Market Overview: S&P 500 Emini Futures

The S&P 500 Emini futures bulls got a strong follow-through bull bar following last week’s High 2 buy entry. Since this week closed near its high, odds slightly favor the Emini to trade at least a little higher. If the bulls continue to create strong consecutive bull bars closing near their highs, it could signal the end of the correction.

The bears hope that the current pullback is simply forming a double top bear flag (with Sept 21 or Sept 12).

S&P500 Emini futures

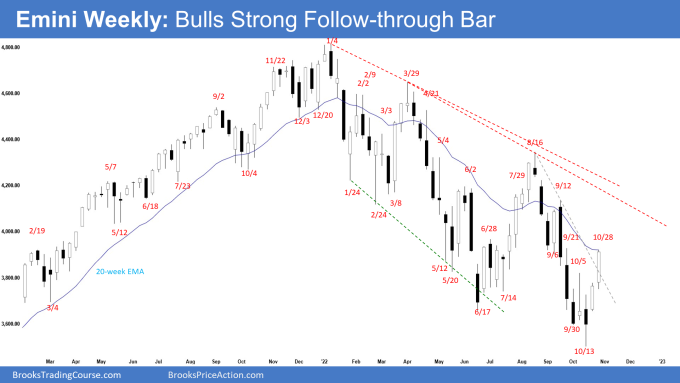

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a strong follow-through bull bar closing near its high.

- Last week, we said that the odds slightly favor the Emini to trade at least higher. The Emini is forming a small trading range around the June low between 3500 and 3800. Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction.

- The bulls got a strong follow-through bull bar following last week’s High 2 entry and a strong breakout above 3800.

- They want a reversal higher from a lower low major trend reversal with the June low and a wedge bottom (Feb 24, June 17 and Oct 13) with a nested wedge (Sept 6, Sept 30 and Oct 13).

- The bulls need to create consecutive bull bars closing near their highs, trading far above the bear trend line and 20-week exponential moving average, to convince traders that a reversal higher may be underway.

- The problem with the bull’s case is that the recent selloff was very strong. The sideways to up leg may only lead to a lower high. For now, this remains true.

- However, if the bulls continue to create strong consecutive bull bars closing near their highs, it could signal the end of the correction.

- The bears got a tight bear channel down testing the June low. That means strong bears.

- The bears failed to get follow-through selling below the June low.

- The bears hope that the current pullback is simply forming a double top bear flag (with Sept 21 or Sept 12).

- They want next week to close with a bear body even though the Emini may trade slightly higher first.

- They want a retest of the October low.

- The bears want a strong breakout below June low and measured move down to around 3450 or the big round number 3400 which is also 2020 high.

- Since this week was a bull bar closing near the high, it is a buy signal bar for next week. The Emini may gap up on Monday, but small gaps usually close early.

- Traders will see whether the bulls can get a strong bull bar closing above the 20-week exponential moving average

- For now, odds slightly favor the Emini to trade at least a little higher.

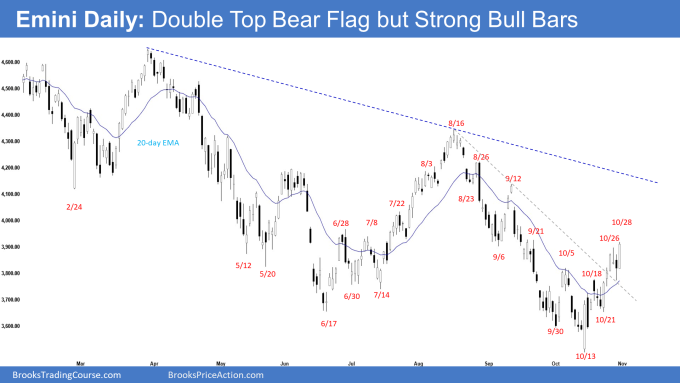

The Daily S&P 500 Emini chart

- The Emini broke above the OO (outside-outside) pattern on Monday with follow-through buying breaking above 3800 on Tuesday.

- Wednesday and Thursday pulled back slightly followed by a strong rally on Friday.

- Last week, we said that odds favor at least slightly higher prices and traders will see if the bulls can break far above 3800 and the bear trend line with consecutive bull bars closing near their highs.

- The bulls broke above the bear trend line and 3800 this week and got some follow-through buying.

- Bulls see the strong selloff from August simply as a sell vacuum testing June low within a trading range.

- They want a reversal higher from a lower low major trend reversal with the June low and a wedge bull flag (Feb 24, June 17 and Oct 13). They also have a nested wedge (Sept 6, Sept 30 and Oct 13).

- They got the second leg sideways to up, testing September 21 high from the higher low major trend reversal setup (Oct 21). The Emini also broke above the minor bear trend line with follow-through buying this week.

- The problem with the bull’s case is that the selloff from August 16 was very strong. Sideways to up pullbacks may only lead to a lower high. For now, this remains true.

- However, if the bulls start creating consecutive bull bars closing near their highs (strong spike up), odds will swing in favor of higher prices.

- The bears want a strong breakout below the June low followed by a measured move down to 3450 or slightly lower around the 3400 big round number which is also the 2020 high.

- They see the current move as a developing wedge bear flag (Oct 18, Oct 26 and Oct 28) and want a reversal lower from a double top bear flag (with Sept 21 or Sept 12 high). They want a re-test of the October low.

- The bears see the selloff from January as a broad bear channel. If the Emini trades higher, the bears want a reversal from a lower high or around the major bear trend line.

- Since Friday was a bull bar closing near the high, it is a buy signal bar for Monday. The Emini may gap up on Monday, but small gaps usually close early.

- Odds favor at least slightly higher prices next week.

- Traders will see if the bulls can create strong consecutive bull bars closing near their highs or fail to do so.

Trading room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

It looks like everything is in contingent of the rate hike on Wednesday. If it’s 75p then bear will take this and run back down to October 13. If it’s less then we will rocket to 4000.

I guess I’ll wait for the announcement before buying calls and puts.

Dear Huey,

Good day to you.. thanks for your comments..

Have a great week ahead!

Best Regards,

AA

Yall dont do the morning premarket reports anymore? it has been awhile since ive seen one

Hey Thomas,

Just saw Brad has started the daily report this week again.

Best Regards,

AA

Thanks Andrew for another great report. Monday is the last trading day for the month and if monthly bar will close around where it is as of now, it will be the 1st decent buy signal bar from the correction started by he beginning of the year.

Dear Eli,

A good day to you..

Yeah agreed.. it will be a buy signal bar for Tuesday.. A gap up would be good for the bulls..

Best wishes and be well!

Best Regards,

AA

Great analysis again Andrew, let’s see how the market will digest FOMC’ interest rate announcement this Wednesday. If 75 points have been mostly priced in, AND November’s midterm elections usually favor market hopes, higher prices might elevate and extended.

Don’t forget this week’s clock change to winter season (Europe today, US next week). All best and have a great weekend!

FWIW, CME FedWatch has dropped the probability of a 3/4 point hike from 95% on October 21st to 81.3% on Friday. Still pretty high but the change may be part of what’s giving equity bulls some hope.

Dear Sybren and Andrew,

A good day to both of you.

Thanks for the reminder of the time change.

Yeah, interesting week ahead!

Let’s see how the market plays out.

Be well, to both of you..

Best Regards,

AA