Market Overview: Weekend Market Update

The Emini reversed up from an extreme parabolic wedge sell climax. The 1st leg up of the short covering rally could last several weeks. In a few months, it might reach 2,800 – 3,000. Traders should expect a trading range for a couple months and probably all year.

The bond futures market has begun a trading range after a strong reversal down from an extreme buy climax.

The EURUSD Forex market has a weak expanding triangle bottom. It will probably work a little higher, but then settle into a trading range.

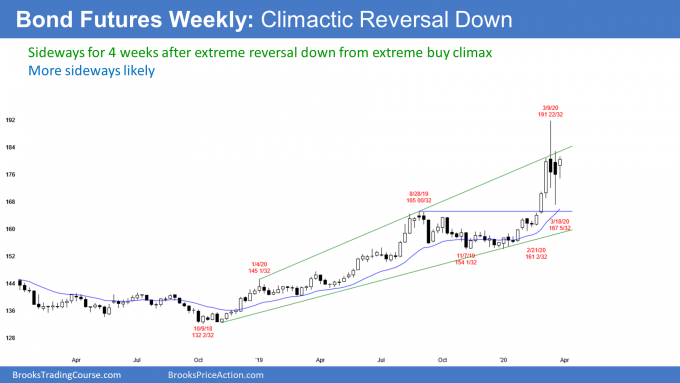

30 year Treasury bond Futures market:

Trading range after extreme buy climax

The 30 year Treasury bond futures this week traded within last week’s range. It was an inside bar. In a bull trend, that is both a buy and sell signal bar. It followed a huge reversal down from the most extreme buy climax in history.

A big move up followed by a big move down creates big confusion. A trader who is confused is confident about only one thing. That is that the market is not clearly trending up or down.

Consequently, the trader is unwilling to hold onto a long when the market is near recent highs. He is also unwilling to hold onto a short position when the market is near recent lows.

He is looking to take quick profits. That means he only wants to buy low and sell high. This creates a trading range. The weekly chart has been sideways for 4 weeks.

Expect at least a couple legs sideways to down after a buy climax

After a routine buy climax, traders expect a couple legs sideways to down for about 10 bars. On the weekly chart, that means 2 – 3 months.

When the buy climax is the most extreme in history, the trading range will probably last longer and be taller. The bottom of the range will probably be around 155 – 160. That was the bottom of a 4 month trading range last year. Traders will assume that buyers will buy again at that level.

The reversal down from the March high was extremely fast and far. Traders will expect sellers around that level again. Consequently, the trading range will probably be from around 160 to 190.

Is a trend likely soon?

Can the 3 week pullback just be another bull flag? Unlikely. When a reversal down is as strong as this one has been, there is a 70% chance of at least a small 2nd leg down.

Can the pullback continue down and grow into a bear trend? That is also unlikely. The bull channel up from the December low was very tight. When a bull trend is that strong, the 1st reversal down is typically minor. A minor reversal means that it is either a bull flag or a bear leg in what will become a trading range.

Since there will probably be at least one more leg down, these 3 weeks have formed a weak bull flag. There will probably be more sellers than buyers above because traders expect at least as small 2nd leg sideways to down.

The midpoint of March’s range is a magnet on the monthly

There are 2 trading days left in March. The bond futures contract is in the middle of March’s very big range.

March will probably not close near its high or low. That makes the 179 14/32 midpoint important. It is more symbolic. The bulls want the month to close above the midpoint. They can then claim that they won the month. The bears want the month to close below the midpoint.

However, a close a little above or below the midpoint is much less important than the climactic reversal down from an extreme buy climax. Traders should expect the bond futures to be sideways for at least a couple months. They will look for reversals up and down every week or two.

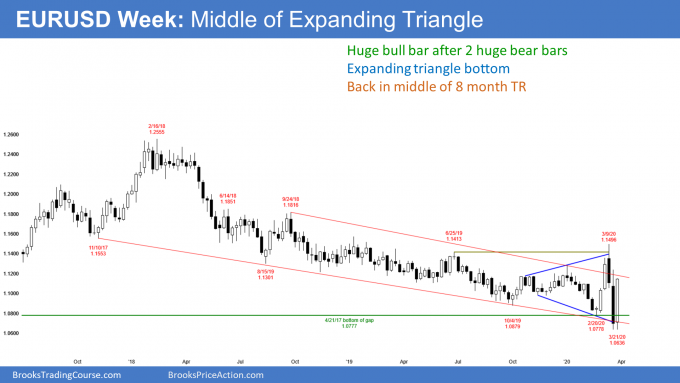

EURUSD weekly Forex chart:

Expanding triangle bottom but minor reversal up

The EURUSD weekly Forex chart rallied strongly this week. It formed a big bull reversal candlestick this week. It is a buy signal bar for next week. Traders see the past 8 month trading range as an expanding triangle. That is a type of major trend reversal.

A good looking major trend reversal has a 40% chance of leading to an actual reversal up into a bull trend. After an extremely strong selloff like this one, until there is also a double bottom, there is only a 30% chance of this growing into a bull trend.

Prior to this week, there was a 2 week collapse after a strong rally to above the 18 month bear trend line. That trend line is the top of the bear channel in the 2 year bear trend. This week reversed up after breaking below the bottom of the bear channel.

Minor reversal up for a couple weeks

While the bulls want as strong a reversal up as the reversal down was, that is unlikely. When there is a reversal up after a reversal down, it typically is minor. Traders usually want to see at least a small double bottom before they believe that a bull trend might be starting.

Therefore, as bullish as this week was, the context is not great. Context means the bars to the left. The bulls might be able to continue the reversal up for another couple weeks. However, it is unlikely to reach the March high without first testing the March low.

How high up can it go? A common target for a minor reversal up is the 50% retracement. This rally is already above that resistance. Less likely, the rally will reach the March high before testing the March low.

Can the bear trend fall down to par (1.00)?

No matter how strong any rally has been for 2 years, it was always followed by a new low. This is a bear channel. Even though the early March rally was by far the strongest in the 2 year bear trend, the bears still turned the EURUSD down to a new low.

Traders are therefore looking at the next lower support levels. The first is the January 2017 low at the bottom of the strong 2017 rally. As long as the current 2 year bear trend holds above that low, traders will wonder if the 2 year selloff is just a protracted pullback from that bull trend. That means it is still a possible bull flag.

But if the EURUSD falls below that low, it will no longer be a possible bottom of the bear trend that began in 2008. They will then look at the next lower support. That is 1.00 (par).

Isn’t the U.S. creating inflation by printing dollars?

It is easy to argue that the EURUSD collapsed in March due to a flight to safety in U.S. markets. That means dollars. And then the EURUSD reversed up sharply this week when the Fed basically said that the U.S. would print “infinite dollars” to protect the economy.

I never pay attention to that because it is impossible to know why the institutions are buying or selling. All I know is that there was a strong break below an 8 month range and a strong reversal up. I also know that the 1st reversal up from a collapse usually will be followed by a test down. That is all that matters.

I want to go back to discredit the teleological arguments. Think about it. If the U.S. begins to print infinite dollars and it rescues the economy, what will the EU do? It will print infinite Euros. China and Japan will also print infinite money.

All of this cancels out. I don’t want to try to figure out who is doing more because it will not make me richer. The charts say this bounce has a little more to go and then there will be a test down.

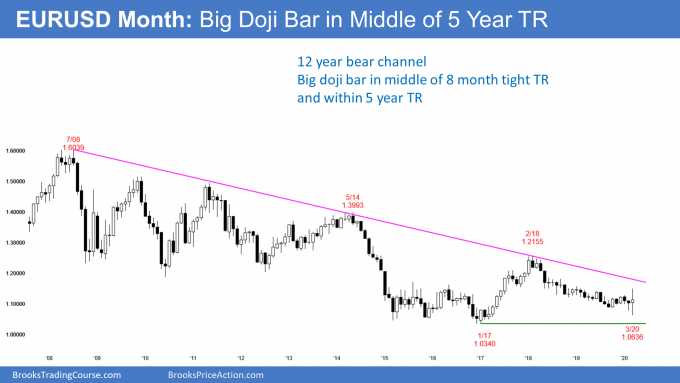

Buyers below the 2017 low on the monthly chart

There are 2 trading days left in March. March reversed down from above the February high and up from below the February low. It is therefore on outside down bar.

However, it is now in the middle of the March candlestick. It is a huge doji candlestick. That means it is neutral. Traders therefore do not expect a big move up or down in April.

Whenever a market falls below major support like the 2017 low, the breakout has a 50% chance of succeeding. Success means having at least a couple legs down, often to a measured move.

The 2 year trading range is more than 2,000 pips tall. Given how the 12 year selloff can still be a bull flag on the monthly chart, there is only be a 40% chance of a measured move down. There is a 60% chance that a break below the 2017 low will reverse up within a few month.

If it did, there would be an expanding triangle bottom, beginning with the March 2015 low. Furthermore, there would be a wedge bull flag where the 1st 2 lows are November 2005 low and the January 2017 low.

Each bar on the monthly chart is one month. It could take more than a year for the EURUSD to fall below the 2017 low and then clearly reverse up.

Coronavirus is still unstoppable

Traders accept that the coronavirus will be with us for about a year. The stock market crash was a rapid repricing of assets due to the damage being caused by the coronavirus pandemic.

Traders are wondering if the Emini is now fairly priced in light of the great reduction in corporate earnings over until there is a vaccine. It still might be overbought, given the change in fundamentals. No one knows.

However, the Emini has already sold off more than in most bear markets. That is reason enough for traders to suspect that it has fallen enough, at least for a few months.

What happens if the worst case scenario unfolds and half of the country gets infected? Traders are certainly aware of that possibility, and it might already be fully priced in. It is too early to tell. We need more information. It will probably take a few months for traders to decide if the current low is low enough.

It probably is not since the final low once a bear market begins typically comes a year after the start of the bear market. That means there are usually one or more strong rallies before the final leg down.

Also, this trading range will probably last for a decade and make at least a couple new lows after the media declares that the low is in.

Some medical news about the coronavirus

As you know, I am an MD. I also have some subspecialty experience in eye viral infections. I therefore have a special interest in this pandemic.

When a drug company creates a vaccine or any drug, it has to pass 3 phases of testing before the FDA will give its approval. Dr. Fauci this week said that the government might be willing to provide financial guarantees to get a drug released sooner.

He said that the U.S. government might pay for a company, if it has a vaccine that passes phase II, to produce huge quantities of the vaccine at the end of phase II, in case phase III is successful. Then, the public could get vaccinated immediately after phase III, assuming the drug gets approved. That would save several months and thousands of lives.

It’s all about the ventilators

We are entering into a frightening phase in the pandemic. Many hospitals and states will probably run out of ventilators over the next month. The sudden surge in deaths will probably be shocking enough to further depress the economy.

However, the rate of increase in new infections will probably begin to turn down in May. That should improve consumer confidence until a 2nd wave starts in the fall.

Doctors have been warning about the shortage of ventilators. The U.S. has 60,00 of them, plus 100,000 older ones in storage. Currently, 5 – 15% of patients need them. Therefore, if the number of infections gets above 1 – 2 million, there will not be enough ventilators. At the current doubling rate, that could happen by the end of April. I am still hoping that the rate of new infections will slow down soon, but there is no evidence of a slowdown yet.

Italy had a terrible ventilator shortage this month and the death rate went from 2% to 9%. If millions of Americans get sick, most who need ventilators will not get them and the number of deaths will be frightening.

A ventilator pumps air into a person’s lungs. There is talk about having a splitter in the line and connecting 2 patients to one ventilator. In normal times, that would be unthinkable. But if a patient needs one and has a 50% chance of death without it, most family members would eagerly consent to having him share it with another patient. It is not as if he is going to contract a coronavirus infection from the other person.

Monthly S&P500 Emini futures chart:

Bulls trying to hold above monthly bull trend line

The monthly S&P500 Emini futures chart in March formed the biggest bar in the history of the stock market. It broke below the December 2018 low, which was the bottom of the 2 year trading range.

However, it bounced strongly this past week. The bulls are trying to minimize the damage when the month ends on Tuesday. Their their first goal is to have March close above that December 2018 low. The Emini therefore would still be in its 2 year trading range.

A more important goal is to have the Emini close back above the bottom of the 11 year bull trend line. That line is around 2610.

There is a small chance that the March might even close above 2706. That is 20% down from the February 19 all-time high. If the bulls can get the Emini back above that line, it would no longer be in a bear trend.

Has the bear trend ended?

No. The past 2 months were surprisingly big bear bars. When there is a bear surprise, there typically will be at least a small 2nd leg down. A surprise means that traders were not expecting it. That means there are many bulls who failed to exit. They are hoping for a rally that will allow them to sell with a smaller loss. That means there is supply above.

Also, there are bears unwilling to sell too low, but eager to sell a bounce. They, too, want a rally to sell.

With both bulls and bears hoping to sell a rally, there should be at least a small 2nd leg sideways to down. However, the sell climax was extreme. Therefore, the rally could be surprisingly big as well.

For example it might even reach the March 3 high on the daily chart. That was the 1st pullback after the initial collapse. It was therefore the start of the parabolic wedge bear channel. That is always a magnet for a rally in a bear trend.

More likely, the rally will stall around the 3,000 Big Round Number, which is around several highs in 2018 and 2019.

Can April continue to crash down?

After 2 big bear bars, there is an increased chance of a 3rd bear bar, but there are several factors that reduce the chance of a 3rd huge bear bar. The obvious one is that the Emini is at the bottom of its 2 year trading range. Trading ranges resist breaking out.

Also, the average bear market falls about 30%. The selloff in the Emini was almost 35%. It is already more than average. In most bear markets, it takes about a year to get there. Since the Emini got there so quickly, traders think that it is overdone near-term.

President Trump took office on January 20, 2017. The Emini tested below the open of that day several times this week. The selloff therefore briefly erased all of the gains of his presidency. However, it reversed up violently. Traders now see that price as strong support.

The Fed will protect the economy

The most important reason why April will probably not crash is that the Fed is determined to prevent more damage to the economy. Neel Kaskari is the president of the Federal Reserve Bank of Minneapolis and he was on 60 Minutes last week. He made it clear that the Fed would print “infinite” dollars to save the economy.

That is giving institutions the confidence that they need to buy again. In addition, Congress’s rescue plan is important. The government’s actions should be enough to prevent much lower prices in April. Since the Emini is holding important support, it will probably be sideways to up for at least a month.

But, this damage is ongoing and will take a long time to heal. Furthermore, there are underlying problems with the economy. How do I know? The huge buy climax in 2017 was the most extreme in history. The bulls will need years to recover. This will probably result in a trading range for a decade. Any rally will probably only be a bull leg in that 10 year trading range.

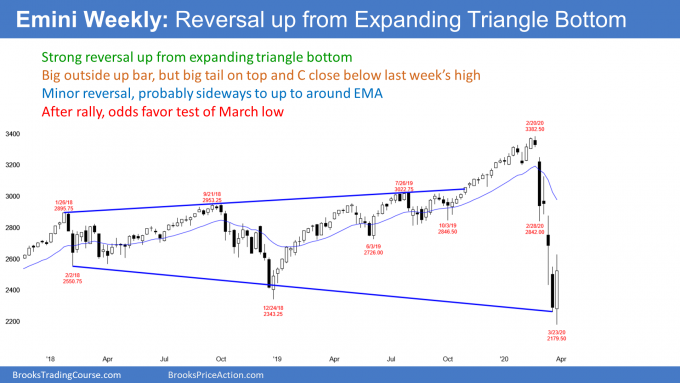

Weekly S&P500 Emini futures chart:

Expanding triangle bottom and short covering rally in April

The weekly S&P500 Emini futures chart traded below last week’s low and then above its high. This week is therefore an outside up candlestick. The bulls see it as a failed breakout below the December 2018 bottom of the 2 year trading range.

Expanding triangle bottom

This week is now a buy signal bar for an expanding triangle bottom. The 1st 2 lows are the February and December 2018 lows. An expanding triangle bottom often leads to a bull trend and a break above the top of the triangle. That is the February all-time high.

However, this reversal up is coming after an exceptionally strong selloff. It is more likely that the 1st rally will have a hard time getting much above the middle of the triangle. That is around 2800 – 3000. Many bulls who bought this week will take profits there. The bulls who bought higher will sell since they recovered half of their losses. The bears will begin to look to sell there, expecting a test of the March low. Therefore, the reversal will probably be minor. Traders should understand that it is more likely to lead to a trading range or a bear flag than to a bull trend.

Daily S&P500 Emini futures chart:

Reversing up from a parabolic wedge sell climax

The daily S&P500 Emini futures chart reversed up strongly this week. It broke above the month-long bear trend line. The Emini is no longer in a Small Pullback Bear Trend. However, it is still in a bear trend… and it is now additionally in a bull trend! And that means it is also in a trading range!!

How can that be? If this rally turns down and there is a new low, traders will say that the rally was just a pullback in the bear trend. If the Emini continues up to a new high, they will say that the bull trend began this week.

Since both are reasonable possibilities, the Emini is currently both in a bear trend and in a bull trend. That is confusing, and it also means that it is in a trading range.

Confusion means traders want more information

When there is a trading range, traders want more information before deciding on the direction over the next few months. They usually need a lot of bars before they will have a strong opinion.

A lot of bars could mean several months. If that is true, there will be legs up and down. Furthermore, there will be both buy and sell setups in the range. For example, most trading ranges have both a double top and a double bottom.

For traders starting out, this is an annoying concept. How can the market be in both a bull and a bear trend at the same time? However, experienced traders know that this is common after a big move. Sometimes, the direction is simply not clear. This is one of those times.

Bear markets usually last about a year

Traders are wondering if this reversal up will be like the January 2019 V bottom. Bear trends end with V bottoms only about 20% of the time. Therefore, even if there is a strong rally for a few months, it will probably not continue up to the old high.

If the rally is in a Small Pullback Bull Trend in April and May, more and more people will claim that it is a repeat of the January 2019 bottom. But there is an 80% chance that they will be wrong.

When a selloff is as strong as this one has been, the first reversal up is typically minor. This is true even if it goes straight up for a couple months.

A minor rally means that traders should expect the rally to reverse down and test the bear low. At the moment, that is the March low. If there is a 2nd reversal up from around that low, the probability of a reversal up into a bull trend would be greater. Traders would look at that buy signal as a major trend reversal.

The end of a bear market does not mean the start of a bull market. The Emini will probably be sideways for a decade. That means no bull or bear market. But there will be trends up and down within that range, and some will last 1 – 3 years

How high will the Emini go?

It is important to remember that a good major trend reversal setup has only a 40% chance of actually leading to a new trend. Therefore, a trading range is likely for the next several months. It could last all year. The Emini will probably not get back to the old high for at least a year or two. Even if it does, it will probably just be testing the top of what will be a 10 year trading range.

Legs in trading ranges often go well past the midpoint. At a minimum, this rally will probably get above 2615.40. That is a 20% rally from the low. The bulls could argue that the Emini is back to being in a bull trend.

A similar target is 2715.00. That is the 20% correction level. If the Emini gets above it, its bear market will have ended, at least temporarily.

Another important target is the top of the 2 year trading range, which is just above 3000.

Next, the rally after a sell climax frequently retraces up to the top of the most recent leg down. That is the March 3 high of 3125.75. That is so far above that the Emini can probably not get there without a test of the March low first.

Most likely, the Emini will have a difficult time getting above 2800 – 3000 for the rest of the year.

Can the bear trend continue down to 50% or more?

It is too early to tell. As I said, the final low in a bear market comes on average about a year after the bear trend begins. Traders therefore will wonder if every rally will fail in 2020.

The bears hope that the 2 month selloff is a spike in a Spike and Channel Bear Trend. They would like at least 2 more legs down. If they get that, the final low will be 50 – 60% below the February high.

The 1929 Crash was a Spike and Channel Bear Trend. There were many legs down and the market lost almost 90%. That will not happen this time. The best the bears will probably get is a 40 – 50% correction. That will only happen if the worst case scenario happens with the coronavirus.

The main reason for the 89% loss in 1929 is that the government did not know what it was doing. Today’s government does. However, our government can only minimize the damage. It can not fix the economy. The damage is ongoing and it will take years to repair.

Again, the economic problem was there before the pandemic

Since a horribly managed economy in 1929 led to about a 90% loss, and well managed economies over the past 20 years have contained losses to about 60%, I think the worst case today will be about 60%. However, I think it will be much worse and last much longer (a decade) than what I am hearing from any “expert.”

I want to be clear. The Titanic hit the iceberg in late 2017. The chart over the next 2 years told us that the economy had very serious problems. If I am right and the economy is stagnant for a decade, it will be due to problems that predated the pandemic. The pandemic pushed the button of a bomb that was there for several years before. If it was not the pandemic, then something else would have been the trigger within the next couple years.

If the bottom is near, is the bull trend resuming?

It is a common mistake to assume that the end of a bear trend means the start of a bull trend. Much more often, the bear trend evolves into a trading range.

Once the market is clearly in a trading range, there is then a 50% chance of a resumption of the bear trend and a 50% chance of a reversal into a bull trend. This transition will take many months. Consequently, traders should assume that the 2 year trading range will continue into the summer. There might be one more brief new low, but a big new low is unlikely near-term.

Furthermore, the 2 year range will likely evolve into a taller range over the next decade. The range will probably be between around 1800 and 3600.

Too many bulls

There is too much bullishness out there. Everyone is talking about the bottom being in and how this is such a great buying opportunity. They keep comparing it to the December 2018 selloff and all of the other selloffs over the past decade.

The difference is that all of those were in a 12 year bull trend. This selloff is the start of a bear trend. This bear trend will be the 1st bear leg in a decade long trading range. That range will have at least a couple 1 – 3 year bull and bear trends.

It is important to not forget that the Emini fell 34% in 5 weeks. Please understand that this represents tremendous damage. It does not get fixed with even massive government action.

While the bulls might be able to halt the bears for a while, the bears are still in control. I doubt that this is a bull market. As I have been saying, the market will have a difficult time getting much above the February high for the next decade. Also, the bear market low will probably be between 1800 and 2000.

No one knows if that low will come soon or more than a year from now, but it is difficult for me to believe that the Fed and Congress have fixed the economy this quickly.

20% down and now 20% up

When the Emini fell to 2706, it was 20% down from the high. That meant it was in a bear market.

On Thursday, it rallied above 2614. That is 20% above the bear trend low. The bulls therefore believe that the Emini is now in a bull market. They would like it to totally erase any claims by the bears and therefore want it to get back above 2706.

Call it what you want. To me, this is a strong rally after an extremely strong sell climax. There is only a 30% chance that it will continue up to the February high without a test of the March low.

Furthermore, there is currently a 60% chance that the March low will not be the final low. Also, there is a 50% chance that the final low will be at least 40% down from the high.

The final low typically comes about a year after the bear market begins. However, those odds will get smaller if this rally goes much further up.

What to expect next week

The end of the quarter it usually bullish. This is especially true after the most dramatic sell climax in history. The rally is strong enough so that it will probably have at least a small 2nd leg up. But it is still a bear rally and the odds favor at least a test of the March low. Most likely, the final low will be at least 40% down.

When will the bears get their test down? No rush. Big Down, Big Up creates Big confusion, and confusion creates trading ranges. Traders are not sure of the direction and are therefore quick to take profits. They bet on reversals instead of successful breakouts.

Another hallmark of a trading range is disappointment. Most strong moves up and down will have bad follow-through because traders are unwilling to hold onto positions. They expect reversals.

The Emini will probably be in a trading range for several months and possibly all year. That means that it will rally for a week or two and sell off for a week or two. This will probably happen at least a few times.

There is probably at least another day or two left to this initial rally. Traders will probably buy the 1st 1 – 2 day pullback. But then many bulls will take profits on the next brief rally and the bears will begin to sell again. This year will be great for traders and terrible for investors.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

Thanks Al for your insight!

Question about the weekly expanding triangle on ES E-Mini.

Why did you not chose the trend line from 02/05/2018 to 12/24/2018 instead of the on illustrated?

I think you are talking about the same line. I used the date of the actual low, which was 2/2/18 on the daily chart. You used the date on the weekly chart, which is the last of that week, 2/5/18.

Hey Al, I’m sure you have seen many patients on hydroxychloroquine due possible bulls maculaopathy side effect (though I’ve never come across one), what’s your thoughts on its possible use against COVID-19. Regardless of Trump stance on it

I am data driven and there are many studies going on right now. They will determine the risk, reward, and probability. They will then come up with the best recommendations based on dose and duration of the medicine and the type and severity of the illness of each patient. No one will get treated with a potentially blinding drug unless the risk, reward, and probability makes sense. I believe that the data will be clear within a few months, and very clear within a year.

I hope you can cover weekly amalysis of the gold market, considering the v-reversal recently. Is this a shakeout of the gold bull rally? Thanks.

There were 5 strong reversals on the daily chart in the past 6 weeks. That’s a mess and a fast money trader’s market. Most people should ignore the daily chart for the time being.

The monthly chart is different. There was a wedge rally since 2018, and the wedge triggered when March fell below February. But then March went above February, theoretically hitting the stop for the bears.

When a wedge top triggers and then fails, there is generally a 50% chance that there will be a 2nd sell signal within a bar or two (1 – 2 months) and a 50% chance of a successful breakout and a swing up. Here, the bulls have less than a 50% chance because the entire rally from either 2016 or 2018 looks like a leg in a trading range and not like a resumption of the decade long bull trend that ended in 2011.

What about fundamentals? There are never fundamentals in gold because it is religion and not a commodity. When it is down, gold traders buy it because it is cheap. When it is up, gold traders buy it because it is strong and going higher. They always believe in gold and are incapable of seeing a reason to sell it. I would only trade gold based on technical factors.

On the monthly chart, it is in a 4 year bull leg in a 10 year trading range. Last month was a top but it has failed. Nothing is clear in trading ranges. When things are not clear on any chart, the chart is clearly in a trading range. Traders should trade it that way.

There will probably be another attempt at a top within a few months. Gold has a 40% chance of breaking strongly above February and going up for several months. There is a 30% chance of it racing up to the 2011 high.

Awesome analysis – TY

“Gold bugs” confuse the rationale for an insurance policy w/ the rationale for a trade (riffing on Jim Rickards). The confusion has theological degree.

Alternatively (riffing on Brooks (?)), it’s a trader’s equation confusion, conflating a low probability/high reward trade as high probability/high reward.

Hi Al, thanks as always for you commentary.

Re your currency observations, it would seem to me that the selloff in risk assets and massive supply and demand collapse created a dollar shortage globally, which has allowed the Fed to print endless amounts of money without significantly devaluing the dollar. I mean, in the last week alone The Fed added $500b in reserve bank credit, $257b in treasuries and proivided fx swaps worth $168b to other CBs*, and yet the DXY still closed the week above 98!

Is it not the case that, as the world’s reserve currency, and given the USD shortage, The Fed can print as much as it likes essentially. Whilst the ECB, BoE etc will end up going the same way as the BoJ and Japan if they print untold amounts of EUR, GBP…?

*Source: Fed weekly report:

https://www.federalreserve.gov/releases/h41/current/

I think there are consequences to everything. The consequence of the Fed not acting is a world-wide depression and huge number of great companies vanishing. The Fed’s decision is easy. Do something extreme or watch America and the world die.

As I wrote, all countries are going to print money. We are just the healthiest patient in the cancer ward.

If the Fed prints (well, the Treasury prints, but the Fed is essentially printing by creating electronic money) disproportionally more than other countries, the dollar will crumble. They have a lot of leeway because they control the biggest economy in the world, they have the smartest Fed governors, and our Fed is probably one of the most honest. It has America’s and the world’s interest at heart. So many other countries are run by people who have dual loyalties. They do what is right as long as they can personally benefit.

The US is greatly benefiting from a worldwide flight to safety. Everyone is buying dollars, US assets, and bonds. There is a tremendous transfer of wealth to the US, but it is not going to be endless. At some point, the rest of the world will feel like they have enough and then stop hoarding. When you finally feel like you have enough toilet paper, you stop giving your money to the toilet paper company.

Yes, the US has the ability to print infinite dollars and they will print as many as needed. But they can not far ahead of other countries because the dollar will suffer.

It is important to remember that the Fed cannot fix the problem. A vaccine is the only solution, and even then, it will take years for the economy to heal. The realistic goal of the Fed is to prevent a collapse of the economy.

Tremendous damage has been done and it is ongoing with no end in sight. I think the pundits on TV haven’t given this enough thoughts.

Appreciate the medical insights. Here in Sweden we are one of the few countries not yet confined to our houses by martial law. Am a bit concerned about Chinas “New IP” proposal for the global internet, and the power struggle that will follow the virus turbulence.

Listening to Jim Rodgers however everything will be alright. https://youtu.be/HnXFq7PvOmc?t=1

Let’s see how that works out.

Our index OMXS30 has been in a trading range since 2015, like most european indicies DAX, CAC, (UK100 even longer) etc. Though there were some overshooting in 2019 October, we are now back in the range.

Your methods has helped me a lot.

Best wishes,

Jens

I have followed Jimmy Rogers for 30 years and have never trusted him. I believe he got his money because George Soros was his partner. I have listened carefully to both for a long time. Soros is a genius. I have found no evidence that Rogers is anything special. I suspect that the wealth from the Quantum fund was much more due to Soros’s decisions than to Roger’s.

I believe Rogers is still living in Singapore. I suspect that makes him more willing to see China as benign.

Until a couple hundred years ago, China was arguably the most important country in the world. One of its most important long-term goals is to reclaim what they feel is rightfully theirs.

Unlike the US, China can make plans that extend decades ahead. That is a big advantage over the US, which mostly plans for the next election and not the next generation.

China understands how important the internet is. Also, they have a controlled economy. They want to expand that control regionally and then worldwide.

Any plan that they suggest is to transfer power to China from the US and Europe. It is a zero sum game. What is good for them is bad for us. They want control, and we will lose freedom. Do you want Apple, Google, Amazon, and Microsoft to control the internet or Huawei?

Why do you think the US is so opposed to Huawei? The US sees it as a tool of China. I don’t see the US and Europe agreeing to give up any control over the internet.

But, China will probably continue to develop its own system and try to persuade others to join in. Remember, they have a lot of client counties in Asia and Africa, and those countries will be very influential over the next several decades. China is very good at playing the long game. I wish we were as well.

Hi Al,

Thanks for your weekly review.

Yesterday the market broke out in the last hour to around 2600 but then reversed back greatly in less than half an hour. What do you think? Does it mean bears think it is good to short at 2600? Or even both bulls and bears think 2600 is a resistance level?

Al has done some excellent work on trading in the final hour recently. He suggests that moves such as the one we saw Friday are more likely to be smart money, which makes sense. So it could have been HFs shorting the PB to 2600. But could also be bulls trapped long with 2600 as an average price who were waiting to get out breakeven. Or MMs with huge Short Call positions at 2600 trying to make sure their Options don’t finish ITM. Most likely all of the above.

Looking at IG weekend price levels, we are down already another 2% from the Friday close, which could easily accelerate to a gap down on Monday (futures) open of 3-5%. Smart money or not, it could be that we test the 2200 low again before we try to jump over 2600. As I am long, I hope this is not the case, but it`s a probability. The last two days of the month, as Al said yesterday, hopefully a little rally.

Actually I am also thinking of whether we will see a higher low double bottom as a confirmation before a real rally occur. I am waiting for this chance to long.

One of the keys to a trading range is to take quick profits because they will not last. However, there should be at least a small 2nd leg up within a couple weeks. The selloff will probably be a test and it will likely form either a higher low or lower low double bottom.

Although the market is in a bear trend and will go lower, it is probably in a trading range for the next several months. Tops and bottoms will not be clear and reversals will be abrupt.

I am looking to sell high, buy low, scale in, trade small, use wide stops, and take small profits. If enough traders do the same, and I think they will, we will get the near-term trading range that I think is likely.

Thanks again Al. Excellent and very useful overview of the current situation. Hope you and your family stay well.