Market Overview: Weekend Market Analysis

The SP500 Emini futures closed 2021 near new all-time high. This week was a weak breakout above the 8-week trading range to the new all-time high. Bulls want a continuation higher to test the top of the trend channel line and the 5000 big round number. Bears want a reversal lower from a wedge top near the top of the trend channel line.

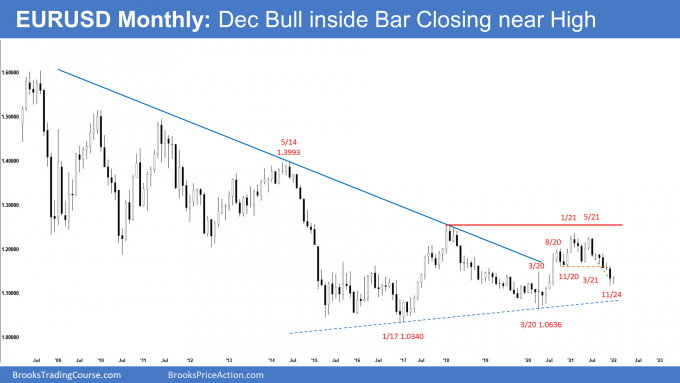

The EURUSD Forex monthly candlestick was a bull inside bar closing near its high. The bears failed to get follow-through selling following November’s big bear bar. The bulls will need to create strong follow-through buying in the next 1- to 2 months to convince traders that a reversal higher is underway. Bears want December to be a bear flag and a continuation of the measured move lower. However, a bull doji closing near the high is a weak sell signal bar.

EURUSD Forex market

The EURUSD monthly chart

- December’s candlestick was a bull inside doji closing near its high with a prominent tail below.

- It came after a bear trend channel line overshoot which means failed bear breakout and follow through after November’s big bear bar.

- There are 3 pushes down since June (June, September and November), which is a wedge.

- An inside bar is a breakout mode situation. There is a 50-50% probability of a bull and bear breakout. Furthermore, the first breakout has 50% chance of failing. Because the move down since September is in a tight bear channel, odds slightly favor a bear breakout.

- An inside bar after a wedge in a protracted bear trend often is the final bear flag of the bear leg. That means the EURUSD may trade slightly lower but may not go much further before there is a reversal higher again.

- The bears want a continuation of the 700-pip measured move lower based on the height of the yearlong trading range.

- However, a bull doji closing near the high is a weak signal bar for a strong sell-off for January.

- The bulls want a reversal higher from a trend channel line overshoot after testing below March 2020 high support. They hope that the selloff is simply a pullback from last year’s breakout above the bear trend line.

- The bulls need to create strong bull bars closing near their highs in the next 1 to 3 months to convince traders that a reversal higher is underway.

- Al has been saying that EURUSD is in the middle of a 7-year trading range and the selloff was climactic. That makes it likely to go sideways to up for a couple of months soon, whether it ultimately breaks below last year’s low and the bottom of the 7-year range.

- If there is a reversal up within a few months, the 7-year trading range will be a triangle, beginning with the 2017 low.

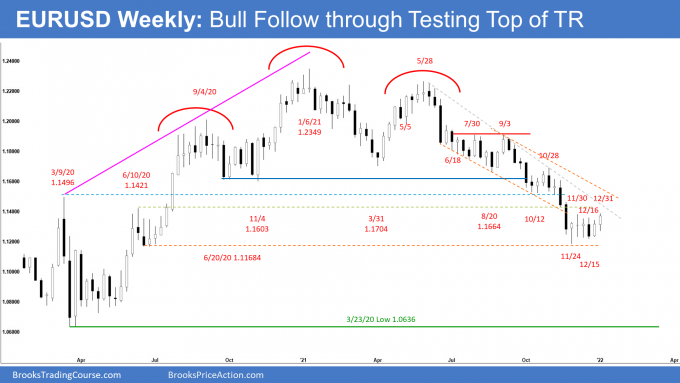

The EURUSD weekly chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bull bar closing just slightly off its high with a long tail below testing the 6-week tight trading range high.

- While the bulls got follow-through buying from last week’s bull signal bar, they have not gotten a strong breakout above the tight trading range yet.

- The bulls want follow-through buying over the next 1 to 2 weeks and a strong breakout above the tight trading range. They need to get big bull bars closing on their highs and closing far above the top of the six-week tight trading range before traders will conclude that a bull trend has begun.

- If those legs are strong, there could be a rally back to the October 28 high, which was the start of the most recent sell climax and therefore a magnet.

- Bulls want these six sideways bars to be a base after the two big bear bars in early November. They want those two bars to be an exhaustive end of the yearlong selloff.

- If the reversal remains sideways, there could be a new low. The bears are hoping that this rally will quickly form a bear flag and then resume the yearlong bear trend from a double top bear flag (November 30 and December 31).

- This week’s candlestick is the 6th consecutive sideways week on the weekly chart. If there is a break below the 6-week trading range, odds are it might be the final flag of the bear leg.

- Since this week’s candlestick is a consecutive bull bar closing near its high, it is a weak sell signal bar for the bears. It reduces the chance that the EURUSD going far below it without another pullback.

- Al has been saying for a few weeks that there should be a sideways to up move lasting at least a couple months starting from where the EURUSD is now or from slightly lower. The EURUSD is in the middle of a 7-year trading range. Legs rarely go straight from the top to the bottom without some confusion, which is a hallmark of a trading range. This year has been clearly bearish. Clarity does not last forever in trading ranges.

- Al has also said that currencies have an increased chance of reversing in early January. The current bear trend began on January 6th of 2021. The bears hope that the yearlong bear trend is a resumption of the bear trend that began in 2008. More likely, the seven-year trading range will continue.

- The 2021 selloff is still more likely a pullback from the 2020 rally than a resumption of the bear trend that began 14 years ago.

- There is only a 30% chance that this selloff will continue down with only brief pullbacks and then break strongly below the 7-year trading range.

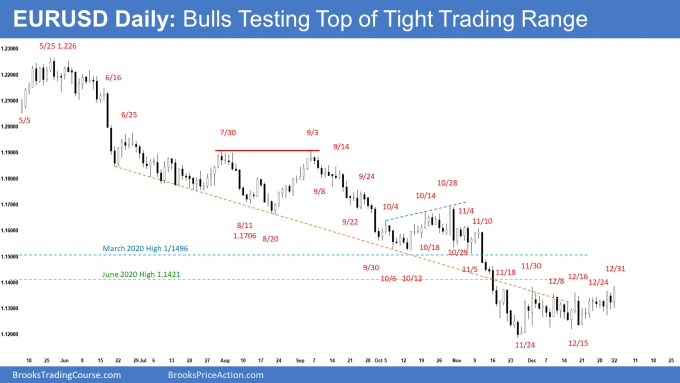

The EURUSD daily chart

- The EURUSD formed an ioi (inside-outside-inside) with a breakout higher on Friday.

- Friday closed near the high but has a prominent tail above and the bulls have not yet broken above the tight trading range.

- The bears are hoping that this rally will form a bear flag and continue the yearlong bear trend. There were several reversals lower from a double top bear flag and a wedge bear flag which had no follow-through in the last 6 weeks.

- The bears want this week to be a test of the trading range high followed by a reversal lower from a Low 4 short setup (November 18, November 30, December 16 and December 31).

- A trading range is an area of balance and a breakout mode situation. There is a 50-50% probability of a bull and bear breakout. It also means that there is a 50% chance that the first breakout up or down will fail and reverse.

- In the last 2 weeks, bears have failed to create strong bear bars or consecutive bear bars while the bull bars have bigger bodies, are more prominent and have closes near their highs.

- Odds slightly favor the bulls in terms of buying pressure within this tight trading range in the last 2 weeks.

- The bulls want a strong breakout above the November 18 high and measured move up which will take them to the November 10 high which was the start of the sell climax on the daily chart. If those legs up are strong, there could be a rally back to the October 28 high.

- If the reversal is more sideways, there could be a new low. However, with the chart in a 7-year trading range, traders still expect a couple of months of sideways to up trading to begin soon.

- There’s only a 30% chance that the small pullback bear trend will continue down to last year’s low without at least a rally lasting a couple of months or more.

S&P500 Emini futures

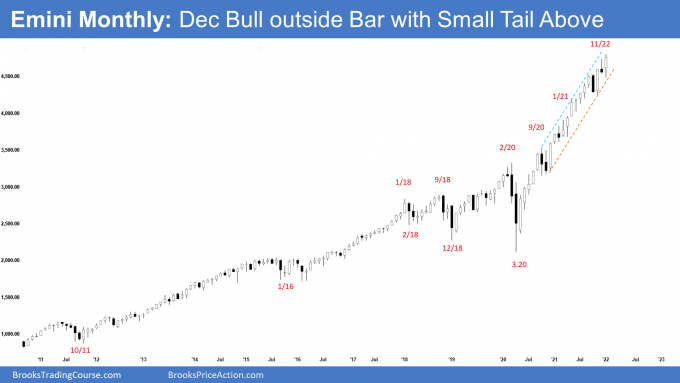

The Monthly Emini chart

- The December monthly Emini candlestick closed as an outside bull bar at a new all-time high. There is a long tail below and a prominent tail above.

- November Low 1 sell signal failed when December went above its high this week.

- The prominent tail above also means the bulls are not as strong as they could have been.

- We have said that if December were an outside up month on the monthly chart, it would increase the chances of higher prices in January.

- The next target for the bulls is the top of the trend channel line around the big round number 5000.

- The bar after an outside bar often is an inside bar or has a lot of overlapping price action with the outside bar. If January is an inside bar, it would form an ioi (inside-outside-inside) pattern which is a breakout situation.

- December is the third leg up where the first legs up were August and October so therefore a micro wedge. Since the bull trend is extreme, traders are looking for reasons to take some profits. A micro wedge is often a trigger for profit-taking. That would probably lead to a couple of bars sideways to down.

- However, since December is a bull bar closing near its high, it is a weak sell signal bar for a strong reversal down.

- The bears want a reversal lower from a micro wedge even if January trades slightly higher first. They want January to be a failed breakout above December outside up bar, similar to November. A third reversal has a higher probability of working.

- Can this rally continue up throughout 2022 without a pullback? That is less likely. It is overextended and there is a likely micro wedge forming.

- Therefore, the bull trend will probably transition into a trading range for at least a couple of months.

- For example, if the market were to get down to the October low, then the trading range would have begun in August and there would be a five or six- or seven-month trading range on the monthly chart.

- At that point, the bulls will try to get a resumption up from a double bottom bull flag and the bears will try to get a bigger reversal down.

- Al has said that the bull trend from the pandemic crash has been in a very tight bull channel. The first reversal down will probably be minor even if it lasts a few months and not continue straight down into a bear trend. Even if it sells off for 10 to 20% correction, that would still only be a pullback on the monthly chart even though it could be a bear trend on the daily chart.

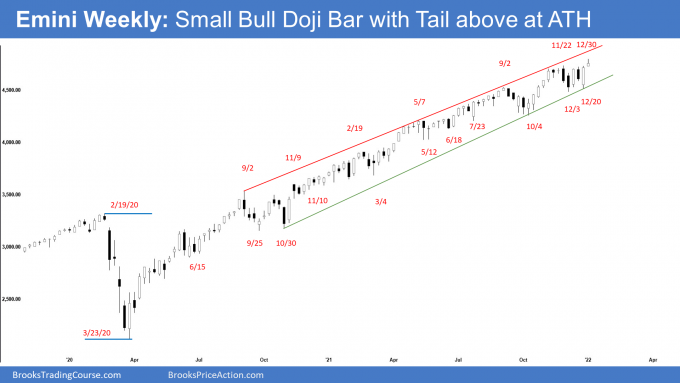

The Weekly S&P500 Emini futures chart

- This week’s Emini weekly candlestick was a bull doji bar at a new all-time high with a prominent tail above. It broke above the 8-week trading range, but the prominent tail and small body mean the bulls are not as strong as they could have been.

- The 8-week trading range late in a trend often is a final bull flag. Therefore, a rally from here may fail within 3 to 5 weeks, possibly at the top of the bull channel and possibly around the 5000 big round Number.

- Therefore, if the market does go up over the next several weeks, it probably will not go up very far before there is a reversal down to the bottom of the bull flag, which is the December low.

- We have said that a tight trading range is a breakout mode pattern and has a 50-50% chance of a successful bull or bear breakout. It also has a 50% chance that the first breakout up or down will fail and reverse within a couple of bars. Because it’s in a strong bull trend, a bull breakout is slightly more likely than a bear breakout.

- The bears want a higher high double top with November 22 or a wedge top with September 2, November 22. They want any breakout above the tight trading range to fail and then a test of the December low followed by a measured move down which will take them to the Oct low.

- However, the bears have not been able to create follow-through selling and consecutive bear bars closing near their lows. They will need a surprise big bear bar or consecutive bear bars closing near their lows to convince traders that a deeper pullback may be developing. At the very least, they need a strong bear reversal bar and a micro double top.

- Al has said that the Emini has been in a strong bull trend since the pandemic crash. There have been a few times when the bears got the probability of a correction up to 50%, but never more. The probability of higher prices has been between 50 and 60% during this entire bull trend. It has never been below 50%. That continues to be true.

- The strong selloffs, like in September in 2020 and again in 2021, pushed the probability for the bears up to 50%. But every prior reversal has failed, and the bears never had better than a 50% chance of a trend reversal.

- For now, odds slightly favor sideways to up more.

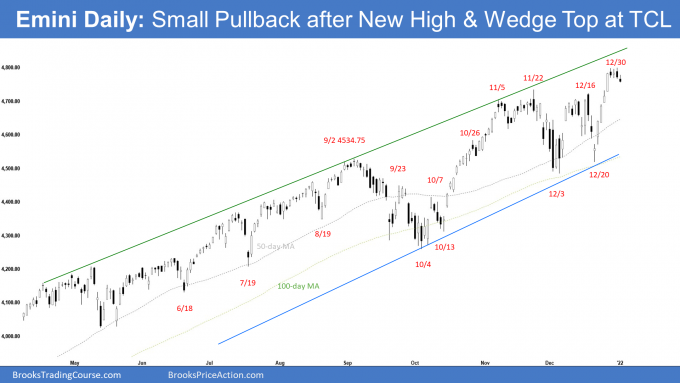

The Daily S&P500 Emini futures chart

- Monday broke above the 8-week tight trading range into a new all-time high. The Emini made another new all-time high on Thursday but closed as a bear bar.

- The rally from December 20 is strong enough for traders to expect at least a small second leg sideways to up move.

- The bears want a reversal lower from a higher high double top with November 22 or a larger wedge top with November 22 and September 2. They then want a pullback to the December 3 possible final flag low and then a breakout and measured move which would take them down to the October 3rd low which was the start of the wedge rally, and which is a common magnet after a wedge reversal.

- However, the bears have not been able to create consecutive strong bear bars closing near their lows. Every pullback has been bought by the bulls since the pandemic crash.

- They will need consecutive bear bars closing near their lows to convince traders that a deeper pullback is underway.

- The next targets for the bulls are the top of the trend channel line around 4900 and a measured move up based on the 2-month trading range (Nov-Dec) to around the 5000 big round number.

- 2021 closed near the high for the year. It is a statement of how strong the bulls have been over the past two years period. However, since this week did not close so near to the high, the bulls will require a big gap up of at least 42 points to create a gap up to a new all-time high on the daily, weekly, monthly, and yearly charts. That may be too far for the bulls to do on Monday.

- Can the bull trend continue straight up for a measured move based upon the height of the two-month trading range which would take them to around 5000?

- There is always such a possibility. It would then be a parabolic buy climax and odds of profit-taking would increase after that as there would be a trend channel line overshoot on the daily chart.

- More likely, traders will either take profits from above the November high which would create a wedge top with the November 22 and September 2 high.

- Therefore, there probably will be at least a couple of months of profit-taking starting sometime early next year.

- For now, odds slightly favor sideways to up more.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Weekly Reports Archive

You can access all weekly reports on the Market Analysis page.

The rally in the EURUSD from the November low looks much more like a bear flag than the start of a bull trend. We’ll know soon enough.

Dear Andrew, Happy New Year to you! 🙂

Thanks for the detailed report Andrew and above all Happy New Year! For all practical purpose the market closed on new high record thus assume the prominent tail top is associated with profit taking. The last 5 trading days was pure profit taking buy bulls (prominent tails top and bear bodies). Despite that, they were able to create ATH close that is a good sign for the bulls I assume. About the bear case (trying to connect this to Al’s market cycle approach): we had bull spike from the pandemic low and thereafter bull channel that is so far being respected. In order to really consider a bear case, don’t we want first to see them breaking down the bull trend line by going side way or sharply splashing down?

Probably we already are in a TR and I woudn’t be surprise to see prices go sharply to LLM.

Bull wants to create a bull channel after the last strong rally, but most probably this rally will become a second leg trap in a TR.

Dear Eli! Happy New Year to you too! Best wishes for a great year in 2022!

The last 4 day’s pullback was small as compared with the move up from Dec 20. The bulls mostly dominated.

As Al always says, there is always a bull’s and bear’s case.. so it is always good to think of what each camp wants and are looking at rather than be too one-sided..

No doubt, in a strong bull trend such as this, the odds of the trend continuing is much higher than a reversal.. until the last reversal that finally worked – which can be far ahead.. Picking tops is a losing strategy.

And yes, for a strong bear’s case, ideally, there should be a prior show of strength, such as breaking a major trend line with strength, and then preferably a weak retest of the trend extreme, and then a double top of some sort.. a MTR..

Once again, wishing a great year ahead Eli! 🙂

Happy New Year to you too Leonardo! 🙂

Added thoughts:

Also, traders are always looking for reasons to take profits. A wedge top is one of those things. Look at crude oil – before the sell off in Oct/Nov, it looked like it was on a rocket ship. However, Oct/Nov was the 3rd push up, add a few fundamental factors/news into the mix, and traders have enough reasons to take profits. Crude pulled back from 85 to 62, slightly more than 25% in a short period of time.

Thanks for the clarification Andrew. Indeed the market is extremely fascinating and as traders we need to be prepared for every scenario that may appear.

First trading day of the year! Wishing a successful year ahead to you Eli! 🙂

In the next few days, I will create a brief video about the yearly and monthly charts.

Dear Al,

Alright noted and looking forward to it..

Wishing a wondeful 2022 to you and your loved ones, filled with happiness, great health and blessings..