Al added a few comments to report

SP500 Emini: Weekend Market Analysis

The SP500 Emini futures reversed higher with big bull bar from a wedge bull flag and a higher low major trend reversal. It broke far above the bear trend line and closed near the weekly high. Bulls hope that the correction has ended and this is the start of the move to re-test the trend extreme followed by a new high.

The bears hope that this pullback (bounce) will simply lead to another lower high or a double top bear flag with February 2 high followed by a break below February 24 low and a measured move lower.

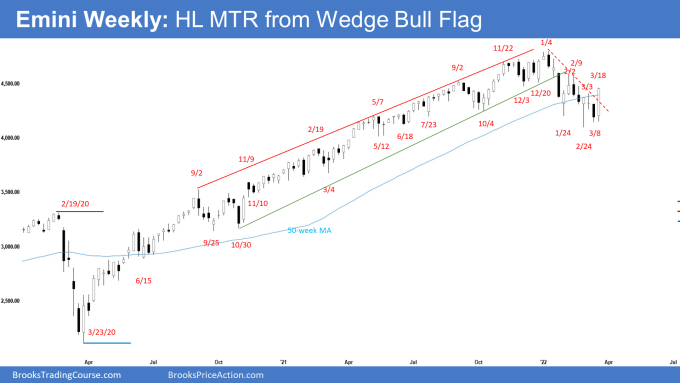

The Weekly S&P500 Emini chart

- This week’s Emini weekly candlestick was a big bull bar closing near the high. It closed above the high of the 3 prior candlesticks, above the bear trend line and the 50-week moving average. The Emini is reversing up from a higher low major trend reversal and a wedge bull flag.

- Last week, we said that odds slightly favor sideways to down. Traders will be monitoring whether the bears get a follow-through bear bar followed by a subsequent breakout below February 24 low, or if the bulls get a strong bull reversal bar closing near its high. The bears failed to get a follow-through bear bar and the bulls got a strong bull reversal bar instead.

- The bulls hope that this is the start of the reversal to re-test the trend extreme followed by a new high. This week’s big bull bar closing near its high is a strong buy signal bar for next week. It increases the odds of a gap up on Monday. If the gap is small, it usually closes early.

- Last week, we said that if the bulls get a big bull bar closing near its high, the odds of a test of the February 2 major lower high increases. This remains true.

- The bears hope that this week’s move higher is the second leg of the pullback which started on February 24. They want the Emini to stall possibly around February 2 high and reverse lower from a double top bear flag.

- Al has been saying that the market was more likely to go up to the February high than go below the February low until last week. With last week’s Big Bear body, he said there was a 50-50 chance that the market might dip below the February low before reversing up.

- Additionally, Al said this week was a very big bull bar and it closed near its high instead. Odds are the correction is probably over. However, the market may continue in its eight-month trading range indefinitely. The next target for the bulls is the February 2nd lower high, which is a major lower high.

- Since this week’s candlestick is a strong bull bar closing near its high and above the high of the 3 prior candlesticks, breaking above the bear trend line and the 50-week moving average, odds are good that next week should trade at least slightly higher.

- The bulls will need to close next week as another bull bar to confirm the reversal higher. The stronger the bull bar and the higher the close, the higher the odds that the correction is over.

- We have been saying that odds slightly favor a wedge bull flag forming rather than a reversal into a bear trend. This remains true.

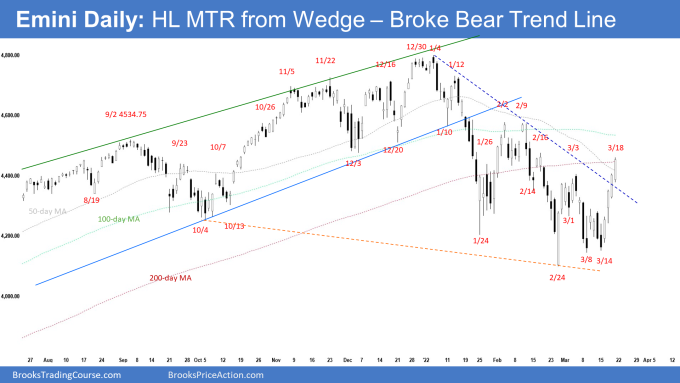

The Daily S&P500 Emini chart

- The Emini traded lower on Monday but formed a micro double bottom with March 8 low and reversed higher from a higher low major trend reversal.

- Last week, we said that traders will be monitoring whether the bears can create consecutive bear bars closing near their lows and far below the February low. If they get that, the odds of a deeper pullback increase. However, if next week trades lower but reverses higher with big bull bars closing near their highs from around or below the February 24 low, odds of a bounce higher from a wedge bull flag increase.

- This week traded lower, and the bulls got the reversal higher with big bull bars closing near their highs from Tuesday into Friday, closing around the 200-day moving average.

- The bulls hope that this is the start of the reversal higher to re-test the trend extreme, followed by a breakout to a new all-time high. The rally this week was strong enough for traders to expect at least a 2nd leg sideways to up after a brief pullback.

- The bears hope that this week’s rally was simply the second leg sideways to up pullback which started from February 24. They want the pullback (bounce) to reverse lower from a lower high or from a double top bear flag with the February 16 high or February 2 high. If the bears get that, they then want a measured move down to around 3600 based on the height of the 7-month trading range.

- The reversals up from January 24th and from February 24th were exceptionally strong. That is why Al says the odds favored a pullback to a higher low major trend reversal and then a resumption of the trend up.

- The market has been in a trading range for eight months. Traders are deciding if the bull trend is resuming or if the rally is a bull leg in the trading range.

- Al also noted that the February 2nd high is a major lower high. If the bulls get two closes above that high, the rally will probably continue up to a new all-time high. Alternatively, if the bulls fail to get two closes above that high, the bears will try to get a reversal down from a double top with that high. But even if they do, a continuation of the trading range would still be more likely than a break below the February 24th neckline of the double top bear flag. Traders should expect the market to be sideways to up for several more months.

- For now, odds slightly favor sideways to up for next week, and for a second leg sideways to up to form after a pullback.

- Traders will be monitoring whether the bulls can test the February 2 high and close far above it, or if the Emini stalls around the February 2 high or around the 100-day and 200-day moving averages.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Weekly Reports Archive

You can access all weekly reports on the Market Analysis page.

On the E-mini daily chart canthe 1/24 lows and 2/24 lows be connected and a parallel channel line be drawn at the 2/9 high between the two to predict the next channel resistance? I have the same bear channel with a breakout as you, and am wondering if I should redraw the channel to show we are not quite at a breakout and nearing resistance here—a “magnet”.

Dear Charlie, a good day to you..

Traders are always drawing and redrawing trend lines and see what makes most sense based on the context..

Personally, I would draw one that covers as much of the price action as possible..

Take care and have a blessed week ahead!

Great one thanks Andrew and Al!

Dear Tim,

Thank you very much! Great reports for the Dax and FTSE! Loved it..

Have a blessed week ahead Tim!

Best Regards,

Andrew

Thanks for the detailed and great report! Truly appreciate it and like the report separation among the different assets.

What level of weight if at all do you give to the MAs order that currently are not inline at least for the time being with bullishness scenario?

Eli since MAs are a lagging indicator, when the longer ones start crossing it is a good bet the market is in a trading range.

Dear Eli,

Thanks for going through the report..

I usually only have the 20ema on all of my charts..

But when analyzing the markets, it is helpful to have the others such as the commonly used 50-period, 100-period, 200-period as reference points and potential support/resistance areas..

Have a blessed week ahead too!

Best Regards,

Andrew