Market Overview: Weekend Market Analysis

The SP500 Emini futures is in a strong bull trend on all time-frames with buy climax testing top of bull channels. Traders will continue to buy until there are consecutive strong bear days on the daily chart. While that could lead to a 10% correction, traders will buy that pullback as well.

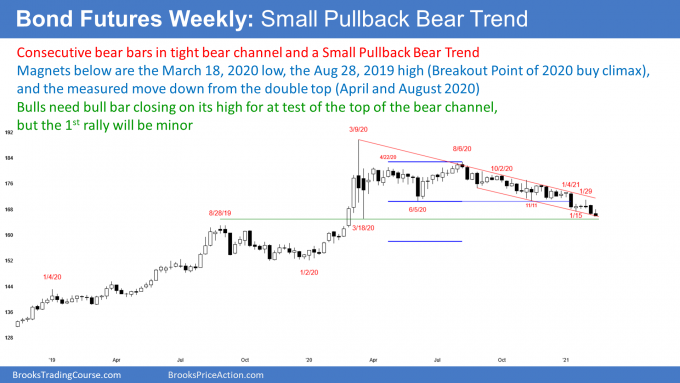

Bond futures are continuing down in a Small Pullback Bear Trend. The next target is the March 2020 low.

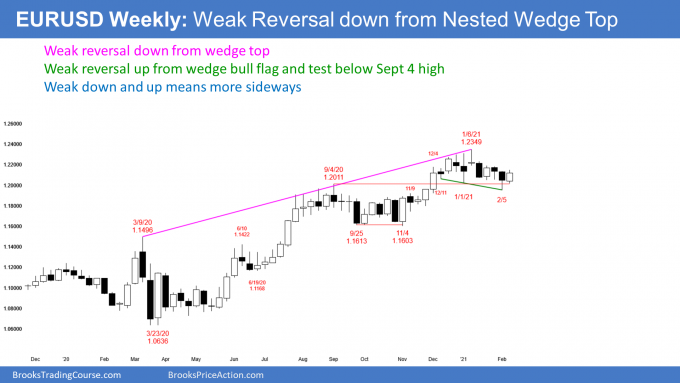

The EURUSD Forex market has been sideways to down for 9 weeks after a wedge top. While this week reversed up, the selloff is still in the tight trading range. Traders will expect sideways to down trading until the bulls can create a couple consecutive strong bull bars.

30-year Treasury Bond futures

Bond futures weekly chart reversing up from bottom of bull channel

The bond futures market has been trending down since the March 2020 buy climax. That was the most extreme buy climax in history, and it will probably remain the high for at least a couple decades, and maybe for your entire trading career. What about all those experts on TV last year saying interest rates would go to zero? I said back then that they were fools, and the market is validating that opinion now.

This week was a 2nd consecutive bear bar closing on its low. That increases the chance of at least slightly lower prices next week.

Also, the bond market is near enough to important magnets below, that it might not be able to escape their magnetic pull. The first is the March 18 major higher low. Just below that is the August 2019 high. That is the breakout point of the early 2020 blow-off top.

However, once the bond market reaches these support levels, many bears will begin to take profits. That typically will at least pause the bear trend.

Because the selloff has been in a tight bear channel for a long time, it is a sell climax. Therefore, if there is profit taking, there could be a rally for a month or more.

However, when a Small Pullback Bear Trend reverses up, the 1st reversal up is typically minor. Traders will look to sell it, expecting at least a test of the sell climax low. They would prefer a resumption of the bear trend, and for the market to collapse down to the January 2020 low, at the start of last year’s buy climax. But it is more likely that the bond market will pause for a few weeks around the magnets.

EURUSD Forex market

EURUSD weekly chart in middle of 9-week tight trading range

The EURUSD weekly chart totally reversed last week’s selloff. While last week broke below an 8-week trading range, I said the the breakout was weak, because the bear bar closed in its middle instead of on its low, and above the January 1 bottom of the trading range. That is why I said that this week was likely to be sideways, and it was.

There is now a 2-bar reversal. This week is therefore a buy signal bar. However, this week broke above a 5-bar bear micro channel (the past 4 bars had highs below the high of the prior bar). That is a sign of persistent bears. Also, the EURUSD is back in the middle of its now 9-week tight trading range. Finally, this week did not close on its high or above last week’s high. These factors reduce the probability that this week is a resumption of the bull trend that began last March.

We will find out next week. If next week is a big bull bar closing on its high, there will then be consecutive strong bull bars. Traders will assume that the bull trend is resuming.

What is likely next week?

The EURUSD is back in its tight trading range. It is therefore more likely to go sideways than strongly up next week. If next week goes above this week’s high, which would trigger a buy signal, the bulls will probably be disappointed by the bar. It might close below its middle. Or, it could even have a bear body instead of being a big bull bar closing on its high. Anything other than a strong bull bar would make traders think that the trading range will continue.

If next week is a big bear bar, traders will wonder if the 6-week selloff is the start of an Endless Pullback. Remember, the January high formed a wedge top. A reversal down often has at least a couple legs, and tests the bottom of the most recent leg up. That is the November 4 low at 1.16.

What is most likely? Markets have inertia. They tend to continue what they have been doing. The EURUSD has been going sideways for 9 weeks. Therefore, it will probably not break strongly up or down next week. More likely, it will stay within the 9-week trading range, and not be particularly bullish or bearish.

What about the next 6 months?

What about over the next few months? There is a credible wedge top on the weekly chart. Traders should expect a selloff to the bottom of the 3rd leg up. That is the November 4 low.

However, the 2nd leg up in the wedge to the September 4 high was strong. It might have started the count over again. If the EURUSD breaks above the January 6 high but reverses down, there would then be a new wedge top where September 4 was the 1st leg up.

Can the TV bulls be right? Can the EURUSD rally 20% from here this year? The chart does not look like it will. The current wedge should lead to sideways to down trading for at least a couple months. But if there is a new high, it will probably reverse down from a new wedge, and the reversal will still likely last at least a couple months and test the November 4 low at 1.16.

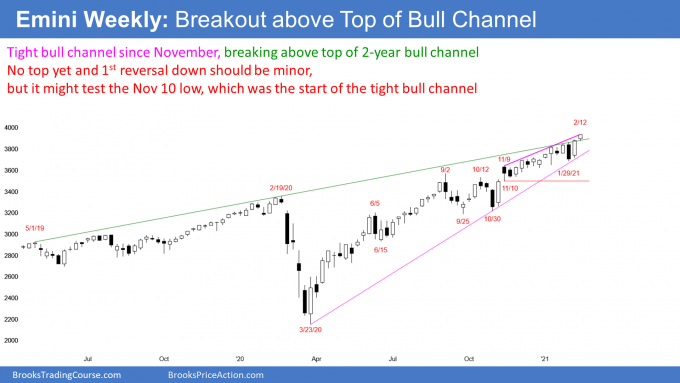

S&P500 Emini futures

Monthly Emini chart has big bull bar in strong bull trend

The monthly S&P500 Emini futures chart is forming a big bull bar so far in February – a buy climax testing top of bull channel. The yearlong bull trend has been extremely strong. Everyone knows it is climactic, but that is irrelevant. Traders will continue to buy until there is a clear reversal down.

There has been only one pullback since the rally began a year ago. That was when September traded below the August low. And what happened next? The bulls bought it and the bull trend resumed. In a strong bull trend, the bulls are quick to buy anything that is bearish, betting that the reversal down will fail, and that the bull trend will soon resume.

In a micro channel (no pullbacks), many bulls are eager for a pullback so they can buy below the low of a bar, instead of above the prior month’s low. When traders are desperate for a pullback, the pullback takes a long time before it arrives.

This is because traders are confident of one of two things happening if they buy. Either the market will go up and they will make money. Or, it will go down briefly and allow them to buy more, and it will then go up, and they will make money. As long as traders think this way, a rally can last a long time between pullbacks.

Is there a bear case?

There is always a bear case, even in a strong bull trend. When there is a reversal, it can be fast and go a long way, like last February and March. Therefore, traders need to be prepared.

This month is the 3rd push up from last February’s low. If this month is a strong bull bar, and March is a bear bar, there would be a parabolic wedge buy climax top. That typically will attract profit takers. Traders would then look for a couple legs down. The selloff often reaches the start of the parabolic wedge, which is the September low.

The September low is around a 20% pullback, and at the moment that much of a pullback is unlikely. More likely, if there is a pullback within a few months, many traders will eagerly buy at around 10% down from the high. That buying should prevent a 20% pullback during the 1st reversal down. But if a reversal up from a 10% pullback leads to a trading range instead of a resumption of the bull trend, then the odds of a test of the September low will go up.

March/April tend to be up

I have one final thought. If you look at any pair of consecutive months, March/April is the most bullish. Historically, the market is strongest from October into May. You often hear, “Sell in May and go away.” That is consistent with traders taking profits after a strong rally through April.

Sometimes a market pulls back just ahead of a strong period. If February sells off in the 2nd half of the month, it might simply be setting up a strong March/April.

I never take calendar trades because there is usually no way to structure a trade with a mathematical advantage. There are almost always many other ways to invest your money. However, I mention this as a reminder that March/April tends to be strong. Therefore, it is another reason to think that traders will buy if there is a 10% selloff into early March.

Weekly S&P500 Emini futures chart formed small bull follow-through bar after last week’s big bull bar

The weekly S&P500 Emini futures chart formed a small bull bar this week after last week’s big bull bar. This is good follow-through and increases the chance of higher prices next week. In fact, next week might gap up to a new all-time high, like this week did. But if the gap is small, like this week’s, it typically closes before the end of the week. This week’s gap closed in the 3rd hour on Monday.

This week is the 14th week in a tight bull channel. That is unsustainable and therefore a buy climax, but a buy climax can last much longer than what you might think is reasonable. While the Emini is at the top of a 2-year bull channel and a 14-week bull channel, there is no sign of a top.

Can the Emini break strongly above the bull channels, and form another breakout phase, leading to an even stronger bull trend? When a market is at the top of a bull channel, there is a 75% chance that it will reverse within about 5 bars. There is only a 25% chance of a strong breakout into an even stronger bull trend. But 25% is not zero, and therefore the bulls will keep buying until there is a reversal.

Once there is a reversal down, the bears need it to be strong. There have been many bear bars since the tight bull channel began in early November, and the bulls bought every one. Until there are a couple consecutive strong bear bars, traders will bet that the tight bull channel will continue, even though it is overbought.

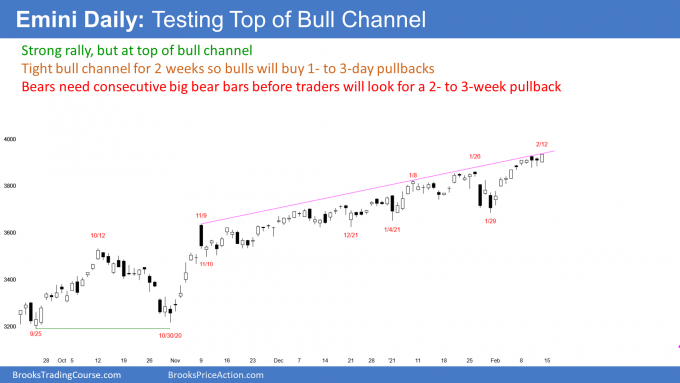

Daily S&P500 Emini futures chart testing top of 4-month bull channel

The daily S&P500 Emini futures chart has rallied strongly since those 2 big bear bars formed 3 weeks ago. The bulls are creating a buy vacuum up to the 4,000 Big Round Number. Even if it breaks above it, it will probably not get far above before there is a 10% pullback. This is because the rally is getting extreme, and extreme rallies eventually attract profit takers.

However, traders continue to buy, betting on higher prices. As a general rule, if a market tries hard to do something 2 or 3 times and fails, it tends to do the opposite. That is the basis of double tops and bottoms and wedge tops and bottoms. And it is the reason why the 2-week rally has been so strong. The bears gave it their best shot twice and failed. They have been buying in a panic since then.

The Emini is again at the top of its bull channel. There is a 25% chance of a strong breakout above the channel and an acceleration up. But 75% of breakouts of channels fail within about 5 bars. Therefore, if next week rallies strongly, the week after will probably begin to turn down.

I want to explain something that I continue to write. That is that the bulls will continue to buy every strong bear bar, until there are consecutive strong bear bars. There have not been consecutive strong bear bars since just after the October buy climax. Those led to a 10% correction, Before that, they came after the September 2 buy climax.

The same is true for selloffs. Look at the pandemic crash last year. The bulls had consecutive big bull bars on February 28 and March 2, but they followed 6 bear bars. That made the reversal up likely to be minor. After that, the next time that the bulls had consecutive bull bars where the 2nd day was higher was just after the March 23 bottom of the selloff.

Reversals that come with consecutive strong bars are more likely to have a couple legs and last 10 or more bars. Without that, the reversals usually fail within a few bars.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.