Market Overview: S&P 500 Emini Futures

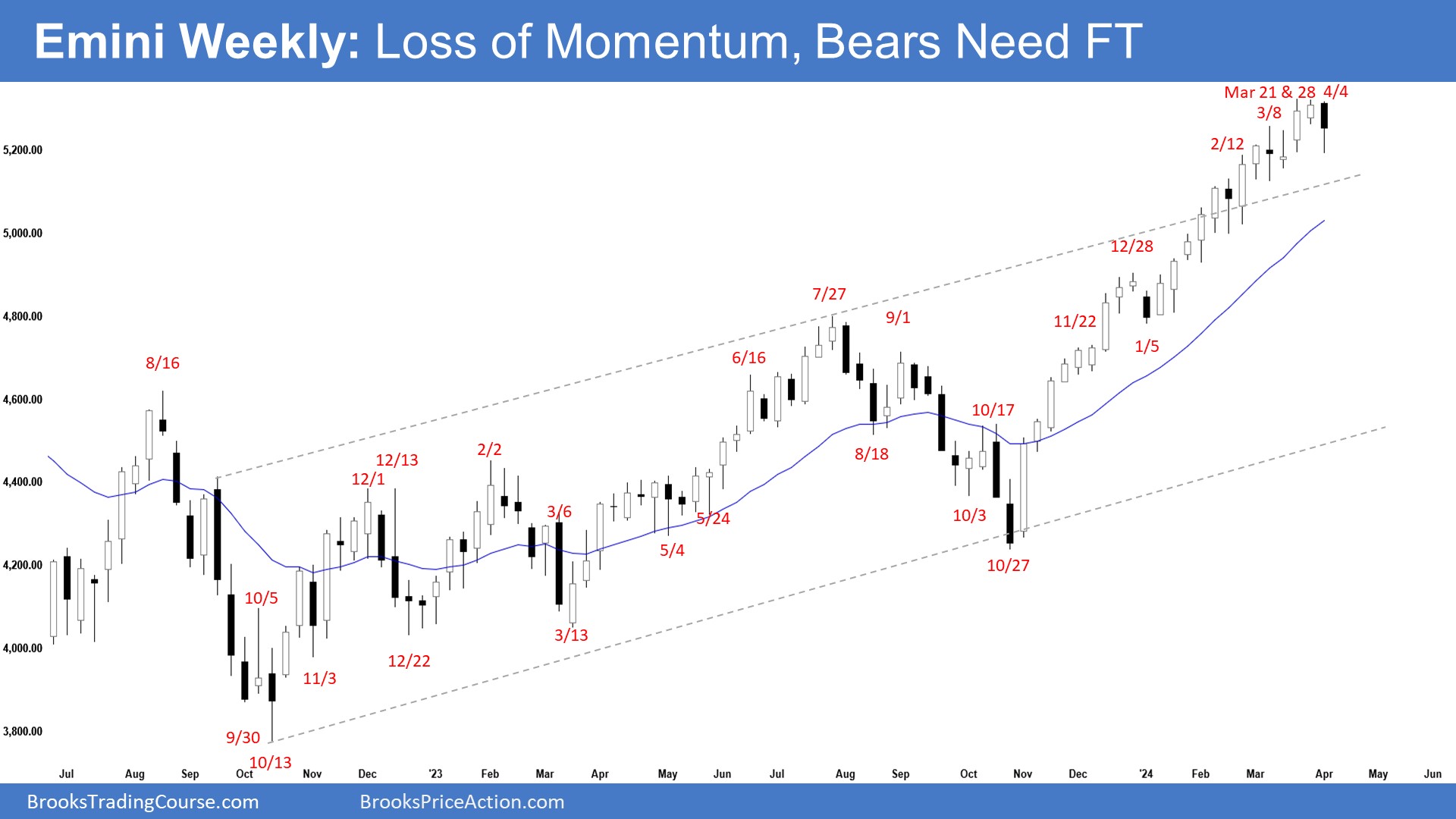

The weekly chart indicates a loss of momentum since February with the Emini overlapping price action. Traders will see if the bears can create follow-through selling following this week’s bear bar. If a pullback begins, the bulls want it to be sideways and shallow, filled with bull bars, doji(s) and overlapping candlesticks.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a bear bar with a long tail below, closing around the middle of the candlestick and below last week’s low.

- Last week, we said that the market having more overlapping price action since February is an indication of a loss of momentum. However, until the bears can create strong bear bars, traders will not be willing to sell aggressively.

- The bulls have a strong rally in the form of a tight bull channel.

- They hope that the rally will lead to months of sideways to up trading after a pullback.

- The trend remains strong with not much selling pressure or follow-through selling yet.

- Because of the climactic nature of the move, a pullback can begin at any moment.

- If a pullback begins, the bulls want it to be sideways and shallow, filled with bull bars, doji(s) and overlapping candlesticks.

- The bears want a reversal from a higher high major trend reversal and a large wedge pattern (Feb 2, July 27, and Mar 28).

- They see a parabolic wedge in the third leg up since October (Dec 28, Feb 12, and Mar 21), an embedded wedge (Feb 12, Mar 8, and Mar 21) and a micro wedge top (Mar 21, Mar 29 and Apr 4).

- The bears hope that the sideways tight trading range (the ioi pattern) will be the final flag of the rally.

- They hope to get a TBTL (Ten Bars, Two Legs) pullback of at least 5-to-10%. They want at least a test of the 20-week EMA.

- The problem with the bear’s case is that they have not been able to create any meaningful selling pressure or follow-through selling.

- Since this week’s candlestick had a bear body, traders will see if the bears can create follow-through selling.

- If they manage to create follow-through selling, especially if it is strong, it could lead to the start of the minor pullback phase.

- The bears need to create a few strong consecutive bear bars to indicate that they are at least temporarily back in control.

- Since this week’s candlestick is a bear bar closing slightly below the middle of its range, it is a sell signal bar for next week albeit weaker (bear body).

- The market continues to be Always In Long.

- However, the rally has lasted a long time and is slightly climactic. Traders are looking for signs of profit taking but there are no obvious signs still.

- The market having more overlapping price action since February is an indication of a loss of momentum.

- Until the bears can create strong consecutive bear bars, traders will not be willing to sell aggressively.

- Traders will see if the bears can create decent follow-through selling next week. If they do, it could lead to the start of a two-legged pullback lasting at least a few weeks.

- However, once traders see a few strong bear bars, the pullback could be halfway over.

The Daily S&P 500 Emini chart

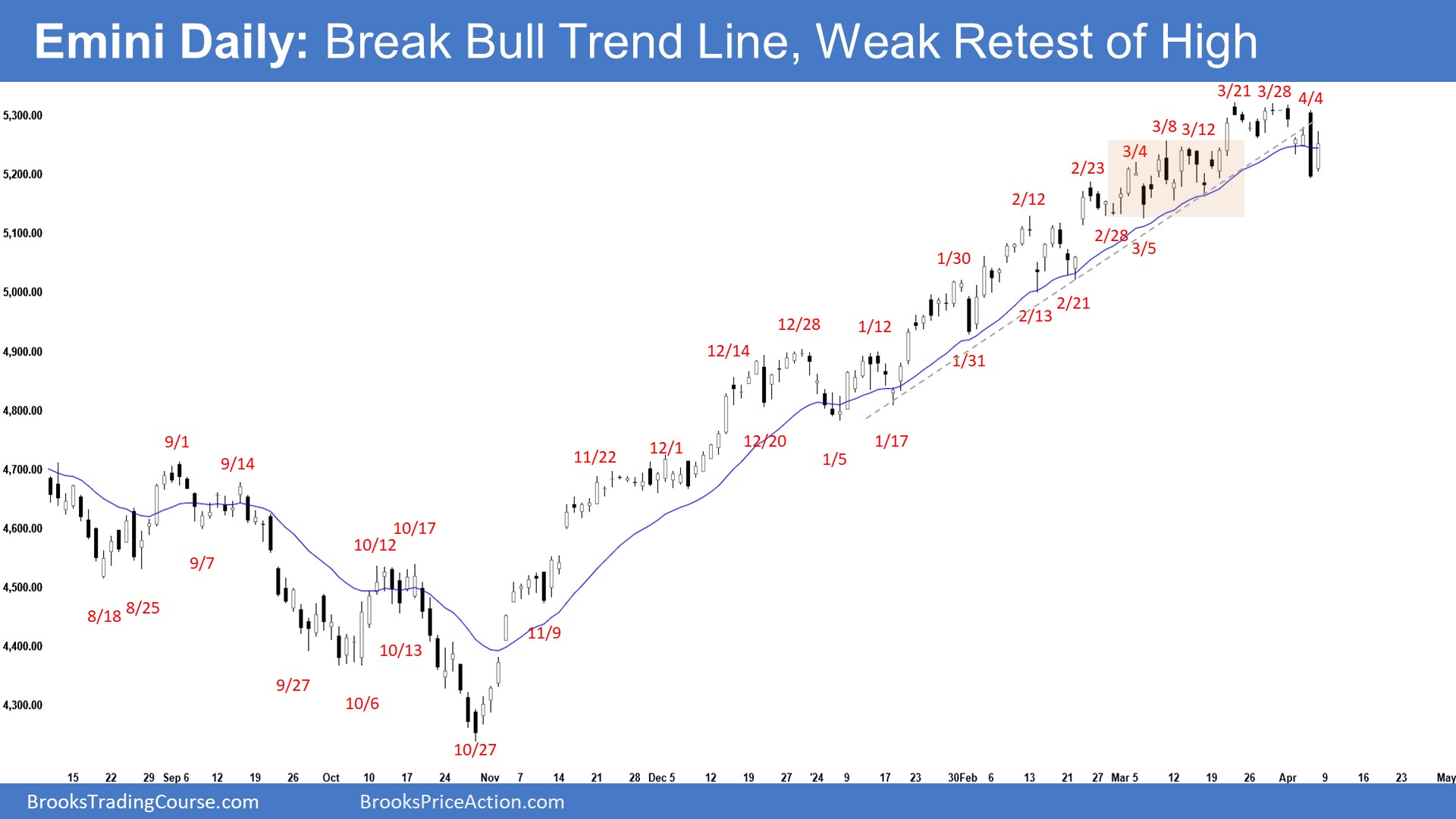

- The market traded lower earlier in the week testing the 20-day EMA. Thursday gapped higher but reversed into a big outside bear bar closing below the 20-day EMA. Friday was an inside bull bar, forming an ioi (inside-outside-inside) breakout mode pattern.

- Previously, we said that the market is still Always In Long. The rally has lasted a long time and is slightly climactic but there are no signs of strong selling pressure yet.

- This week broke below the 20-day EMA followed by a weak retest of the recent high (on Thursday which reversed into a big outside bear bar).

- The bulls got a tight bull channel making new all-time highs.

- They hope that the current rally will form a spike and channel which will last for many months after a deeper pullback.

- They got 3 pushes up since the January low, therefore a wedge (Feb 12, Mar 8, and March 21).

- The third leg up (since Feb 21 low) consists of 3 pushes (Mar 4, Mar 8, and Mar 21) therefore an embedded wedge. They also see a micro wedge in the last 2 weeks (Mar 21, Mar 28 and Apr 4).

- The risk of a profit-taking event is elevated. However, bears have not yet been able to create any meaningful selling pressure with follow-through selling.

- If there is a deeper pullback, the bulls want at least a small sideways to up leg to retest the current trend extreme high (now March 21).

- The bears want a reversal from a higher high major trend reversal, a large wedge pattern (Feb 2, July 27, and Mar 31) and a parabolic wedge (Dec 28, Feb 12, and Mar 31).

- They also see an embedded wedge in the current leg up (Mar 4, Mar 8, and Mar 21) and a micro wedge top (Mar 21 and Mar 29).

- They hope that the recent sideways tight trading range (in the first half of March) will be the final flag of the rally.

- The bears will need to create consecutive bear bars closing near their lows and trading far below the 20-day EMA and the bear trend line to indicate that they are at least temporarily back in control.

- The problem with the bear’s case is that they have not yet been able to create strong selling pressure (consecutive bear bars closing near their lows).

- The big outside bear bar this week also lacked follow-through selling. Until they can create sustained follow-through selling, traders will not be willing to sell aggressively.

- Traders will see if the bears can create a breakout from the ioi (inside-outside-inside) next week with follow-through selling.

- So far, the breakout above the tight trading range (in the first half of March) has been disappointing with poor follow-through buying.

- However, the selling pressure remains weak still (no strong consecutive bear bars breaking below the 20-day EMA).

- For now, the market is still Always In Long.

- The market formed an ioi (inside-outside-inside) pattern. The bulls want a breakout above, while the bears want a breakout below the ioi pattern. The first breakout can fail 50% of the time.

- The rally has lasted a long time and is slightly climactic. Traders are looking for signs of profit taking but there are no obvious signs yet.

- The bears need to create sustained follow-through selling trading far below the 20-day EMA to show that they are at least temporarily back in control.

- They have not yet been able to do so. While this may change soon, until there is a breakout, there is no breakout.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Hi Andrew thanks once again for another great analysis.

Could we also note that the first touch on the 20EMA on the daily after 20 or more bars could set us up for a retest of the top of the CH (double top with 4/1) and then maybe sell off from there?

Dear Pedro,

A good day to you.

You’re referring to the 20-day gap bar setup right?

Yes, it actually did. The Thursday big gap up day, which reversed into a big outside bar was a retest of the prior high.

Remember, the retest can be lower, higher or the same. In this case, it was a lower high.

A retest which was a lower high, and reversed into a big outside bear bar (and no follow-through buying) does tell us something.. that traders are less willing to buy as compared with a couple of week ago..

Let’s see how this play out.

Have a blessed week ahead!

Best Regards,

Andrew