Market Overview: Weekend Market Update

The Emini has a ledge top on the daily chart. Traders should expect a breakout above the 4 week range. But that breakout will probably fail and lead to a move below the August low.

The monthly gold futures chart has rallied strongly, but is at resistance. It might pause here for a month or two, but traders should expect at least slightly higher prices.

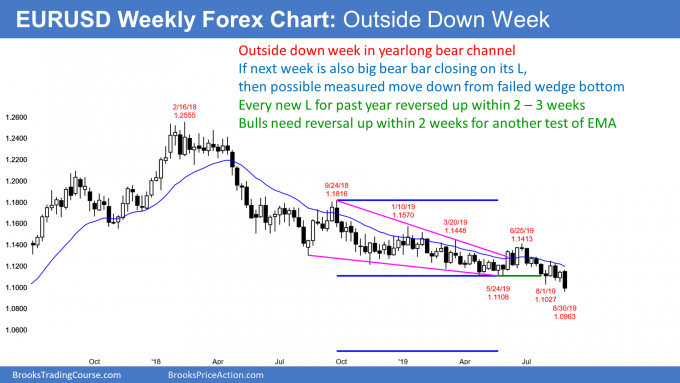

The EURUSD weekly Forex chart is breaking below the yearlong bear channel. All prior breakouts reversed up within a couple weeks. But if next week is a 2nd consecutive big bear bar closing near its low, this selloff will probably continue down for a measured move to around 1.04

Gold Futures market:

Strong rally, but buy climax at resistance

Gold futures have trended up strongly for 4 months. The rally began with a double bottom higher low major trend reversal on the monthly chart in August 2018.

As strong as the rally has been, it is now testing the August 2013 high. Why is that important? Because beginning in April 2013, there was a 3 month strong bear break below a bull trend line. That was a bear spike. The bear channel began with the top of the August 2013 rally.

When there is a Spike and Channel bear trend, traders expect a bull breakout above the bear channel. The rally typically tests the start of the bear channel. In this case, it was the August 2013 high. Then, the chart typically enters a trading range.

The 2019 rally went just above that August 2013 high. As strong as the rally has been, many traders will begin to take profits. That is because the rally reached a resistance level where a trading range typically begins.

A trading range has bull and bear legs. The 2019 rally is a bull leg. The bulls hope it is the start of a bull trend that will break above the September 2011 buy climax high. More likely, the bulls will start to take profits and the bears will soon sell. Both know that the rally will probably stall for at least a couple bars on the monthly chart. That means a 1 – 2 month trading range on the daily chart.

Do the bulls have to exit?

Investors will hold long, even if there is a 2 month reversal down to 1400 and the January 2018 high. Traders, however, will quickly take profits if they sense that widespread profit-taking is underway.

How will they know if the profit-taking might last a couple months and fall far below, perhaps down to 1400? They look for either a surprisingly big bear bar or a series of 3 or more smaller bear bars closing near their lows.

Both represent strong profit-taking and they increase the chance of at least 10 bars down on the daily chart. More likely, the daily chart would test the July trading range at around 1400, which is also the January high breakout point.

How far will a pullback fall?

The June/July rally had 3 legs up on the daily chart (not shown) and it is therefore a wedge rally. A reversal down from a wedge typically tests the start of the wedge. That is the pullback after the 1st leg up. Here, it is the July low at around 1400.

Was this week’s selling a likely candidate for the start of a 1 – 2 month pullback? The bears need to do more. The 3 month rally has been in a tight bull channel. The 1st break below the bull trend line typically leads to a bull flag or trading range and not a bear trend. Traders therefore expect a trading range over the next couple of weeks and not a bear trend.

The trading range could be another bull flag that would lead to higher prices. But with a wedge rally on the daily chart and the monthly chart testing the resistance of the August 2013 high, the upside over the next few weeks is probably small. This is despite the strong bull trend.

EURUSD weekly Forex chart:

Outside down week, but bottom of bear channel

The EURUSD weekly Forex chart had a buy signal bar last week. This week traded above last week’s high, triggering the buy signal. It then reversed down and traded below last week’s low. This week therefore was an outside down bar.

While bearish, traders must consider the context. The EURUSD weekly chart is near the bottom of a yearlong bear channel. Every new low reversed up within a couple weeks. Also, every rally reversed back down after a few weeks. Traders expect that any follow-through selling will end within a few weeks.

A year is unusually long for a bear channel in the Forex markets. Consequently, traders need to be prepared for a change in the price action.

The Market Cycle

All markets typically go through a repeating cycle of price action. A breakout weakens into a channel. The channel weakens further and transitions into a trading range. Then traders wait for the next breakout up or down.

The EURUSD weekly Forex chart has been in a bear trend for 18 months. The current channel phase has lasted for more than a year. Traders know that there is a 75% chance of a break above the bear channel and then a transition into a trading range. Sometimes there is a breakout below the bear channel and then a reversal up, and then a transition into a trading range.

But 25% time, there is a successful breakout below a bear channel. That means two or more consecutive bear bars closing near their lows and an acceleration of the bear trend. Traders then expect a transition into a bear channel, and then a trading range.

What should traders expect next week?

Traders know that most breakout attempts fail. As a result, they expect a reversal up within a few weeks. But they also know that a year is a long time for a channel. Consequently, there is an increasing chance of a successful breakout above or below the channel with each passing week.

If there are consecutive big bear bars closing on their lows, traders will bet on a successful bear breakout. That means an acceleration down and probably lower prices for at least a couple more months. A measured move down based on the height of the wedge is around 1.04.

More likely, once there is a successful breakout, it will be up. Traders need to see consecutive closes above a major lower high, like the June 25 high of 1.1413. Until that happens, the bear trend is still intact and traders will continue to sell 2 – 3 week rallies.

Since the EURUSD Forex market is in a bear channel, the bears will continue to take profits below the last low. Also, the bulls will look to buy a reversal up from around the last low, expecting a tradeable bounce for a couple weeks.

But if this is the start of a successful bear breakout, next week will close on its low. This would be caused by bears continuing to sell instead of taking profits. That would represent a change in the price action of the past year.

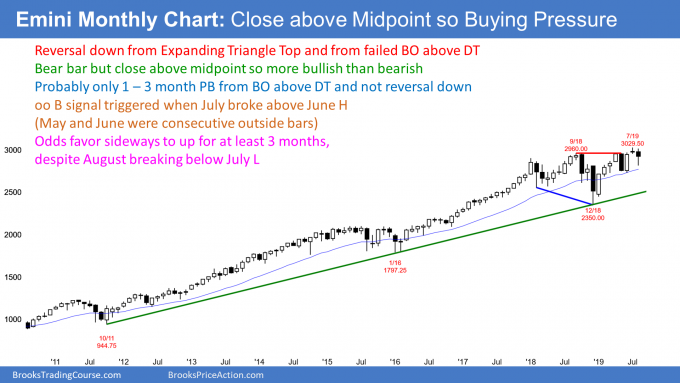

Monthly S&P500 Emini futures chart:

Reversal up in August but bear body

The monthly S&P500 Emini futures chart triggered an oo buy signal when July traded above consecutive outside bars in May and June. I have written about this every week since June. When an oo bull flag triggers, there is a 60% chance of sideways to higher prices for 3 bars. On the monthly chart, that means into September.

This month was a big bear bar on the monthly chart until this past week. Then, the bullishness of the oo buy signal asserted itself. The Emini rallied and August closed above the midpoint of the month’s range. While the month still had a bear body, the close above the midpoint means that the bulls won the month. It is a sign of buying pressure and strong bulls.

August would have been much more bullish if it rallied strongly from the 1st day and the month became a big bull trend bar closing far above the July high. Instead, the bulls achieved the minimum. They erased more than half of the selling and gave the bulls hope that the selloff has ended.

Since the August high is below the July high, August is a pullback in a bull trend. It is therefore a High 1 bull flag. But it has a bear body and the Emini is at the top of a 20 month expanding triangle. That is a weak buy setup. Traders will not be eager to buy above the August high.

When a buy setup is weak, there are usually more sellers than buyers above the high of the buy signal bar. Therefore September will probably not be a strongly bullish month.

Has the correction ended?

The selloff from the January 2018 high was mostly sideways for 3 months. The selloff in September lasted 3 months. Traders would not be surprised if the current selloff continues sideways for another month or two. Can the bears get a strong reversal down from the July high at the top of the expanding triangle? Probably not without more sideways bars 1st.

Weekly S&P500 Emini futures chart:

Weak higher low buy setup in yearlong bull channel

The weekly S&P500 Emini futures chart formed a bull bar this week and it closed near its high. This week is therefore a buy signal bar for next week.

But there are problems for the bulls. Buying with a stop above a tight trading range and just below the EMA is a low probability bet.

Furthermore, the August selloff from an expanding triangle top is likely to have at least a small 2nd leg down. Consequently, while this week is a buy setup, there will probably be more bears looking to sell above this week’s high than bulls looking to buy.

What do traders need to see to believe that the 2019 bull trend is resuming? The bulls need at least 2 consecutive big bull bars closing near their highs and above the 4 week tight trading range. More likely, a breakout above will reverse down within a couple weeks.

Daily S&P500 Emini futures chart:

Emini August ledge top so brief bull breakout likely

The daily S&P500 Emini futures chart reversed down again this week from the top of the August trading range. This is the 4th top in the trading range and all 4 tops are almost exactly at the same price. That makes this a ledge top.

On the 5 minute chart, the 4 or more highs in a ledge top are exactly at the same price. But the bars on the daily chart are much bigger than those on the 5 minute chart. They therefore have many more ticks in each bar. With so many possible prices for the high, it almost impossible to have 4 bars in a short period time with exactly the same high.

That does not mean ledges cannot exist on higher time frame charts. It only means they are not perfect. The closer they are to perfect, the more likely they will act like a ledge.

Why do ledges work?

I talked about the ledge bottom in Bitcoin a couple times over the past few weeks. I said there would be a break below 10,000, which happened this past week.

The Emini now has a ledge top. You might sometimes hear that a triple top always has a bull breakout. While “always” is never true, some things have high probability. A ledge top is a quadruple top. It has a higher probability of a bull breakout than a triple top.

The Emini keeps rallying to 2940. That has made it very easy to short there with a limit order. If something is easy, you must wonder if it is wrong. We should always assume that an institution is taking the other side of every trade that we take.

Why? Because they make up 95% of the volume. They are both sides of almost every trade and therefore probably the other side of your trade.

If it is easy for you to keep selling at 2940, then institutions are eager to buy from you at that price. Why? Because they see it as cheap, even though it is the top of the range.

At some point, the bears will become concerned that the Emini is not going down. If enough of them buy back their shorts, there will be a break above the ledge. The remaining bears might then cover their shorts in a panic. The result would be a bull breakout.

Most breakouts come back to test the breakout point. That is why traders expect a test back below the ledge top. But will the reversal down be only a test or a failed breakout and the start of a swing down?

What happens after a ledge top?

When there is a ledge top on the 5 minute chart, There is an 80% chance of a break above the ledge within 2 days. Furthermore, there is also an 80% chance of a pullback to below the top of the ledge within 20 bars after the bull breakout. At that point, the bull trend can reverse or resume.

How does that translate to the daily chart? Ledges are never perfect and are rare. That means there is more variation. Traders should expect a break above the top of the ledge within a couple weeks. They should then see a reversal back down below the top of the ledge within a couple weeks after the breakout.

The bulls hope that the pullback will be a bull flag. They want the breakout to continue up to a new all-time high.

The bears want the pullback to become a failed bull breakout and then a bear trend reversal. After such a strong selloff in early August, the bears still have a slightly higher probability of a break below the August low before there is a new all-time high. Consequently, traders should look for a bull breakout within a couple weeks and then a lower high that leads to a selloff to below 2800 within a couple months. A measured move down based on the 4 week trading range would be around 2700.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.