Market Overview: S&P 500 Emini Futures

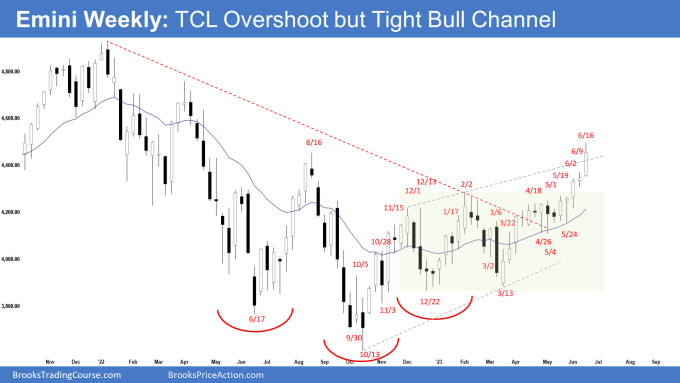

The S&P 500 Emini futures traded higher and formed a TCL Overshoot (trend channel line). The bulls want a strong breakout above the August high and a measured move up to around the March 2022 high area. The bears want a failed breakout above the August high and at least a pullback following the trend channel line overshoot.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a big bull bar closing in the upper half with a prominent tail above.

- Last week, we said that while the odds slightly favor the market to still be in the sideways to up phase, a minor pullback can begin at any moment.

- This week traded above the August high but did not close above it.

- The bulls got a strong leg up creating the wedge pattern with the first two legs being December 13 and February 2.

- The move up is in a tight bull channel and a 4-bar bull microchannel. That means strong bulls.

- They want a breakout far above the August high followed by a measured move using the height of the 6-month trading range which will take them to the March 2022 high area.

- They will need to create follow-through buying trading far above the August high.

- If there is a pullback, they want at least a small second leg sideways to up retesting the current leg extreme (June 16).

- The bears want a reversal down from a wedge pattern (Dec 13, Feb 2, and Jun 16) and a double top with the August high.

- They hope to get a failed breakout above the August high. If there is a failed breakout, it would usually occur within 5 bars after the breakout.

- They want at least a small pullback from the TCL Overshoot (trend channel line).

- The problem with the bear’s case is that they have not been able to create credible selling pressure since the March low.

- They will need to create strong bear bars with follow-through selling to convince traders that a deeper pullback could be underway.

- At the very least, the bears will need a strong reversal bar or a micro double top before they would be willing to sell more aggressively.

- Since this week was a bull bar closing in its upper half, it is a buy signal bar for next week, albeit weaker because of the prominent tail above. It is not a strong sell signal bar.

- While the odds continue to slightly favor the market to still be in the sideways to up phase, a minor pullback can begin at any moment.

- Traders will see if the bulls can continue creating consecutive bull bars or will the Emini stall around the August high and begin the pullback phase.

The Daily S&P 500 Emini chart

- The Emini traded higher for the week. Friday opened higher but reversed to close as a bear bar near its low.

- Previously, we said that the odds continue to slightly favor sideways to up. This can change if the bears manage to create strong consecutive bear bars closing near their lows.

- This week continued the move up and broke above the trend channel line.

- The bulls want a measured move up using the height of the 6-month trading range which will take them near the March 2022 high.

- They will need to break far above the August high with follow-through buying to increase the odds of reaching the measured move target.

- The move up since May 24 low is in a tight bull channel which means strong bulls.

- However, the move up is also slightly climactic and has the shape of a parabolic wedge (May 30, Jun 5, and Jun 16).

- Thursday’s big bull bar late in a trend could be a sign of climactic price action.

- A minor pullback can begin at any moment. If there is a pullback, a reasonable target would be the 20-day exponential moving average area.

- Traders will still expect at least a small leg to retest the current leg extreme high (Jun 16).

- The bears have not yet been able to create credible selling pressure.

- They see the move up from October 2022 simply as forming a large wedge (Dec 13, Feb 2, and Jun 16) within a broad bear channel.

- The longer they fail to create the trend resumption lower (the more candlesticks in between) from the selloff from January – October 2022 to now, the less relevant the effects of the prior move down would have on the current price action.

- The bears want a failed breakout above the August high and a reversal from a trend channel line overshoot.

- They will need to create follow-through selling early next week to increase the odds of a deeper pullback.

- Because of the lack of strong bear bars with follow-through selling, odds continue to slightly favor sideways to up.

- However, the move up is also climactic and a minor pullback can begin at any moment.

- The market is closed on Monday for Juneteenth National Independence Day.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Hi Andrew, thanks for the report.

It is mentioned that last week did not close above the August high, but on my E-mini chart, the market did close above. It looks like the charts in the report are set to adjust for contract changes – is that the case? Many thanks.

Charts will vary due to adjustments and also using only RTH data or having overnight prices included.

Dear Harold and Andrew,

A good day to you..

Yes, that was the explanation given by Tradestation when I asked previously..

If you use the symbol SPX and Spy on Tradingview for example, I know all of them have traded and closed above August high..

The symbol for the Emini on Tradestation is @es.d

Wishing a good week to both of you..

Best Regards,

Andrew

I am curious why Brooks et al uses contract adjusted /es charts ? When SPY and SPX for example have far surpassed aug high, the /es with contract adjusted has not. Thus we have two different analyses. I could be wrong (wedges double tops etc), but doesn’t the levels of SPY / SPX trump /es? How do you personally reconcile differences.

Thanks Andrew, a reasonable pullback to the daily 20EMA coincides also with the BO Point at the February High, a chance for the Bears to get out Breakeven at their failed Double Top.

Dear Sybren,

A good day to you.. yeah both are around the same areas..

Thanks for going through the report.. have a blessed week ahead..

Best Regards,

Andrew