought both 3 day pullbacks in May, even though this week’s selloff was strong.

Where will the bears sell?

What about the bears? They would like to prevent the buy signal from triggering. Therefore, they sold this week just below the April high. If they can keep May within the April’s range and have May close near its low, May could be the start of the 2nd leg down from the high.

Will the bears sell just above the April high? They might because there is resistance on the daily chart just above the April high at the 200 day moving average.

More likely, if they are unable to stop the buy signal from triggering, many will buy back their shorts. That would probably lead to at least several days of higher prices. The rally would probably go about 50 points above the April high before the bears will try again to get their 2nd leg down.

Weekly S&P500 Emini futures chart:

2nd reversal at the 20 week EMA

The weekly S&P500 Emini futures chart reversed down from the 20 week EMA 2 weeks ago. At the time, I said that the reversal would probably last only 2 – 3 weeks because it was coming after a 6 bar bull micro channel.

That is a sign of very aggressive bulls. For 6 weeks, they bought above the low of the prior week. The pullback was mostly sideways and it lasted only 2 weeks.

The bulls triggered a High 1 buy signal this week by going above last week’s high. However, it immediately sold off. The Emini then traded below last week’s low after reversing down from above last week’s high. This week therefore was an outside down week.

There are now consecutive reversals down from the 20 week EMA. But the week closed in the middle of its range. The bears were unable to get the week to close below last week’s low and at the low of the week. This week therefore was neutral.

Is the 6 week bull trend resuming?

Traders are still deciding if the rally up from the V bottom will continue higher or reverse down from the 20 week EMA. It might take a few more weeks to become clear.

If next week goes above last week’s high, but then reverses down, there would be a 6 week micro wedge top. That could lead to a reversal down for several weeks.

The rally has been exceptionally strong. A tight bull channel does not typically immediately reverse into a bear trend. Consequently, even if the bears get a selloff to below 2600 in May or June, the bulls will buy it. They expect at least a small 2nd leg up after a very strong rally.

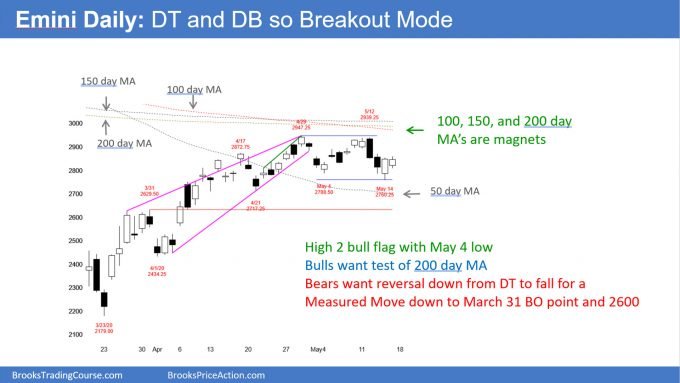

Daily S&P500 Emini futures chart:

Is the 200 day moving average a strong enough magnet?

The daily S&P500 Emini futures chart reversed down from a wedge top on April 29. But the 6 week bull channel was tight. That made the 1st leg down likely to be minor.

The Emini rallied back to the April high this week. When there is a wedge top and the bull channel is tight, there is a 50% chance of a rally to above the wedge before there is a bear trend. The bulls tried early this week and failed. They have been trying again on Thursday and Friday.

The bears want the 2 day rally to reverse down from below the May high. There would then be a 2nd lower high. That would increase the talk of a possible early bear trend.

Even though the daily chart has been sideways for a month, traders know that it is overbought. They expect a 10 – 20% pullback to begin in May or June. Traders are deciding if it has already begun or if there will be one more leg up first.

Legs in trading ranges usually go beyond major support and resistance

Support and resistance are magnets. Like all magnets, when you get near, the magnetic force increases. It is hard to avoid getting pulled to the magnet.

The 200 day moving average is widely followed by institutional traders. It therefore is an important magnet. The Emini was nearby on Tuesday. It might have been near enough so that it cannot go down without first testing at least a little above it.

But to go above it, the Emini would also have to rally above the April high. That is the top of the wedge. Theoretically, the bears will get stopped out above that high.

Some bears will exit, but others will be looking to sell around the 200 day moving average. They are betting that the March reversal will not make a new all-time high without at least a 50% pullback first. They currently have a 70% chance of being right.

The March parabolic wedge sell climax began on March 3

A strong break above the March high will lead to a test of the March 3rd high. That was the start of the March parabolic wedge selloff.

I have been saying since the March low that the March 3rd high was a potential target. The Emini is close enough so that it will probably get near it at some point this year. What we do not yet know is if the current rally will continue up there or if there will be a reversal down to 2600 1st.

The importance of 2600

The bulls are hoping that the reversal up from the V bottom will be like last year’s bull reversal and lead to a new high this year. They have only a 30% chance after the 35% selloff. Therefore, traders expect a pullback before then.

If there is a deep pullback, traders will conclude that the April rally was a bull leg in the 2 1/2 year trading range. Trading ranges typically disappoint traders hoping that a leg will grow into a trend. The legs up and down usually go beyond important support and resistance before reversing.

For example, if the rally breaks above the 200 day moving average this month, there will probably be a reversal down. That would disappoint the bulls.

The March 31 high is an important breakout point

The Emini broke strongly above the March 31 high in April. The April 21 pullback did not overlap the breakout point. There is a gap between the March 31 high and the April 21 low. That is a sign of strong bulls.

But I believe that the rally is really just a bull leg in a trading range. If so, there should be a reversal down that closes that gap and disappoints the bulls.

That March 31 high is 2629.50. If the Emini falls below it, the selloff will probably test the next nearby support. That is the 2600 Big Round Number.

To get there, the Emini would have to fall below 2706.00. Why is that important? Because it is 20% down from the all-time high. If the Emini drops below it, the news will be that despite the huge rally, the Emini was back in bear market territory.

The coming week

The Emini has been sideways for a month. Traders know that they will not get a new high this year. But they do not know where this current rally will end. It might have ended with the April wedge top. However, if there is another leg up, it will probably fail around the 200 day moving average and the 3,000 Big Round Number.

The month-long trading range means that the bulls and bears are balanced. There is a 50% chance of one more leg up to the 200 day moving average before a move down to 2600. There is also a 50% chance that the move is already underway.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Great read on Corona – Appreciate your politically neutral analysis.

Thanks Al, your medical past and experience makes a better read than a NYTimes post. I look forward to the weekly posts.

Hi Al,

Thanks for a great website and video course!

If you think the Emini will be going mostly sideways for the next decade then where do you think long term investors agreeing with you will place their money?

I think the world’s economy will be stagnant for the decade. That is good for traders who will get repeated swings up and down, but bad for investors, who want to buy and then have their asset worth more in 5 – 10 years.

If I were investing (buying and planning to hold for 5 – 10 years), I would choose stocks over any other asset class. However, I would be looking to buy 20 – 50% below the high, in the bottom half of the 2 1/2 year range.

I do not think it is optimal to buy now because so many good stocks are near their highs and they will probably be 20 – 30% cheaper at some point in the next year.

I wrote about this strategy many times over the past year. Since 20 – 50% pullbacks will be probably be the norm for the next decade, I think it is better for investors to wait for one and then buy. They will be many chances.

Great advice, thank you!

Hi Al,

Thanks for your weekly review!

I am curious to know do you think are we going to see a second leg down below this year’s low in the coming months or year?

I am looking at your encyclopedia and one slide shows monthly Dow Jones chart from 1986-1991. The index crashed 21% and then rallied without a second leg. Do you have any idea why there was no second leg? Or was it just a probability that usually we will have second leg but that wasn’t the case after 1986 crash?

I have written many times that I think we would have a couple 40 – 60% selloffs in the 2020s and that we would be mostly sideways for the decade. We have been sideways for 2 1/2 years. The 35% selloff might have been the 1st one, but I doubt it will be the last or the biggest.

Over the past 3 months, I have said that there would be a strong V bottom reversal, but that it would have only a 30% chance of making a new high without about a 50% pullback. That is still true, and that pullback might be underway. But there is a 50% chance that the Emini will 1st test the 200 day MA and 3,000 before there is a pullback to 2600.

My wife is a patriotic, optimistic American. Her mother grew up in a mansion in the Berkshires with a butler and chauffeur. However, with the great depression came the margin calls and the family’s wealth disappeared within days. My wife’s mother, twice widowed, nevertheless managed to bring up 4 children on a Campfire secretary’s salary and got them all through college; the son even earned a Harvard PhD. Throughout all the market iterations and despite her bad childhood memories, my mother-in-law consistently invested in individual stocks – she had a wonderful down-to-earth New England attitude. When she died in 2004 we inherited a sizable stock portfolio that we have grown over the years.

My wife’s family history is in stark contrast to my own. My dad grew up dirt poor, but worked hard as a tool and die maker after WW II, advancing through the ranks, and eventually heading a mechanical design company with 800 workers. His advice to his children was simple: 1) education is everything, 2) never carry debt, 3) save 20% of your income each month, and 4) always keep a year’s net salary in cash. He died of a heart attack in 1989 and my brother and I eventually inherited two debt-free houses and a decent amount of cash.

Last week, when I read in Barron’s that more than half of the US households have no savings at all (for incomes over $150K the percentage is still 25%) I had to think of my dad’s warning “be self-reliant and don’t become a basket case of your government”.

Yes, my heart goes out to the grossly obese single mother who expresses her frustration on prime time TV about not having received the stimulus check, while three overweight children are seen nibbling on chips in the background. Over the past several years I have jokingly sampled my class students about their personal finances and I have consistently discovered that quite a few have car loans and more than half carry credit card debt.

Does capitalism require intelligent people to survive this virus-induced hard reset? Probably not, since multiple stimulus programs will socialized our financial incompetence. And when the single mother eventually gets her government stimulus check, perhaps she will buy the double bottom that Al predicts the market will print around 2600. After all, the probability is 50%.

Excellent post. Thank you. (Could be a great movie!). Yes, I do wonder what will happen and where it will all end.

Message for Dr. Brooks,

My wife and I have enjoyed your trading room greatly.. For far too many months we have had our house for sale with lackluster results.. But, we are taking an offer and moving to a better climate First week in June.. I may not become your best student, but I will be earnest.. I’ve learned a great many lies in this business, but from you I see truth worth trading on.. We’ll be back in the room soon, and for the duration..

Thank You for what you do..

Gary & Joy

I love your weekend posts, they are so much a good read – not saying I agree with everything you write however.

In my view we will have close to zero or even zero interest rates for the long term. They cannot raise rates – they have too much borrowing and debt and it would therefore be impossible for the US Gov to raise rates. How on earth could they raise rates?!! Like it or not, that’s clear as day to me.

So yes, pensioners are going to suffer massive falls in their pension values.

I cannot see a way out of this financial mess until there is a global reset of some kind. We cannot just keep printing ad infinitum and supporting the markets by printing on and on and on. The Fed are stuck between a rock and a hard place with no way out.

Regarding Covid, some interesting latest research done by testing a small town by scientists in Germany indicates the death rate of Covid is actually coming in at around 0.3 – 0.1%. It makes sense.There are many more cases of infection in the population than we know of, thus lowering the actual death rate percentage. Also remember, this is not as scary as some would like us to believe – well, depending where you live.

Nearly all who die are overweight or have existing health problems – and it’s only a small percentage of those who do die too. The vast majority of people however will either not even know they had Covid, or will experience anything from mild symptoms to a very bad flu. I am afraid to say the statistics in the States might be a bit worse, because quite frankly, there is a large part of the population who are very overweight and many have pre-existing health conditions – just look at the number of drugs sold!

I think the future will highlight some very interesting facts about how this whole thing is being played out – including exposing some vested interests in all of this.

We live in interesting times.

I agree. And this has been a missed opportunity to graphically remind people that their lifestyle choices (eating habits, exercise etc..) are amongst their best protection. I have seen little media coverage of this).