- Market Overview: Weekend Market Update

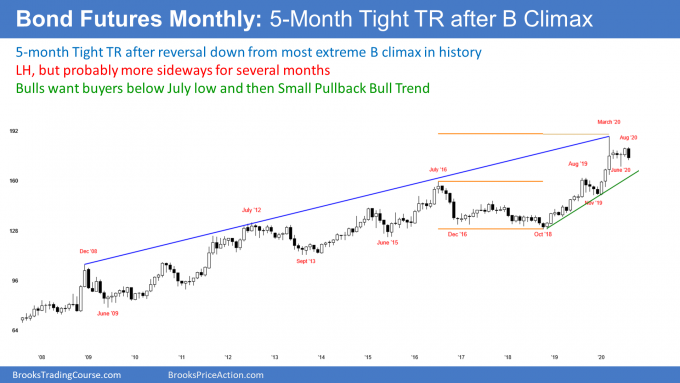

- 30 year Treasury Bond futures

- Bond futures formed outside down on monthly chart

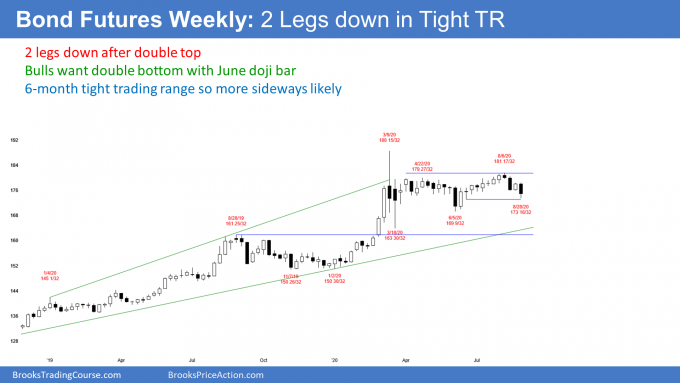

- Bond futures weekly chart in 2nd leg down from double top

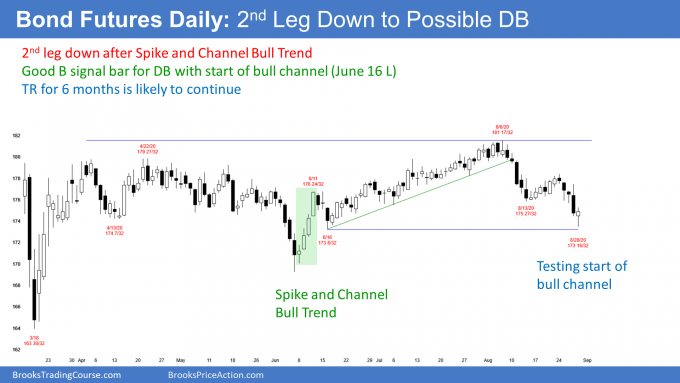

- Bond futures daily chart in 2nd leg down after Spike and Channel Bull Trend

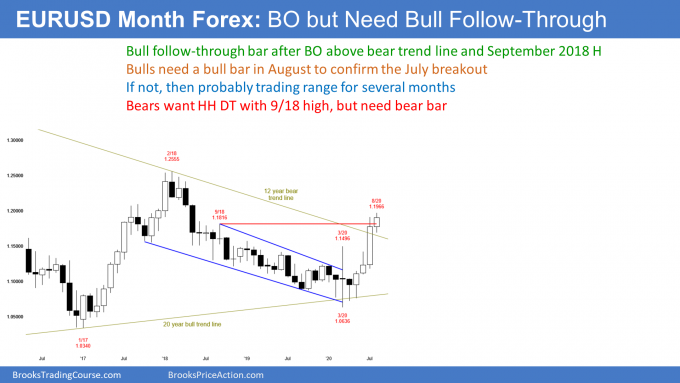

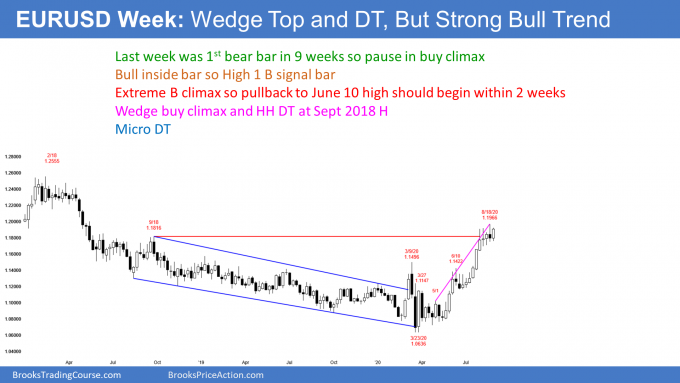

- EURUSD Forex market stalling at the September 2018 high

- August is the follow-through bar on the EURUSD monthly chart

- EURUSD weekly chart has wedge rally to resistance

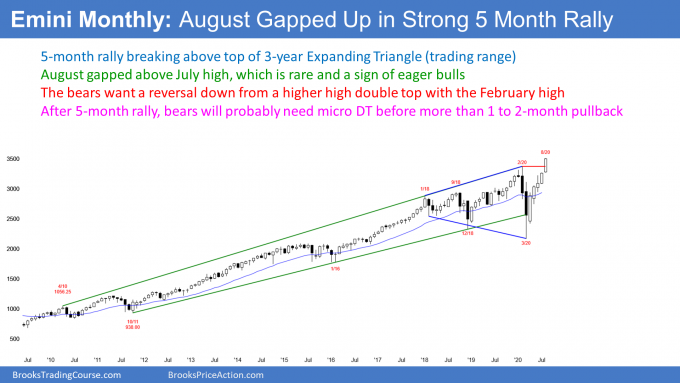

- S&P500 Emini futures

- Monthly Emini chart forming strong bull bar in August

- Weekly S&P500 Emini futures chart

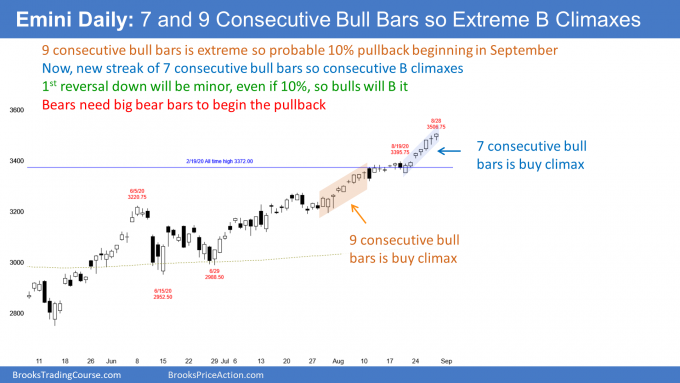

- Daily S&P500 Emini futures strong August buy climax makes September pullback likely

Market Overview: Weekend Market Update

The S&P500 Emini futures is in a strong bull trend and it should trade higher next week. It might even accelerate up next week. Since the buy climax is extreme, there is a 50% chance of a 10 – 20% pullback starting in September. However, traders will buy the selloff.

Bond futures are selling off to the start of the bull channel on the daily chart. Traders will then expect a bounce and a trading range.

For the EURUSD Forex market, August will probably a bull body on the monthly chart and be a good follow-through month. The EURUSD might trade a little higher in the next week or two, but the wedge rally on the weekly chart will probably lead to a test down at some point in September.

30 year Treasury Bond futures

Bond futures formed outside down on monthly chart

The monthly bond futures chart formed an outside down candlestick in August. There is only one more trading day in August. The bears want the month to close below the July low. That would increase the chance of at least slightly lower prices in September.

March reversed down from the biggest buy climax in the history of the bond market. Traders are deciding if August was a test of the March high and the start of a bear trend. Alternative, it could be just a pause in the 30 year bull trend before another leg up to a new all-time high.

This month was good for the bears. But the bond market has been sideways for 5 months. Unless traders see 2 or 3 consecutive strong trend bars up or down, they will assume that the 5 month tight trading range will continue. After an extreme buy climax, if could continue for 10 or more bars, which means the remainder of the year.

Bond futures weekly chart in 2nd leg down from double top

The weekly bond futures broke below a 9 week tight bull channel 3 weeks ago. That was a small buy climax and a double top with the April 22 high.

Although last week was a bull bar, I said that traders would sell it since they expected a 2nd leg from the buy climax. Furthermore, there was room to the June 16 low, which was a doji bar after a big reversal up. Its low is therefore a magnet.

Since this week was an outside down week that closed below last week’s low and there is a magnet below, traders expect at least slightly lower prices next week. If next week is a 2nd consecutive big bear bar closing on its low, traders will look for a test of the March low in September.

Sometimes the week after an outside bar is an inside bar. If next week’s low stays above this week’s low and if next week closes near its high, next week will be a buy signal bar on the weekly chart. But because the weekly chart has been in a trading range for 5 months, traders are not expecting a trend up or down. Instead, they are looking for reversals every 2 – 3 weeks.

Bond futures daily chart in 2nd leg down after Spike and Channel Bull Trend

The daily bond futures rallied in a Spike and Channel Bull Trend from the June 5 low. June 16 was the 1st pullback after the reversal (spike) up. It was therefore the start of the bull channel. A reversal down from a Spike and Channel Bull Trend typically tests the start of the channel. Therefore the June 16 low is a magnet below.

I said that last week’s rally was going to be a bear flag. That is because traders expected a 2nd leg down from the break to far below the bull channel.

Also, they know that the reversal usually reaches to around the start of the bull channel. Did this week’s low get close enough? It might have, especially since Friday was a big bull reversal bar closing near its high. It is a buy signal bar for Monday.

The bulls have a High 2 buy signal with the August 13 low, and a double bottom with the June 16 low. Traders should expect a reversal up from here or from slightly lower. The 1st target is the August 13 lower high.

But whether or not this week is the end of the swing down, traders know that a Spike and Channel Trend typically evolves into a trading range. Consequently, even if the selloff continues to below the June 16 low, traders will look for a leg up in the developing trading range.

This is consistent with the weekly and monthly charts already being in trading ranges. Markets have inertia. They tend to continue to do what they have been doing. Therefore, a developing trading range on the daily chart would simply be a continuation of the trading range on the weekly and monthly charts.

EURUSD Forex market stalling at the September 2018 high

August is the follow-through bar on the EURUSD monthly chart

The EURUSD Forex monthly chart has one day left in August. The EURUSD is trading far enough above the open of the month so that August should have a bull body.

July was a big bull bar. This month is the follow-through bar after that breakout. Follow-through bars are important because they often give a clue of what to expect in the next month.

If this month were to be a big bull bar closing near its high, traders would expect a test of the February 2018 high by the end of the year. If August was a big bar closing on its low, traders would conclude that the July breakout would fail. They would look for a reversal down, possibly to the March low.

Neither of these extremes is likely. Traders expect August to probably have a small bull body. There is a 20% chance of a big selloff on Monday and August ending up with a bear body.

If it has a bull body, traders would see that as confirmation of the July breakout. That would increase the chance of at least slightly higher prices in September. Or, if there is a test down in September, they would expect a test back up within a month or two.

Pullback in Spike and Channel Bear Trend

The 2 year selloff was a Spike and Channel Bear Trend. For the past year, I have said that there would be a rally to the September 2018 high. This is because that was the start of the channel phase of the pattern, and that is always a magnet.

Once there, the chart usually evolves into a trading range. This is what traders should expect over the next several months, even if the EURUSD goes a little high in September.

EURUSD weekly chart has wedge rally to resistance

The EURUSD weekly chart formed an inside bar this week. It was the 5th consecutive sideways bar and each of the 5 bars had prominent tails.

These weeks have been relatively neutral after an extreme 3 month rally. But since this week is a bull inside bar closing on its high, it is a High 1 buy signal bar for next week. That increases the chance of at least slightly higher prices next week.

The bulls hope that the strong 4 month rally will soon continue up to the February 2018 high at around 1.25. More likely, it will continue a little higher, maybe for a week or two, but then test down because of the wedge buy climax.

Streak of 8 bull bars is a buy climax

The bear bar of 2 weeks ago was the 1st bear bar after a streak of 8 consecutive bull bars. While 8 consecutive bull bars mean the bulls are strong, it is also unsustainable.

The last time there were 8 or more consecutive bull bars was in 2004. That streak had 11 bull bars. A streak is a type of buy climax. The market often goes a little higher or sideways afterwards, but it then usually reverses for many bars. Consequently, traders should expect several weeks down beginning sometime in September.

Wedge buy climax

The 4 month rally has had 3 clear legs up. It is therefore a wedge buy climax. Traders expect at least a couple legs down based both on the wedge and on the streak of bull bars. However, the 3rd leg up was so strong that the bulls might get one more brief leg up in early September before the reversal down begins.

A wedge rally to a double top (the September 2018 high) is a common reversal pattern. The bears want a selloff down to the breakout points. These are the June 10 and March 9 highs.

S&P500 Emini futures

Monthly Emini chart forming strong bull bar in August

The monthly S&P500 Emini futures chart has one trading day left in August. August will probably remain a big bull bar closing near its high. It is also closing well above the February all-time high. This is a breakout to a new high.

Next month is the follow-through bar. It probably will not be another big bull bar. But if it is, traders will expect a continued strong rally to the end of the year.

However, if September is a bear bar closing on its low and below the February high, traders will conclude that July was a failed breakout and just a bull trap.

The August high is just above the top of the expanding triangle that began in 2017. The bears hope that July is just a buy vacuum test of the top of the triangle. They want a reversal down.

But after 5 consecutive strong bull bars, traders will buy the 1st 1 – 2 bar pullback. Consequently, there is not much downside risk on the monthly chart for the remainder of the year. The bears will likely need at least a micro double top before they can get a reversal back to the middle of the 3 year trading range.

August gapped up, and September might gap up as well

Gaps on the monthly chart are rare. This is because most days do not gap up. To get a gap on the monthly chart, there must be a gap up on the 1st day of the month. Furthermore, the gap has to be above the high of prior month and not just above the prior day.

Despite this, August gapped above July and the gap stayed open. Since August might close near the high of the month, traders should wonder if September will gap up to a new all-time high and above the August high when September begins on Tuesday.

A gap up is a sign of aggressive bulls. This 5 month rally has been very strong and traders are chasing it up. Consequently, they might buy a gap up on Tuesday.

Most small gaps close before the bar closes. Since this is a monthly chart, if there is a gap, it will probably close before the end of September. However, if it stays open and if September closes near its high, the chance of the rally lasting all year will go up.

What will happen in September?

Whenever a market is in a buy climax, there is always the risk of a surprisingly quick, big profit taking selloff. It can come in many ways. For example, September might rally for the 1st half of the month and then sell off in the 2nd half. It would then be a bear reversal bar.

Another thought to keep in mind is that September could trade above the August high, maybe even gapping up, but then work its way down to below the August low. September would then be an outside down month.

Both of these possibilities would turn September into a sell signal bar on the monthly chart. That could lead to a 1 – 2 bar (month) pullback. However, the bears will probably need at least a micro double top before they can create a bear trend. Traders will buy the 1st pullback, even if it is surprisingly big.

Weekly S&P500 Emini futures chart

The weekly S&P500 Emini futures chart formed its 5th consecutive bull bar this week. Also, there is now a 9-bar bull micro channel. Every low for the past 8 weeks has been above the low of the prior week. This is a sign of very eager bulls.

In addition, 5 of the past weeks gapped up. Although 3 of the gaps closed, it is sign of eager bulls. With this week closing near its high, there is an increased chance of another weekly gap up on Monday.

But this behavior is extreme and therefore a buy climax. The stop for the bulls is getting far below. Traders are beginning to consider reducing their risk. The easiest way to do this is to take some profits and reduce their position size.

It is important to note that the bulls have been eagerly buying above the low of the prior week. Many will be happy to have an opportunity to buy below the low of the prior week. Consequently, if there is some profit-taking, it will probably only last 1 – 3 weeks. Traders will buy the pullback and expect a test back up to the high.

Daily S&P500 Emini futures strong August buy climax makes September pullback likely

The daily S&P500 Emini futures chart has been in a Small Pullback Bull Trend since June. Traders have been aggressively buying every 1 – 3 day pullback. They will continue to do that until there is a bigger pullback.

Sometimes a Small Pullback Bull Trend accelerates up in a blow-off top. This is more common in extremely strong trends, like this one. Therefore, there might be a sharp rally next week, even after the strong 2 month rally. If so, it will probably be the end of this leg up and lead to several weeks of lower prices.

A Small Pullback Bull Trend is a sign of very strong bulls. A strong bull trend does not usually reverse into a bear trend without 1st transitioning into a trading range. Therefore, even if there is a surprisingly sharp selloff in the next month or two, traders will buy it.

Streak of 9 consecutive bull bars still makes a 10% correction likely soon

Over the past 2 weeks, I talked about the streak of 9 consecutive bull bars that ended a couple weeks ago. That many consecutive bull bars is unusual. It is therefore unsustainable and climactic.

There was a streak of 8 bull bars in June. It led to a 8% selloff to below the bottom of the streak.

The most recent 9 bar streak was 2 1/2 years ago. It became the 1st leg up in a parabolic wedge buy climax. Two weeks later, there was a 10% correction that reversed to far below the start of the streak.

There is now a new streak of 7 consecutive bull bars on the daily chart. This is therefore a consecutive buy climax. That increases the chance of a profit taking selloff coming soon. The odds will go up if this 7 day streak extends with a few more bull days.

10% pullback will probably start in September

Despite the impressive rally since June, these buy climaxes give the bears at least a 50% chance of a sharp selloff down to the start of the streak beginning in September. The streak began just below 3200. That would be about 10% and comparable to the most recent 2 similar streaks. If the selloff continued down to the June trading range, which is a potential Final Bull Flag, the correction would be 15 – 20%.

If the current rally keeps adding bars, these streaks will get pushed further into the past. If there is no pullback within the next several more weeks, these streaks will have lost their influence. The market will then begin to focus on something else.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.

This is not a technical comment but a psychological for a reason for the market to go down, other than price action. I think Election will be the impetus for a major correction mainly because the clear winner will not be decided way into January 2021. I do not think the market likes uncertainty and that coupled with the economic climate, debt, China relations will be enough to push us over the edge. Other than that I love these long term charts and Al’s reasoning and explanation of price action.

The market is going strongly in one direction. That indicates confidence, agreement, and certainty. I agree with you that the psychology will change in the coming months and the change should affect the price action.

Also, whenever there is a sell climax and then a sharp reversal up, there eventually is a pullback. That forms a Cup and Handle setup. This is likely over the coming months.

Thanks for your comment. I use your course for longer-term trading. In the case of a pullback would the Nasdaq follow the S&P, or vice versa. Technically the Nasdaq is the leader, do you agree? Anyway, I appreciate your feedback and your Course.

Thanks Al,

Your insight and experience reading the market is highly inspirational to me.

I was wondering what you see when you look at the Monthly /NQ chart. Is this the third climactic push up to a blow off top?

Any feedback is much appreciated and I’m in the trading room if you care to respond there.

The monthly Nasdaq chart tried to top out in February. It was a bear trap. The reversal back up broke strongly above that high and the rally will probably reach a measured move up from the March low to the February high.

That target is 12,7000.50, which is only 6% above Friday’s close. The Nasdaq could pull back sharply before getting there, and it does not have to stop there. That is just reasonable target that all of the computers see.

I agree that there were clear tops in August 2018 and February of this year. However, the current 5 month rally on the monthly chart has been surprisingly strong.

A reversal down from a Surprise Breakout is usually minor. Therefore, traders will buy the 1st 1 – 2 month selloff. The bears will need at least a micro double top before they can get more than a 1 – 2 month pullback.

When a breakout is as strong as this one has been, a trader will stand to make more money looking to buy a pullback than selling the 1st reversal down.

Hi Al,

Thank you for your weekly analysis!

Recently I am also trading Dow Jones futures. Since the market movement is highly correlated between different indexes, I was thinking whether traders in Dow Jones futures want to test the high of February that push all the markets up? Do you have any insight on this?

The Dow is not very important. Not enough people trade it to make it do anything independent of other markets. If the S&P and Nasdaq go up, the Dow will follow. It can never lead or move independently.

Thanks much for your clarification!

The Dow is a price weighted index which has caused its lagging behavior compared to the NASDAQ and S&P which are capitalization weighted and being pushed higher by a small number of mega capitalization stocks like FB, AAPL, MSFT, GOOGL, TSLA & AMZN. The Russell 2000 is weighted in yet a third manner and its lagging performance has a lot to do with financial stocks which have performed very poorly this year.

These has been an expanding triangle forming since end of 2017, as you mentioned above. Each time it touches that Expanding triangle, there is an aggressive reversal. I would say this is decent context for a reversal from a resistance area.

I also see there seems to be an aggressive buy up as we approach the top of that triangle. This started on August 20th, 2020. In addition to this it broke above what appears to be a wedge that was forming on the way up to test all time high. I believe this to be the buy climax or a vacuum test that you speak about above. I also believe this to be fantastic price action for a reversal. Bears need to hustle a bit more right about now, though…

If the market decides to fall rapidly, it’s incredible how we have the infrastructure to support such an aggressive sell off. I can’t even imagine the number of positions closed, and shorts initiated, to move the market at that velocity, and acceleration.

Thank you for making this post. Been waiting for it all week. Take care, Al.

There is one important difference between the top and the bottom, and I have mentioned this many times. The bottom was a reversal up from a 10 year bull trend line. We see that about once a decade and the market typically has a good rally.

A reversal down in a strong bull trend, even at an expanding triangle top, is a lower probability event. However, because the the buy climax on the daily chart, there will probably be a 10% (maybe 20%) pullback starting soon. There is currently only a 20% chance of a reversal straight down to the March low.